Buy now pay later (BNPL) services offer deferred payment options with typically lower interest rates compared to payday loans, which are short-term, high-interest loans intended for urgent cash needs. BNPL allows consumers to split purchases into manageable installments, improving budgeting flexibility, while payday loans often carry fees and risks of debt cycles due to their high APRs. Explore the advantages and risks of each to make informed financial decisions.

Why it is important

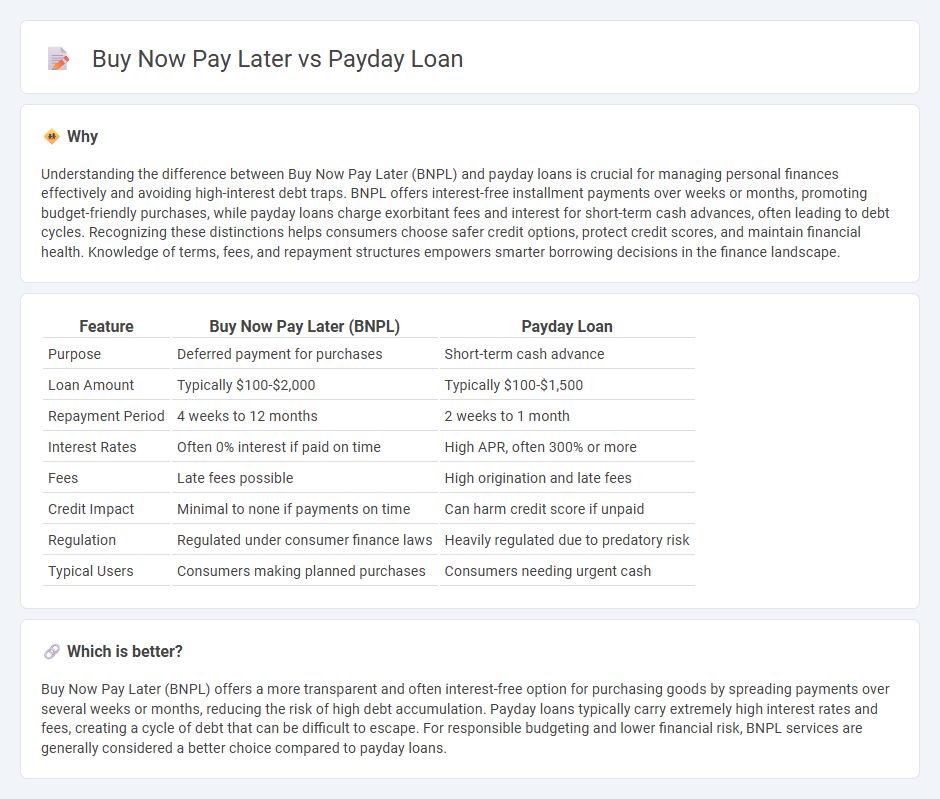

Understanding the difference between Buy Now Pay Later (BNPL) and payday loans is crucial for managing personal finances effectively and avoiding high-interest debt traps. BNPL offers interest-free installment payments over weeks or months, promoting budget-friendly purchases, while payday loans charge exorbitant fees and interest for short-term cash advances, often leading to debt cycles. Recognizing these distinctions helps consumers choose safer credit options, protect credit scores, and maintain financial health. Knowledge of terms, fees, and repayment structures empowers smarter borrowing decisions in the finance landscape.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Payday Loan |

|---|---|---|

| Purpose | Deferred payment for purchases | Short-term cash advance |

| Loan Amount | Typically $100-$2,000 | Typically $100-$1,500 |

| Repayment Period | 4 weeks to 12 months | 2 weeks to 1 month |

| Interest Rates | Often 0% interest if paid on time | High APR, often 300% or more |

| Fees | Late fees possible | High origination and late fees |

| Credit Impact | Minimal to none if payments on time | Can harm credit score if unpaid |

| Regulation | Regulated under consumer finance laws | Heavily regulated due to predatory risk |

| Typical Users | Consumers making planned purchases | Consumers needing urgent cash |

Which is better?

Buy Now Pay Later (BNPL) offers a more transparent and often interest-free option for purchasing goods by spreading payments over several weeks or months, reducing the risk of high debt accumulation. Payday loans typically carry extremely high interest rates and fees, creating a cycle of debt that can be difficult to escape. For responsible budgeting and lower financial risk, BNPL services are generally considered a better choice compared to payday loans.

Connection

Buy Now Pay Later (BNPL) and payday loans both offer short-term credit solutions aimed at consumers needing immediate funds, often with quick approval and minimal credit checks. BNPL services let users split purchases into interest-free installments, while payday loans provide lump-sum advances with high interest rates due on the next paycheck. Their connection lies in addressing urgent financial needs, but BNPL is typically less costly and designed for retail spending, whereas payday loans carry higher risks of debt accumulation due to expensive fees and interest.

Key Terms

Interest Rate

Payday loans often come with annual percentage rates (APR) exceeding 400%, making them some of the most expensive short-term credit options available. Buy Now Pay Later (BNPL) services typically offer interest-free periods, but may charge high fees or interest if payments are missed or extended beyond the promotional window. Explore the differences in cost structures and risks to determine which credit solution suits your financial needs best.

Repayment Terms

Payday loans typically require repayment in full on the borrower's next payday, often within two to four weeks, resulting in high-interest rates and potential financial strain. Buy Now Pay Later (BNPL) services offer installment plans spreading payments over weeks or months with lower or no interest, improving affordability for consumers. Explore the detailed repayment structures and benefits of each option to make an informed financial decision.

Credit Check

Payday loans typically require minimal credit checks, allowing quick access to funds regardless of credit history, but often come with high interest rates and fees. Buy now pay later (BNPL) services generally perform soft credit checks, posing less risk to credit scores while offering flexible repayment options spread over weeks or months. Explore further to understand how these credit assessment differences impact your financial decisions and borrowing costs.

Source and External Links

What is a payday loan? | Consumer Financial Protection Bureau - A payday loan is a short-term, high-cost loan usually for $500 or less, typically repaid on the borrower's next payday via post-dated checks or automatic bank withdrawal, often without a credit check.

What Is a Payday Loan and How Does It Work? - NerdWallet - Payday loans are small, high-cost loans intended to be repaid in a lump sum on the borrower's next payday, often accessible to those with poor or no credit, but they carry risks of high fees and debt cycles.

Payday Loans Online | CreditNinja - Payday loans provide quick funds with no credit check but come with very high interest rates and fees, which can worsen financial situations; they are often replaced by more affordable installment loan options like those offered by CreditNinja.

dowidth.com

dowidth.com