Zero day options offer investors the opportunity to trade options contracts that expire within the same trading day, providing high-risk, high-reward scenarios due to their rapid time decay. Digital options, also known as binary options, deliver fixed payouts based on whether the underlying asset meets a specified condition at expiration, simplifying risk and reward assessment. Explore more to understand how these financial instruments can fit into your trading strategy.

Why it is important

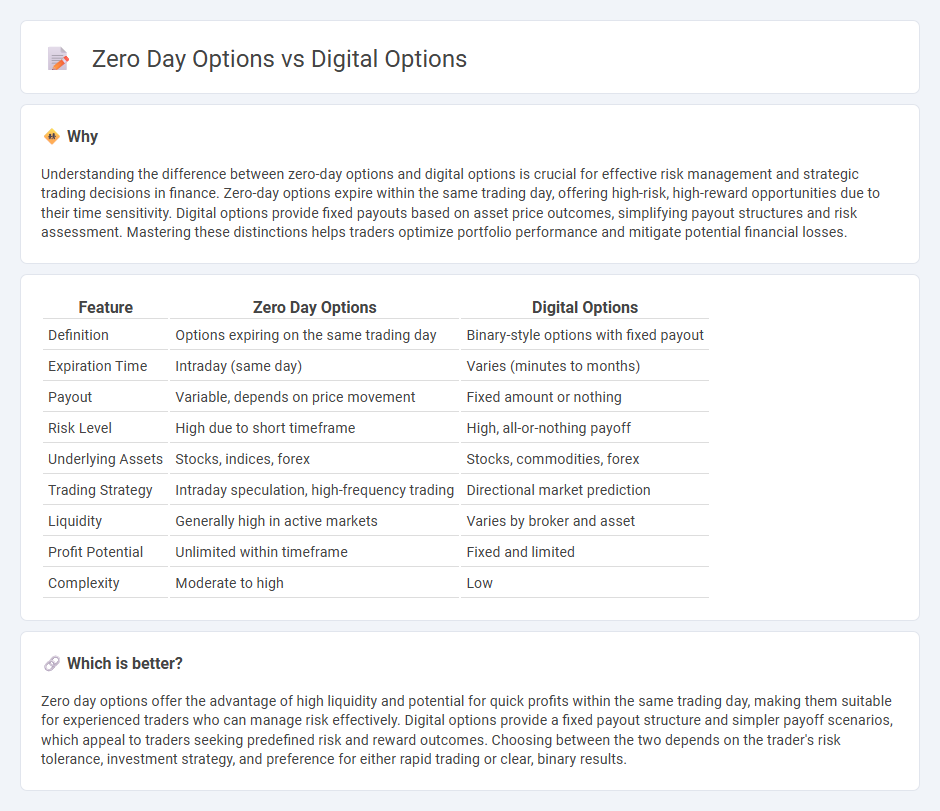

Understanding the difference between zero-day options and digital options is crucial for effective risk management and strategic trading decisions in finance. Zero-day options expire within the same trading day, offering high-risk, high-reward opportunities due to their time sensitivity. Digital options provide fixed payouts based on asset price outcomes, simplifying payout structures and risk assessment. Mastering these distinctions helps traders optimize portfolio performance and mitigate potential financial losses.

Comparison Table

| Feature | Zero Day Options | Digital Options |

|---|---|---|

| Definition | Options expiring on the same trading day | Binary-style options with fixed payout |

| Expiration Time | Intraday (same day) | Varies (minutes to months) |

| Payout | Variable, depends on price movement | Fixed amount or nothing |

| Risk Level | High due to short timeframe | High, all-or-nothing payoff |

| Underlying Assets | Stocks, indices, forex | Stocks, commodities, forex |

| Trading Strategy | Intraday speculation, high-frequency trading | Directional market prediction |

| Liquidity | Generally high in active markets | Varies by broker and asset |

| Profit Potential | Unlimited within timeframe | Fixed and limited |

| Complexity | Moderate to high | Low |

Which is better?

Zero day options offer the advantage of high liquidity and potential for quick profits within the same trading day, making them suitable for experienced traders who can manage risk effectively. Digital options provide a fixed payout structure and simpler payoff scenarios, which appeal to traders seeking predefined risk and reward outcomes. Choosing between the two depends on the trader's risk tolerance, investment strategy, and preference for either rapid trading or clear, binary results.

Connection

Zero day options and digital options are connected through their short-term, high-risk trading nature, appealing to traders seeking rapid profit opportunities within tight time frames. Both instruments rely on precise market predictions and often involve binary outcomes, making them popular in volatile financial markets. Their pricing models frequently incorporate advanced algorithms and real-time data analysis to gauge asset price movements accurately.

Key Terms

Payout Structure

Digital options offer a fixed payout determined at the contract's inception, providing traders with clarity on potential returns regardless of asset price movement beyond the strike price. Zero-day options, expiring within the trading day, emphasize rapid payout realization but carry heightened risk due to minimal time for market fluctuation. Explore the nuances of payout structures to optimize your short-term trading strategy effectively.

Time to Expiry

Digital options offer fixed payouts limited to precise expiry times, making them ideal for short-term trading strategies focused on specific event outcomes. Zero day options expire within the same trading day, providing traders with rapid exposure to price movements and volatility in ultra-short time frames. Explore how these time-to-expiry differences impact risk management and trading tactics for enhanced decision-making.

Gamma Exposure

Digital options provide traders with binary payoff structures that amplify Gamma exposure near the strike price, resulting in heightened sensitivity to underlying price movements. Zero day options, expiring within a single trading session, exhibit extreme Gamma behavior as time decay accelerates, making real-time Gamma management essential for risk mitigation. Explore how mastering Gamma exposure can enhance strategies across varying option lifespans for optimized trading outcomes.

Source and External Links

Digital Options Trading in 2025: A Modern Approach to Options - Digital options, also called binary options, are financial instruments with preset payouts and binary outcomes, where traders predict if an asset's price will rise or fall within a set timeframe, enabling clear risk-reward and access to a broad range of assets like stocks, commodities, and currencies.

What Are Digital Options? | Digital Call and Put Definition - TIOmarkets - Digital options allow traders to speculate on the direction of an asset's price within a fixed period, resulting in a fixed payout if their directional prediction (call or put) is correct, or nothing if it is incorrect, simplifying options trading.

Digital Option - Overview, How It Works, Features, Example - A digital option lets traders choose a strike price and offers a fixed payout if the asset's market price exceeds this strike price, presenting a straightforward yes-or-no outcome that controls risk and potential profit, with payouts varying by strike price selection.

dowidth.com

dowidth.com