Synthetic assets replicate the value and performance of traditional assets using derivatives and financial engineering, allowing exposure without owning the underlying asset. Traditional assets include physical holdings like stocks, bonds, and commodities that investors directly own and trade. Explore the key differences between synthetic and traditional assets to optimize your investment strategy.

Why it is important

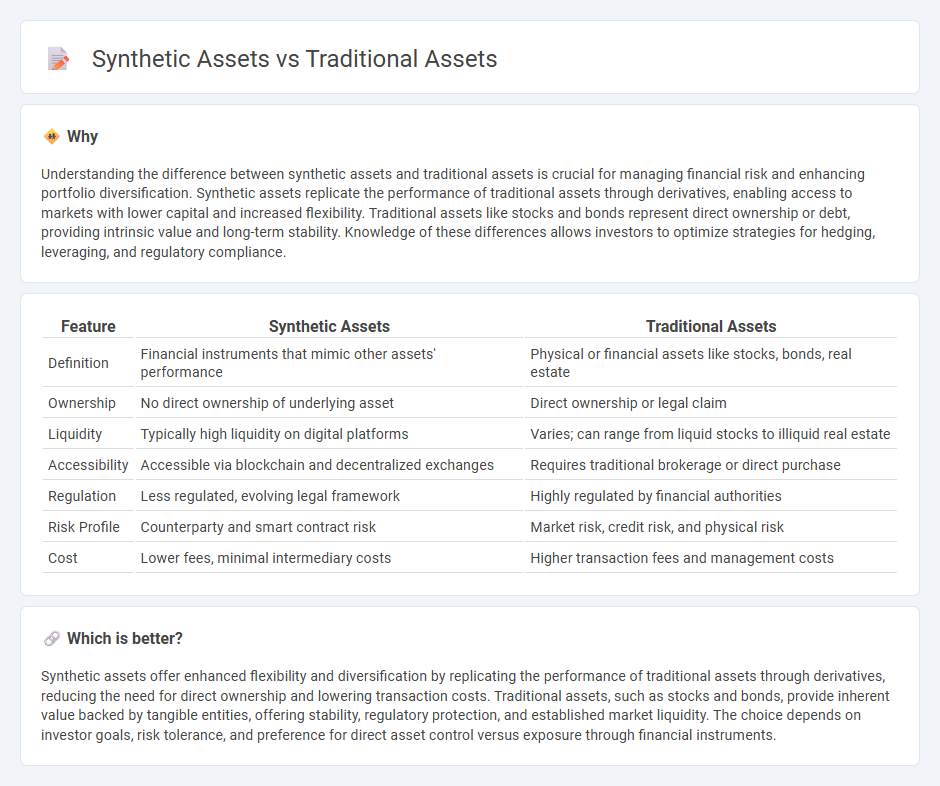

Understanding the difference between synthetic assets and traditional assets is crucial for managing financial risk and enhancing portfolio diversification. Synthetic assets replicate the performance of traditional assets through derivatives, enabling access to markets with lower capital and increased flexibility. Traditional assets like stocks and bonds represent direct ownership or debt, providing intrinsic value and long-term stability. Knowledge of these differences allows investors to optimize strategies for hedging, leveraging, and regulatory compliance.

Comparison Table

| Feature | Synthetic Assets | Traditional Assets |

|---|---|---|

| Definition | Financial instruments that mimic other assets' performance | Physical or financial assets like stocks, bonds, real estate |

| Ownership | No direct ownership of underlying asset | Direct ownership or legal claim |

| Liquidity | Typically high liquidity on digital platforms | Varies; can range from liquid stocks to illiquid real estate |

| Accessibility | Accessible via blockchain and decentralized exchanges | Requires traditional brokerage or direct purchase |

| Regulation | Less regulated, evolving legal framework | Highly regulated by financial authorities |

| Risk Profile | Counterparty and smart contract risk | Market risk, credit risk, and physical risk |

| Cost | Lower fees, minimal intermediary costs | Higher transaction fees and management costs |

Which is better?

Synthetic assets offer enhanced flexibility and diversification by replicating the performance of traditional assets through derivatives, reducing the need for direct ownership and lowering transaction costs. Traditional assets, such as stocks and bonds, provide inherent value backed by tangible entities, offering stability, regulatory protection, and established market liquidity. The choice depends on investor goals, risk tolerance, and preference for direct asset control versus exposure through financial instruments.

Connection

Synthetic assets replicate the value and performance of traditional assets through financial derivatives such as options, futures, and swaps. They enable investors to gain exposure to underlying asset classes like stocks, bonds, or commodities without owning the actual physical assets. This connection allows for enhanced liquidity, risk management, and access to diversified markets in modern finance.

Key Terms

Underlying Asset

Traditional assets represent ownership or a claim on tangible or financial instruments, such as stocks, bonds, or real estate, where the value is directly tied to the underlying asset itself. Synthetic assets are financial instruments designed to mimic the value and payoff of traditional assets through derivatives and smart contracts, without requiring the actual underlying asset ownership. Explore how synthetic assets transform investment strategies by studying their relationship to underlying assets in greater detail.

Derivative

Traditional assets represent physical or financial instruments such as stocks, bonds, or commodities, while synthetic assets are engineered financial products derived from underlying assets to mimic their value and risk profiles. Derivatives, a key category of synthetic assets, include options, futures, and swaps that derive value from underlying assets and enable investors to hedge risks or speculate on price movements. Explore deeper insights into the mechanics of derivatives and their impact on modern finance.

Tokenization

Traditional assets such as real estate, stocks, and commodities represent tangible or legally recognized ownership, while synthetic assets in tokenization use blockchain technology to digitally replicate these assets' value and characteristics. Tokenization enhances liquidity, enables fractional ownership, and streamlines transactions by converting physical assets into tradable digital tokens on decentralized platforms. Discover how tokenization is transforming investment opportunities and reshaping the future of asset management.

Source and External Links

Traditional investments - Wikipedia - Traditional assets typically include bonds, cash, real estate, and equity shares, which investors use expecting capital appreciation, dividends, and interest earnings.

Get to Know Various Types of Asset Classes - PIMCO - Traditional asset classes mainly consist of bonds, cash, and stocks, where bonds and cash are considered defensive, providing regular income, while stocks are growth assets aimed at capital appreciation.

Alternative assets versus traditional assets - FranShares - Traditional assets fall into three primary categories: stocks, bonds, and cash, and they are highly accessible to investors, often used for portfolio diversification due to their lower risk and high liquidity.

dowidth.com

dowidth.com