A decentralized autonomous organization (DAO) treasury consists of digital assets managed through blockchain protocols, allowing transparent and automated decision-making by token holders, while endowment funds are traditional investment portfolios managed by institutions to generate steady income for long-term financial support. DAO treasuries offer real-time governance and liquidity, contrasting with endowment funds' reliance on professional fund managers and more rigid structures. Explore further to understand how each model shapes financial sustainability and governance strategies.

Why it is important

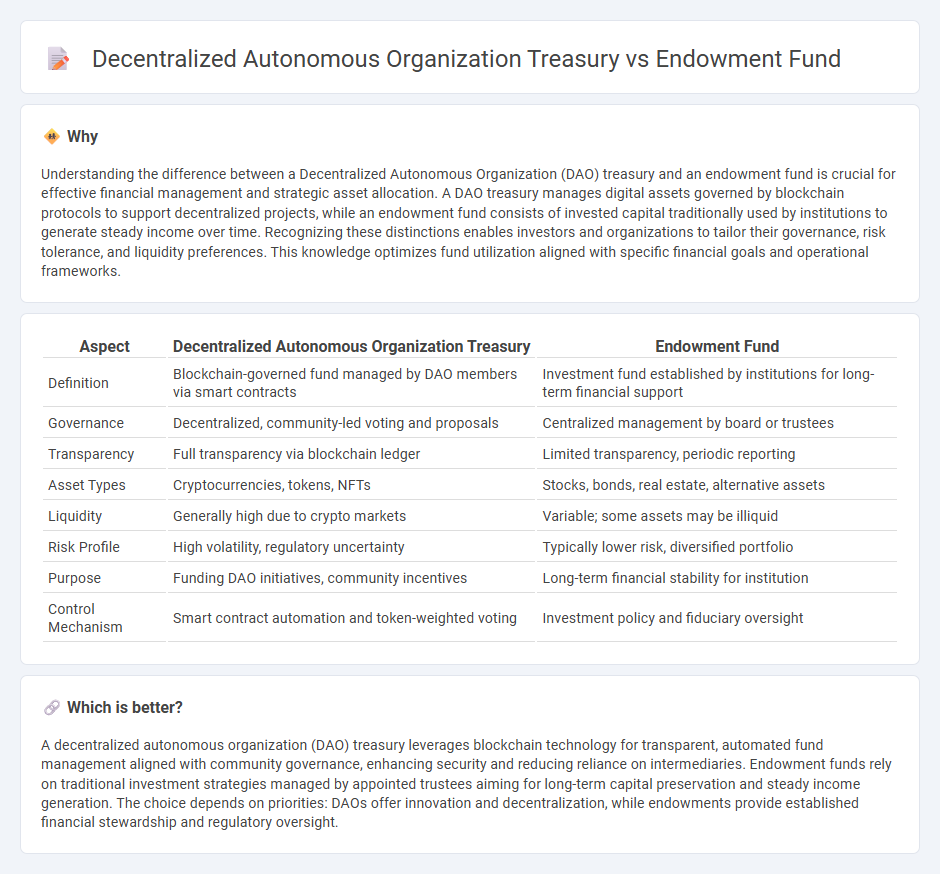

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and an endowment fund is crucial for effective financial management and strategic asset allocation. A DAO treasury manages digital assets governed by blockchain protocols to support decentralized projects, while an endowment fund consists of invested capital traditionally used by institutions to generate steady income over time. Recognizing these distinctions enables investors and organizations to tailor their governance, risk tolerance, and liquidity preferences. This knowledge optimizes fund utilization aligned with specific financial goals and operational frameworks.

Comparison Table

| Aspect | Decentralized Autonomous Organization Treasury | Endowment Fund |

|---|---|---|

| Definition | Blockchain-governed fund managed by DAO members via smart contracts | Investment fund established by institutions for long-term financial support |

| Governance | Decentralized, community-led voting and proposals | Centralized management by board or trustees |

| Transparency | Full transparency via blockchain ledger | Limited transparency, periodic reporting |

| Asset Types | Cryptocurrencies, tokens, NFTs | Stocks, bonds, real estate, alternative assets |

| Liquidity | Generally high due to crypto markets | Variable; some assets may be illiquid |

| Risk Profile | High volatility, regulatory uncertainty | Typically lower risk, diversified portfolio |

| Purpose | Funding DAO initiatives, community incentives | Long-term financial stability for institution |

| Control Mechanism | Smart contract automation and token-weighted voting | Investment policy and fiduciary oversight |

Which is better?

A decentralized autonomous organization (DAO) treasury leverages blockchain technology for transparent, automated fund management aligned with community governance, enhancing security and reducing reliance on intermediaries. Endowment funds rely on traditional investment strategies managed by appointed trustees aiming for long-term capital preservation and steady income generation. The choice depends on priorities: DAOs offer innovation and decentralization, while endowments provide established financial stewardship and regulatory oversight.

Connection

Decentralized autonomous organization (DAO) treasuries and endowment funds both manage assets to support long-term financial sustainability, leveraging blockchain technology for transparency and security. DAO treasuries allocate cryptocurrency and digital assets through community governance to fund projects, while endowment funds invest capital to generate steady returns for organizational missions. Integration of DAO treasuries with endowment fund strategies optimizes resource allocation, risk management, and funding efficiency in decentralized finance ecosystems.

Key Terms

Governance

Endowment funds typically operate under centralized governance structures governed by boards or committees that make investment and disbursement decisions to ensure long-term financial sustainability. Decentralized autonomous organization (DAO) treasuries leverage blockchain technology for transparent, community-driven governance, enabling token holders to propose and vote on fund allocation and operational rules. Explore deeper insights into how governance models impact financial management and stakeholder engagement in these funding mechanisms.

Asset Management

Endowment funds strategically allocate diversified portfolios including equities, bonds, and alternative assets to generate long-term, stable returns that support institutional missions. Decentralized autonomous organization (DAO) treasuries primarily manage digital assets such as cryptocurrencies and governance tokens through smart contracts, enabling transparent, community-driven financial decisions. Explore how asset management practices differ between traditional endowment funds and DAO treasuries for optimized financial stewardship.

Sustainability

Endowment funds traditionally allocate capital to generate long-term, sustainable income streams supporting organizational missions, with investment strategies emphasizing diversification and risk management to preserve principal. Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology to maintain transparency, enable community governance over asset management, and rapidly adapt funding allocation to sustainability projects through smart contracts. Explore how integrating both models can enhance sustainable financial ecosystems and drive innovation in responsible asset stewardship.

Source and External Links

Endowment Fund - Overview, How It Works, Types - An endowment fund is an investment portfolio initially funded by donations to support nonprofit organizations, where the principal is usually kept intact and only the investment income is used for charitable purposes, allowing perpetual funding for causes defined by donors.

Financial endowment - A financial endowment is a legal structure managing investments to perpetually support specific purposes, often structured as trusts or nonprofit foundations with the principal preserved and only a portion of income spent yearly, commonly used by educational, cultural, and religious institutions.

What is an Endowment Fund? - An endowment fund consists of money invested to generate revenue for charitable activities with the principal kept intact and earnings used to support nonprofit grants, allowing donors to provide lasting support with tax-deductible donations consisting of cash or assets.

dowidth.com

dowidth.com