A finfluencer leverages social media platforms to share personal finance tips, investment strategies, and budgeting advice, often reaching a broad audience with accessible content. Financial planners provide personalized financial consulting, creating tailored strategies to help clients achieve long-term goals such as retirement planning, tax optimization, and wealth management. Explore the key differences and benefits of each to determine the best approach for your financial journey.

Why it is important

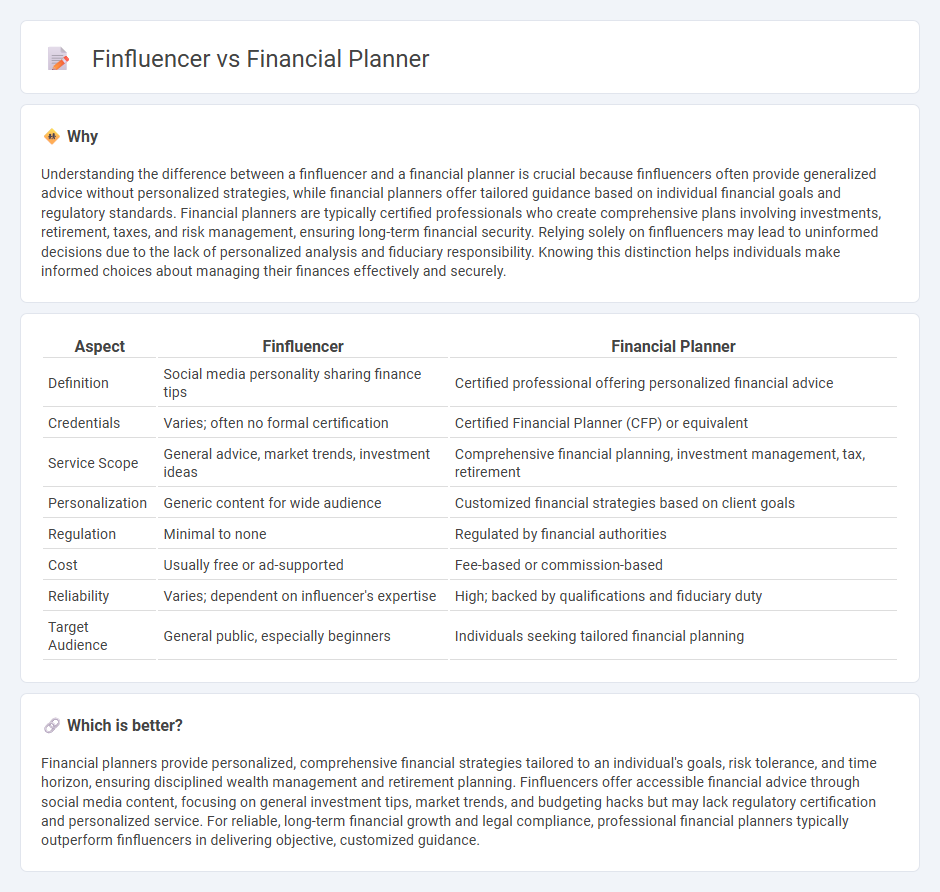

Understanding the difference between a finfluencer and a financial planner is crucial because finfluencers often provide generalized advice without personalized strategies, while financial planners offer tailored guidance based on individual financial goals and regulatory standards. Financial planners are typically certified professionals who create comprehensive plans involving investments, retirement, taxes, and risk management, ensuring long-term financial security. Relying solely on finfluencers may lead to uninformed decisions due to the lack of personalized analysis and fiduciary responsibility. Knowing this distinction helps individuals make informed choices about managing their finances effectively and securely.

Comparison Table

| Aspect | Finfluencer | Financial Planner |

|---|---|---|

| Definition | Social media personality sharing finance tips | Certified professional offering personalized financial advice |

| Credentials | Varies; often no formal certification | Certified Financial Planner (CFP) or equivalent |

| Service Scope | General advice, market trends, investment ideas | Comprehensive financial planning, investment management, tax, retirement |

| Personalization | Generic content for wide audience | Customized financial strategies based on client goals |

| Regulation | Minimal to none | Regulated by financial authorities |

| Cost | Usually free or ad-supported | Fee-based or commission-based |

| Reliability | Varies; dependent on influencer's expertise | High; backed by qualifications and fiduciary duty |

| Target Audience | General public, especially beginners | Individuals seeking tailored financial planning |

Which is better?

Financial planners provide personalized, comprehensive financial strategies tailored to an individual's goals, risk tolerance, and time horizon, ensuring disciplined wealth management and retirement planning. Finfluencers offer accessible financial advice through social media content, focusing on general investment tips, market trends, and budgeting hacks but may lack regulatory certification and personalized service. For reliable, long-term financial growth and legal compliance, professional financial planners typically outperform finfluencers in delivering objective, customized guidance.

Connection

Finfluencers and financial planners both aim to educate and guide individuals on money management, investment strategies, and financial literacy. Finfluencers leverage social media platforms to reach a broad audience with accessible financial advice, while financial planners provide personalized, professional planning services based on clients' unique financial goals and circumstances. Collaboration between finfluencers and certified financial planners can enhance public awareness and encourage informed financial decision-making.

Key Terms

Fiduciary Duty

Financial planners are certified professionals bound by fiduciary duty to prioritize clients' best interests in personalized financial strategies, while finfluencers primarily offer general financial advice without regulatory obligations. Fiduciary duty requires financial planners to provide transparent, unbiased recommendations, ensuring clients' goals and risk tolerance guide all decisions. Discover how fiduciary standards impact your financial guidance by exploring the roles of planners and finfluencers further.

Regulatory Oversight

Financial planners operate under strict regulatory oversight from entities such as the SEC and CFP Board, ensuring compliance with fiduciary standards and ethical guidelines to protect clients' interests. Finfluencers, often lacking formal certification, work in a largely unregulated space where content is driven by personal experience and social influence rather than regulatory compliance. Explore the nuances of regulatory frameworks to understand how each impacts investment advice and consumer protection.

Disclosure Requirements

Financial planners must adhere to strict regulatory disclosure requirements, including transparent presentation of fees, conflicts of interest, and fiduciary responsibilities as mandated by bodies like the SEC and FINRA. Finfluencers, while influential on platforms like Instagram and TikTok, often operate under less formal disclosure standards but are increasingly scrutinized for proper transparency regarding sponsorships and endorsements. Explore the evolving regulatory landscape to understand how disclosure requirements impact these financial advisors differently.

Source and External Links

Choosing a Financial Planner - A financial planner helps create a tailored financial plan focused on personal goals, including a review of finances, budgeting, risk assessment, and action plans you agree to follow.

Financial Planner: Definition, How to Find One - NerdWallet - Financial planners take an inventory of your finances to help you meet needs and long-term goals, but the term is unregulated; credible planners like CFP(r)s have a fiduciary duty to act in your best interest.

Stephanie Genkin - This Brooklyn-based fee-only Registered Investment Advisor offers affordable, fiduciary financial advice tailored to your personal situation and goals, emphasizing guidance over sales.

dowidth.com

dowidth.com