Basis trading exploits price differences between a financial asset and its futures contract to generate risk-free profits, often involving commodities or equity indices. Statistical arbitrage employs quantitative models to identify and trade pricing inefficiencies across correlated securities, relying heavily on historical data and mean-reversion strategies. Explore the nuances between these strategies to enhance your trading approach and optimize returns.

Why it is important

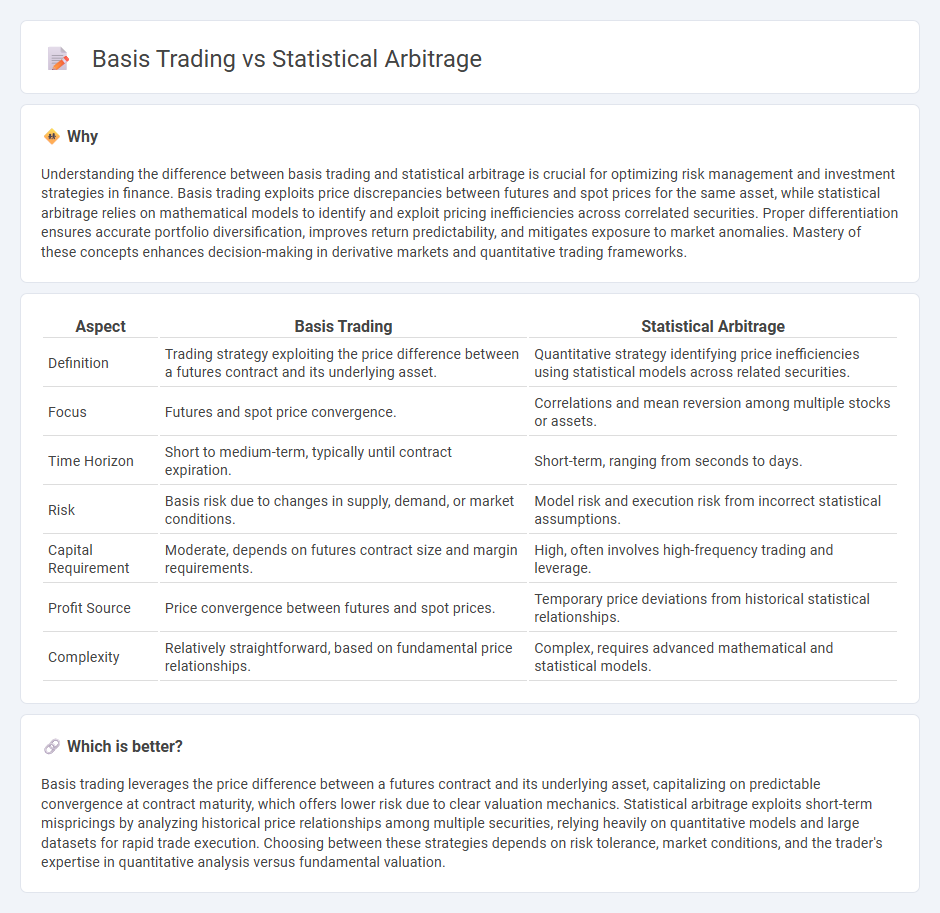

Understanding the difference between basis trading and statistical arbitrage is crucial for optimizing risk management and investment strategies in finance. Basis trading exploits price discrepancies between futures and spot prices for the same asset, while statistical arbitrage relies on mathematical models to identify and exploit pricing inefficiencies across correlated securities. Proper differentiation ensures accurate portfolio diversification, improves return predictability, and mitigates exposure to market anomalies. Mastery of these concepts enhances decision-making in derivative markets and quantitative trading frameworks.

Comparison Table

| Aspect | Basis Trading | Statistical Arbitrage |

|---|---|---|

| Definition | Trading strategy exploiting the price difference between a futures contract and its underlying asset. | Quantitative strategy identifying price inefficiencies using statistical models across related securities. |

| Focus | Futures and spot price convergence. | Correlations and mean reversion among multiple stocks or assets. |

| Time Horizon | Short to medium-term, typically until contract expiration. | Short-term, ranging from seconds to days. |

| Risk | Basis risk due to changes in supply, demand, or market conditions. | Model risk and execution risk from incorrect statistical assumptions. |

| Capital Requirement | Moderate, depends on futures contract size and margin requirements. | High, often involves high-frequency trading and leverage. |

| Profit Source | Price convergence between futures and spot prices. | Temporary price deviations from historical statistical relationships. |

| Complexity | Relatively straightforward, based on fundamental price relationships. | Complex, requires advanced mathematical and statistical models. |

Which is better?

Basis trading leverages the price difference between a futures contract and its underlying asset, capitalizing on predictable convergence at contract maturity, which offers lower risk due to clear valuation mechanics. Statistical arbitrage exploits short-term mispricings by analyzing historical price relationships among multiple securities, relying heavily on quantitative models and large datasets for rapid trade execution. Choosing between these strategies depends on risk tolerance, market conditions, and the trader's expertise in quantitative analysis versus fundamental valuation.

Connection

Basis trading and statistical arbitrage are connected through their reliance on price discrepancies between related securities to generate profits. Basis trading focuses on the price difference between a futures contract and its underlying asset, while statistical arbitrage uses quantitative models to exploit temporary mispricings across multiple assets. Both strategies depend on market efficiency inefficiencies and require sophisticated risk management and execution algorithms to capitalize on short-term opportunities.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages quantitative models and historical price data to identify pricing inefficiencies between correlated securities, enabling traders to execute market-neutral strategies that profit from mean reversion. It relies on high-frequency trading algorithms, extensive data analysis, and risk management techniques to capture small, consistent returns across diverse asset pairs. Explore deeper insights into statistical arbitrage methodologies and implementation strategies.

Mean Reversion

Statistical arbitrage leverages mean reversion by identifying temporary mispricings across correlated assets, exploiting price deviations expected to revert to their historical relationship. Basis trading specifically targets the convergence between the spot price and the futures price of a commodity or financial instrument, capitalizing on the basis spread's tendency to revert to its mean. Explore detailed strategies and quantitative models to maximize returns through mean reversion in both statistical arbitrage and basis trading.

Pairs Trading

Pairs trading, a core strategy in statistical arbitrage, exploits price divergences between two historically correlated assets to generate profits from mean reversion. Basis trading, often used in futures markets, capitalizes on the price difference between a futures contract and its underlying asset, focusing on convergence at contract maturity. Explore the nuances and applications of these strategies to enhance your trading expertise.

Source and External Links

The Power of Statistical Arbitrage in Finance - Statistical arbitrage, or "stat arb," uses quantitative models to identify temporary price discrepancies between related financial instruments, relying on mean reversion principles to trade profitably by buying undervalued and selling overvalued assets expecting price convergence.

Statistical arbitrage - Statistical arbitrage is a short-term trading strategy using mean reversion models on broadly diversified portfolios, often held from seconds to days, supported by statistical and computational techniques, typically automated to handle high turnover and small profit margins.

What is Statistical Arbitrage? - Statistical arbitrage is a quantitative trading approach exploiting pricing discrepancies or deviations from expected price relationships between securities, often utilizing multi-factor and automated strategies to generate trading signals.

dowidth.com

dowidth.com