Bucket investing segments assets into distinct categories based on time horizons and risk tolerance, providing a structured approach to managing retirement funds and cash flow needs. Momentum investing focuses on capitalizing on existing market trends by buying securities exhibiting upward price movement, aiming to benefit from continued price momentum. Explore in-depth comparisons and strategies to determine the best fit for your financial goals.

Why it is important

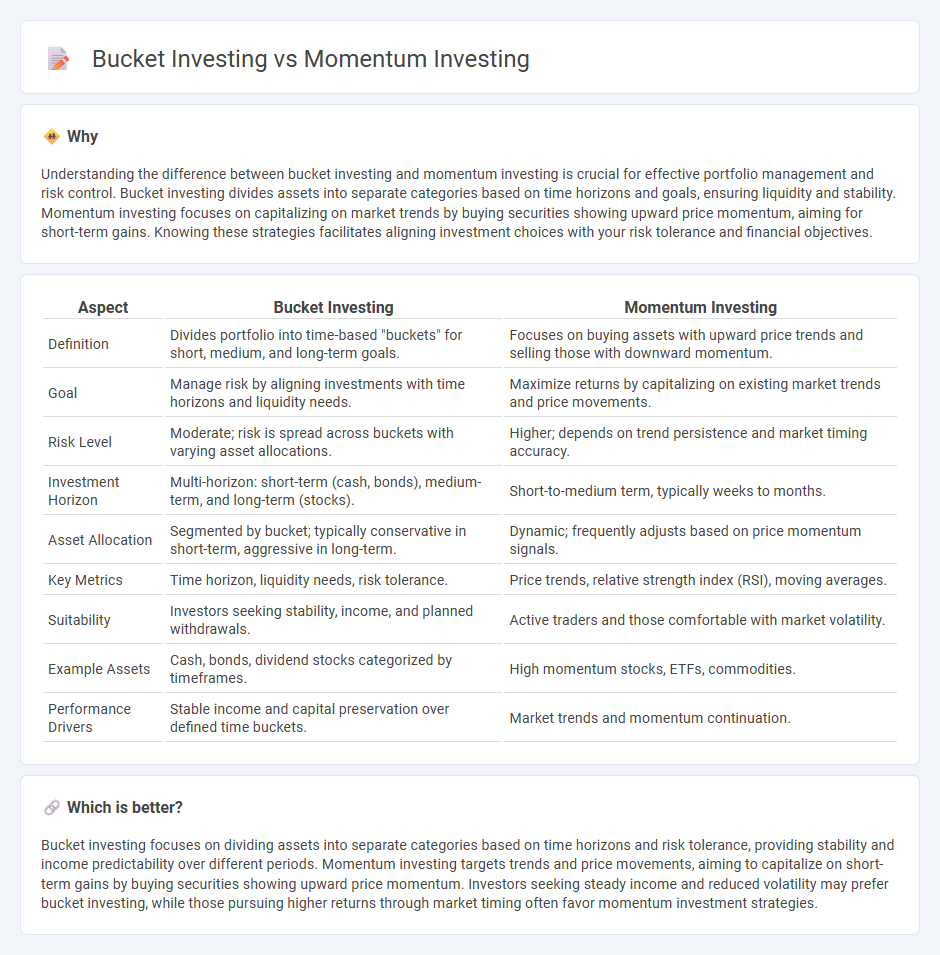

Understanding the difference between bucket investing and momentum investing is crucial for effective portfolio management and risk control. Bucket investing divides assets into separate categories based on time horizons and goals, ensuring liquidity and stability. Momentum investing focuses on capitalizing on market trends by buying securities showing upward price momentum, aiming for short-term gains. Knowing these strategies facilitates aligning investment choices with your risk tolerance and financial objectives.

Comparison Table

| Aspect | Bucket Investing | Momentum Investing |

|---|---|---|

| Definition | Divides portfolio into time-based "buckets" for short, medium, and long-term goals. | Focuses on buying assets with upward price trends and selling those with downward momentum. |

| Goal | Manage risk by aligning investments with time horizons and liquidity needs. | Maximize returns by capitalizing on existing market trends and price movements. |

| Risk Level | Moderate; risk is spread across buckets with varying asset allocations. | Higher; depends on trend persistence and market timing accuracy. |

| Investment Horizon | Multi-horizon: short-term (cash, bonds), medium-term, and long-term (stocks). | Short-to-medium term, typically weeks to months. |

| Asset Allocation | Segmented by bucket; typically conservative in short-term, aggressive in long-term. | Dynamic; frequently adjusts based on price momentum signals. |

| Key Metrics | Time horizon, liquidity needs, risk tolerance. | Price trends, relative strength index (RSI), moving averages. |

| Suitability | Investors seeking stability, income, and planned withdrawals. | Active traders and those comfortable with market volatility. |

| Example Assets | Cash, bonds, dividend stocks categorized by timeframes. | High momentum stocks, ETFs, commodities. |

| Performance Drivers | Stable income and capital preservation over defined time buckets. | Market trends and momentum continuation. |

Which is better?

Bucket investing focuses on dividing assets into separate categories based on time horizons and risk tolerance, providing stability and income predictability over different periods. Momentum investing targets trends and price movements, aiming to capitalize on short-term gains by buying securities showing upward price momentum. Investors seeking steady income and reduced volatility may prefer bucket investing, while those pursuing higher returns through market timing often favor momentum investment strategies.

Connection

Bucket investing divides assets into segments based on time horizons and risk tolerance, creating a structured approach to capital allocation. Momentum investing focuses on capitalizing on trends by buying securities showing upward price movement. The connection lies in using momentum strategies within buckets to optimize returns in specific timeframes, blending time-based asset allocation with trend-following tactics.

Key Terms

Relative Strength

Momentum investing capitalizes on relative strength by identifying stocks with strong recent performance, aiming to capture continuing price trends. Bucket investing segments assets into distinct categories based on risk tolerance and time horizon, often underweighting the dynamic shifts captured by relative strength metrics. Explore how integrating relative strength into bucket strategies can enhance portfolio returns and risk management.

Asset Allocation

Momentum investing targets assets exhibiting strong recent performance to capitalize on trending gains, whereas bucket investing emphasizes structured asset allocation by dividing investments into distinct "buckets" based on time horizons and risk tolerance. Momentum strategies rely on technical indicators and market sentiment, while bucket investing prioritizes diversification and goal-specific investment timelines. Explore detailed comparisons of these strategies to optimize your portfolio's asset allocation approach.

Rebalancing

Momentum investing emphasizes frequent rebalancing to capitalize on trending assets, using quantitative models to shift allocations toward high-performing securities. Bucket investing adopts a structured approach by dividing portfolios into distinct time-based segments, with scheduled rebalancing to maintain risk alignment across short-, medium-, and long-term buckets. Explore how rebalancing techniques impact risk and return in each strategy to enhance your investment decisions.

Source and External Links

Growth vs. Momentum Investing - Momentum investing is a strategy that capitalizes on buying securities that have performed well recently and selling those that have underperformed, relying on price trends rather than company fundamentals.

Strategies and Types of Momentum Investing - This strategy focuses on purchasing securities showing upward price trends and often uses technical indicators and behavioral finance insights to identify and benefit from established market trends.

Momentum investing - Momentum investing involves buying securities with high returns over the past 3 to 12 months and selling those with poor returns, explained by theories of risk compensation or behavioral investor biases, despite challenges to the efficient market hypothesis.

dowidth.com

dowidth.com