Trader funding programs offer individual traders access to capital with profit-sharing models, enabling active management of high-risk strategies without personal financial exposure. Mutual funds pool resources from multiple investors to invest in diversified portfolios managed by professionals, catering to those seeking steady, long-term growth with reduced risk. Discover how these distinct financial vehicles can align with your investment goals and risk tolerance.

Why it is important

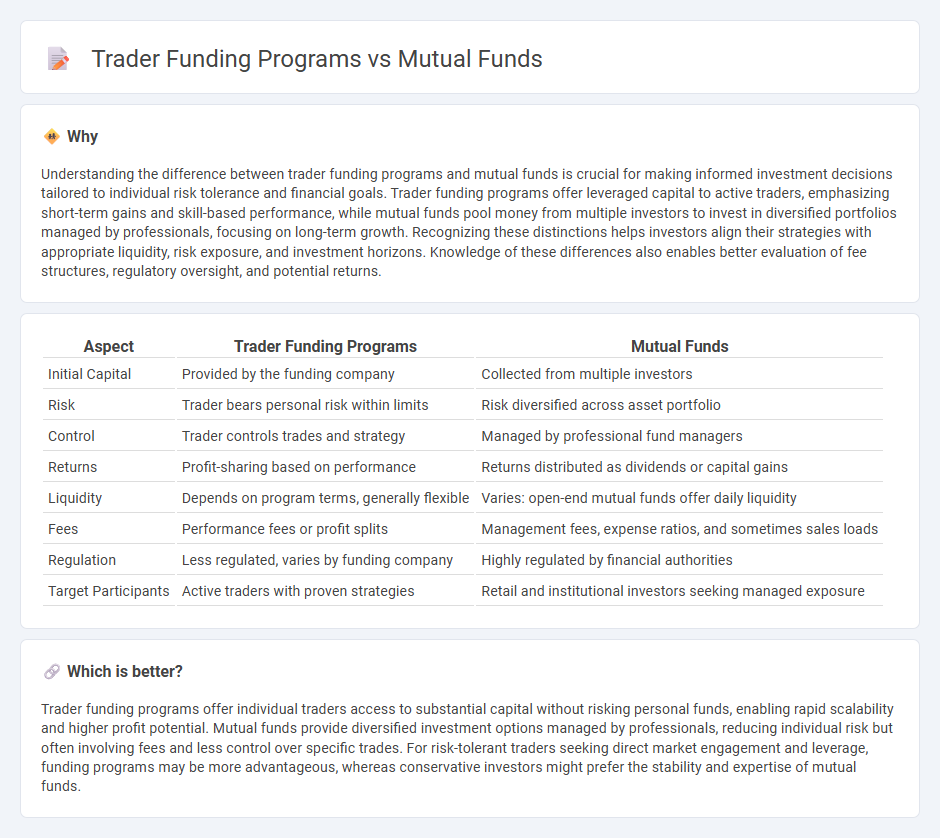

Understanding the difference between trader funding programs and mutual funds is crucial for making informed investment decisions tailored to individual risk tolerance and financial goals. Trader funding programs offer leveraged capital to active traders, emphasizing short-term gains and skill-based performance, while mutual funds pool money from multiple investors to invest in diversified portfolios managed by professionals, focusing on long-term growth. Recognizing these distinctions helps investors align their strategies with appropriate liquidity, risk exposure, and investment horizons. Knowledge of these differences also enables better evaluation of fee structures, regulatory oversight, and potential returns.

Comparison Table

| Aspect | Trader Funding Programs | Mutual Funds |

|---|---|---|

| Initial Capital | Provided by the funding company | Collected from multiple investors |

| Risk | Trader bears personal risk within limits | Risk diversified across asset portfolio |

| Control | Trader controls trades and strategy | Managed by professional fund managers |

| Returns | Profit-sharing based on performance | Returns distributed as dividends or capital gains |

| Liquidity | Depends on program terms, generally flexible | Varies: open-end mutual funds offer daily liquidity |

| Fees | Performance fees or profit splits | Management fees, expense ratios, and sometimes sales loads |

| Regulation | Less regulated, varies by funding company | Highly regulated by financial authorities |

| Target Participants | Active traders with proven strategies | Retail and institutional investors seeking managed exposure |

Which is better?

Trader funding programs offer individual traders access to substantial capital without risking personal funds, enabling rapid scalability and higher profit potential. Mutual funds provide diversified investment options managed by professionals, reducing individual risk but often involving fees and less control over specific trades. For risk-tolerant traders seeking direct market engagement and leverage, funding programs may be more advantageous, whereas conservative investors might prefer the stability and expertise of mutual funds.

Connection

Trader funding programs provide capital to skilled traders, enabling them to access larger markets and increase potential returns, while mutual funds pool investor money to collectively invest in diversified portfolios managed by professionals. Both mechanisms facilitate capital allocation and risk-sharing, enhancing liquidity and market efficiency. By integrating trader funding strategies within mutual funds, investors can benefit from diversified exposure combined with active trading expertise.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investor capital to invest in a wide range of assets across multiple sectors and geographies, reducing individual risk. Trader funding programs typically focus on providing capital for individual traders to execute strategies, often concentrating on specific markets or instruments with less inherent diversification. Explore how diversified asset allocation in mutual funds compares with targeted trading capital in funded programs for optimized portfolio growth.

Leverage

Mutual funds typically do not use leverage, focusing instead on pooled investments managed to minimize risk and provide steady returns, whereas trader funding programs offer significant leverage to amplify potential gains and losses. These programs require traders to meet strict performance metrics but provide access to large capital pools, enabling higher-risk, higher-reward trading strategies. Explore detailed comparisons and leverage mechanics to understand which option aligns with your financial goals.

Liquidity

Mutual funds offer high liquidity by allowing investors to buy or redeem shares on any business day, providing flexible access to their investments. Trader funding programs often require participants to meet specific performance targets before accessing profits or capital, which can restrict immediate liquidity. Explore the differences in liquidity management between these options to determine the best fit for your investment strategy.

Source and External Links

Mutual Funds - Mutual funds are SEC-registered investment companies that pool money from many investors to invest in diversified portfolios of stocks, bonds, and other securities, managed professionally with features like low minimum investments and liquidity.

Mutual fund - Mutual funds pool money from investors to purchase various securities and come in several types like actively managed funds aiming to outperform indices or passively managed index funds that track market performance, offering benefits such as diversification and professional management but charging fees.

Understanding mutual funds - Mutual funds allow investors to share ownership in a professionally managed portfolio of assets, providing diversification, lower transaction costs, and convenience, with options including active and index funds, often accessible through brokerage firms.

dowidth.com

dowidth.com