Zero day options offer ultra-short-term trading opportunities with contracts expiring on the same day, providing traders with high volatility and rapid profit potential. Mini options have smaller contract sizes compared to standard options, making them accessible for retail investors seeking lower capital requirements and reduced risk exposure. Explore the differences between zero day options and mini options to optimize your trading strategy.

Why it is important

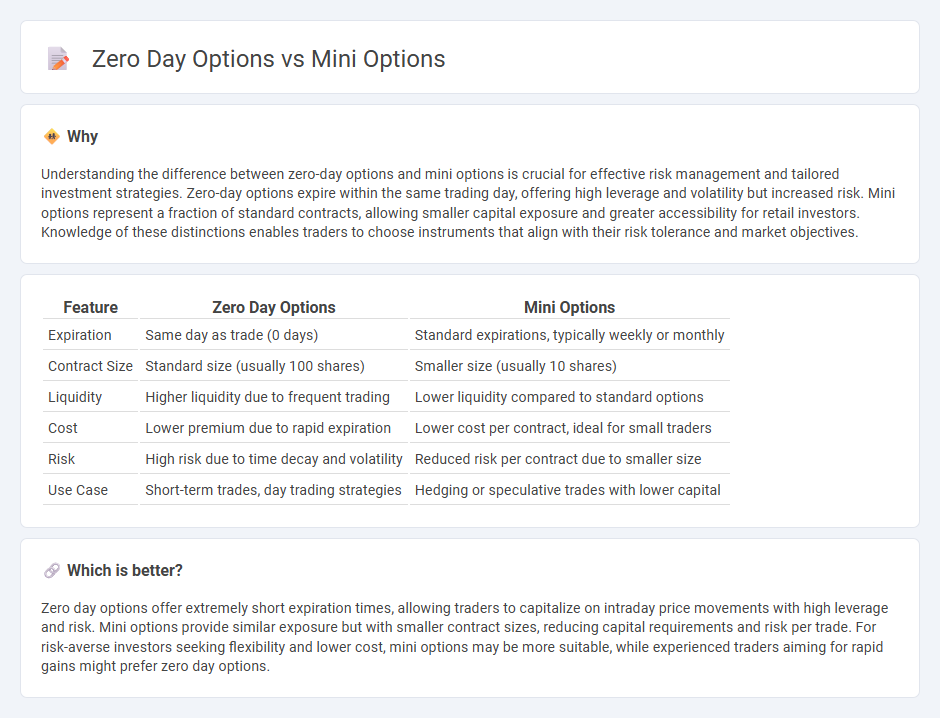

Understanding the difference between zero-day options and mini options is crucial for effective risk management and tailored investment strategies. Zero-day options expire within the same trading day, offering high leverage and volatility but increased risk. Mini options represent a fraction of standard contracts, allowing smaller capital exposure and greater accessibility for retail investors. Knowledge of these distinctions enables traders to choose instruments that align with their risk tolerance and market objectives.

Comparison Table

| Feature | Zero Day Options | Mini Options |

|---|---|---|

| Expiration | Same day as trade (0 days) | Standard expirations, typically weekly or monthly |

| Contract Size | Standard size (usually 100 shares) | Smaller size (usually 10 shares) |

| Liquidity | Higher liquidity due to frequent trading | Lower liquidity compared to standard options |

| Cost | Lower premium due to rapid expiration | Lower cost per contract, ideal for small traders |

| Risk | High risk due to time decay and volatility | Reduced risk per contract due to smaller size |

| Use Case | Short-term trades, day trading strategies | Hedging or speculative trades with lower capital |

Which is better?

Zero day options offer extremely short expiration times, allowing traders to capitalize on intraday price movements with high leverage and risk. Mini options provide similar exposure but with smaller contract sizes, reducing capital requirements and risk per trade. For risk-averse investors seeking flexibility and lower cost, mini options may be more suitable, while experienced traders aiming for rapid gains might prefer zero day options.

Connection

Zero day options and mini options are connected through their roles in enhancing trading strategies by offering flexibility and cost efficiency. Zero day options, expiring on the same day they are traded, provide opportunities for rapid speculation and hedging, while mini options represent smaller contract sizes, making options trading accessible to investors with limited capital. Combining these features allows traders to manage risk and capitalize on short-term market movements with lower investment thresholds.

Key Terms

Contract Size

Mini options typically represent 10 shares per contract, making them more accessible for smaller investors compared to standard options that cover 100 shares. Zero day options refer to contracts expiring on the same trading day, offering high leverage but increased risk due to their extremely short lifespan. Explore the nuances of contract size and expiration to optimize your trading strategy.

Expiration Date

Mini options feature smaller contract sizes and typically expire on the same day as standard options, offering traders flexibility with lower risk exposure. Zero-day options are contracts that expire on the very day they are traded, providing opportunities for ultra-short-term hedging or speculative strategies with heightened time decay sensitivity. Explore detailed expiration date differences to optimize your options trading approach.

Risk Management

Mini options offer a smaller contract size compared to standard options, reducing the potential loss exposure and making them ideal for conservative traders focused on risk management. Zero-day options, with their extremely short expiration, carry higher risk due to rapid time decay but allow skilled traders to capitalize on quick price movements with tight stop-loss strategies. Explore more details on managing risk effectively with mini and zero-day options to enhance your trading strategies.

Source and External Links

Mini Options FAQs - Mini options are smaller contract size options designed mainly for retail investors with less than 100 shares; they have the same strike prices as standard options, no special margin requirements, and can be paired with other mini options or stock for margin purposes.

Trading Micro E-mini Options - Micro E-mini options on major equity indices provide traders with precise risk management, smaller contract sizes for flexible position scaling, multiple expiration cycles, and are useful tools for hedging during market uncertainty.

MRUT: Mini-Russell 2000 Index Options - Mini-Russell 2000 Index options are cash-settled, European-style options that are one-tenth the size of standard contracts, offering simpler settlement, covered margin benefits, and specific tax advantages for small-cap market exposure.

dowidth.com

dowidth.com