Bucket investing diversifies assets by allocating funds into different "buckets" based on time horizons and risk tolerance, aiming to balance income and growth for various life stages. Growth investing focuses on companies with above-average earnings potential, prioritizing capital appreciation over immediate income. Explore the distinct strategies and benefits of bucket investing versus growth investing to optimize your financial portfolio.

Why it is important

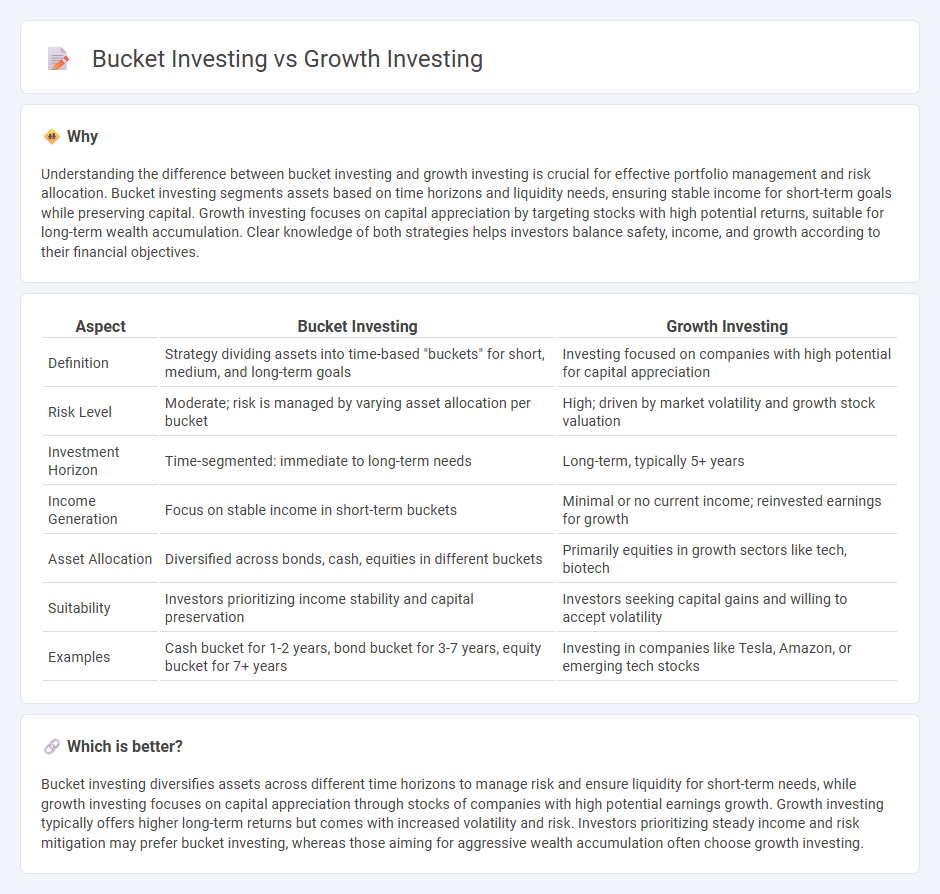

Understanding the difference between bucket investing and growth investing is crucial for effective portfolio management and risk allocation. Bucket investing segments assets based on time horizons and liquidity needs, ensuring stable income for short-term goals while preserving capital. Growth investing focuses on capital appreciation by targeting stocks with high potential returns, suitable for long-term wealth accumulation. Clear knowledge of both strategies helps investors balance safety, income, and growth according to their financial objectives.

Comparison Table

| Aspect | Bucket Investing | Growth Investing |

|---|---|---|

| Definition | Strategy dividing assets into time-based "buckets" for short, medium, and long-term goals | Investing focused on companies with high potential for capital appreciation |

| Risk Level | Moderate; risk is managed by varying asset allocation per bucket | High; driven by market volatility and growth stock valuation |

| Investment Horizon | Time-segmented: immediate to long-term needs | Long-term, typically 5+ years |

| Income Generation | Focus on stable income in short-term buckets | Minimal or no current income; reinvested earnings for growth |

| Asset Allocation | Diversified across bonds, cash, equities in different buckets | Primarily equities in growth sectors like tech, biotech |

| Suitability | Investors prioritizing income stability and capital preservation | Investors seeking capital gains and willing to accept volatility |

| Examples | Cash bucket for 1-2 years, bond bucket for 3-7 years, equity bucket for 7+ years | Investing in companies like Tesla, Amazon, or emerging tech stocks |

Which is better?

Bucket investing diversifies assets across different time horizons to manage risk and ensure liquidity for short-term needs, while growth investing focuses on capital appreciation through stocks of companies with high potential earnings growth. Growth investing typically offers higher long-term returns but comes with increased volatility and risk. Investors prioritizing steady income and risk mitigation may prefer bucket investing, whereas those aiming for aggressive wealth accumulation often choose growth investing.

Connection

Bucket investing and growth investing both focus on optimizing portfolio returns by strategically allocating assets based on risk tolerance and investment horizons. Bucket investing divides funds into separate categories aligned with specific timeframes and goals, while growth investing targets equities with high potential for capital appreciation to maximize long-term wealth. Combining these approaches enables investors to balance immediate liquidity needs with aggressive growth opportunities, enhancing overall financial planning.

Key Terms

Capital Appreciation

Growth investing emphasizes capital appreciation by targeting stocks with high potential for earnings growth, often in emerging industries or innovative companies. Bucket investing diversifies assets across different time horizons and risk levels to balance growth, income, and capital preservation. Explore more about these investment strategies to align your financial goals effectively.

Asset Allocation

Growth investing targets high-potential stocks aiming for capital appreciation, emphasizing dynamic asset allocation in equities to maximize returns. Bucket investing segments assets into distinct portfolios based on time horizons and risk tolerance, ensuring stable income and preserving principal through fixed income and cash reserves. Explore more about effective asset allocation strategies to balance growth and stability in your investment plan.

Time Horizon

Growth investing targets capital appreciation by investing in companies with strong potential for revenue and earnings growth, often suited for long-term horizons of 10 years or more. Bucket investing segments assets into different time frames or goals, ensuring liquidity and planned withdrawals for short, medium, and long-term needs. Explore more to understand which strategy aligns best with your financial goals and time horizon.

Source and External Links

Growth investing: What it is and how to build a high-growth portfolio - Growth investing focuses on companies expected to grow at an above-average rate, benefiting from compounding returns and leading innovations, often in fast-moving sectors like technology and renewable energy.

Growth investing - Wikipedia - Growth investing aims at capital appreciation by investing in companies showing signs of above-average growth, even if their share prices seem expensive, differentiating it from value investing but with overlapping principles as noted by Warren Buffett.

Investing for growth opportunities - BlackRock - Growth investing targets businesses expected to generate above-average earnings and revenue growth, suitable for investors seeking long-term wealth accumulation and able to tolerate more risk.

dowidth.com

dowidth.com