Decentralized finance (DeFi) revolutionizes traditional financial services by leveraging blockchain technology to enable peer-to-peer transactions without intermediaries, enhancing transparency and accessibility. Insurtech integrates innovative technologies like AI and IoT to streamline insurance processes, improve risk assessment, and offer personalized policies. Explore how DeFi and insurtech are transforming the financial landscape and redefining customer experiences.

Why it is important

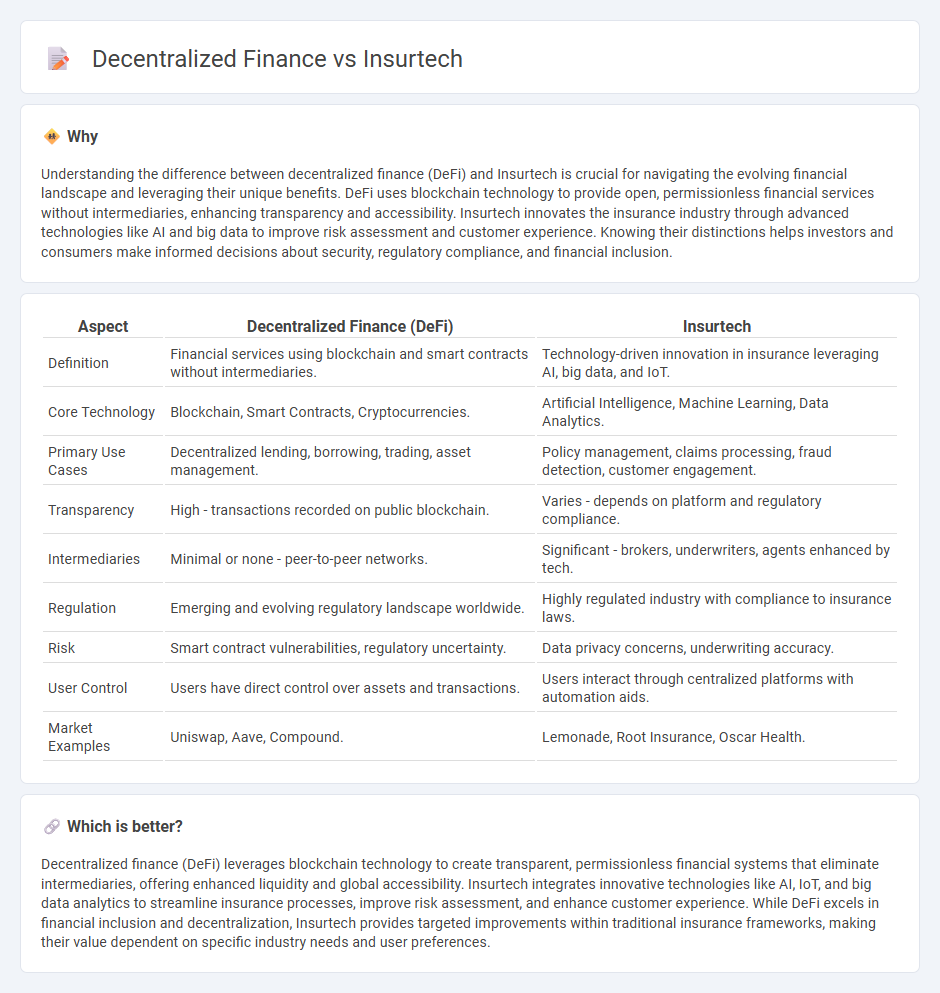

Understanding the difference between decentralized finance (DeFi) and Insurtech is crucial for navigating the evolving financial landscape and leveraging their unique benefits. DeFi uses blockchain technology to provide open, permissionless financial services without intermediaries, enhancing transparency and accessibility. Insurtech innovates the insurance industry through advanced technologies like AI and big data to improve risk assessment and customer experience. Knowing their distinctions helps investors and consumers make informed decisions about security, regulatory compliance, and financial inclusion.

Comparison Table

| Aspect | Decentralized Finance (DeFi) | Insurtech |

|---|---|---|

| Definition | Financial services using blockchain and smart contracts without intermediaries. | Technology-driven innovation in insurance leveraging AI, big data, and IoT. |

| Core Technology | Blockchain, Smart Contracts, Cryptocurrencies. | Artificial Intelligence, Machine Learning, Data Analytics. |

| Primary Use Cases | Decentralized lending, borrowing, trading, asset management. | Policy management, claims processing, fraud detection, customer engagement. |

| Transparency | High - transactions recorded on public blockchain. | Varies - depends on platform and regulatory compliance. |

| Intermediaries | Minimal or none - peer-to-peer networks. | Significant - brokers, underwriters, agents enhanced by tech. |

| Regulation | Emerging and evolving regulatory landscape worldwide. | Highly regulated industry with compliance to insurance laws. |

| Risk | Smart contract vulnerabilities, regulatory uncertainty. | Data privacy concerns, underwriting accuracy. |

| User Control | Users have direct control over assets and transactions. | Users interact through centralized platforms with automation aids. |

| Market Examples | Uniswap, Aave, Compound. | Lemonade, Root Insurance, Oscar Health. |

Which is better?

Decentralized finance (DeFi) leverages blockchain technology to create transparent, permissionless financial systems that eliminate intermediaries, offering enhanced liquidity and global accessibility. Insurtech integrates innovative technologies like AI, IoT, and big data analytics to streamline insurance processes, improve risk assessment, and enhance customer experience. While DeFi excels in financial inclusion and decentralization, Insurtech provides targeted improvements within traditional insurance frameworks, making their value dependent on specific industry needs and user preferences.

Connection

Decentralized finance (DeFi) leverages blockchain technology to create transparent, automated financial services that reduce reliance on traditional intermediaries, transforming the insurance sector through Insurtech innovations. Insurtech integrates DeFi by utilizing smart contracts for claim automation, risk assessment, and fraud prevention, enhancing efficiency and trust in insurance processes. The convergence of DeFi and Insurtech drives financial inclusion by enabling peer-to-peer insurance models and real-time policy management on decentralized platforms.

Key Terms

Smart Contracts

Smart contracts revolutionize insurtech by automating claims processing and underwriting, reducing fraud, and increasing transparency with blockchain technology. In decentralized finance (DeFi), smart contracts enable trustless, programmable financial services like lending, borrowing, and asset exchanges without intermediaries. Explore the transformative impact of smart contracts on both industries to understand their future potential.

Risk Pooling

Insurtech leverages advanced algorithms and big data to optimize risk pooling by creating dynamic, personalized insurance pools that reduce adverse selection and improve claims accuracy. Decentralized finance (DeFi) uses blockchain technology to enable transparent, trustless risk-sharing through smart contracts, allowing participants to pool funds directly without intermediaries. Explore how these innovations transform risk pooling and redefine insurance models today.

Tokenization

Tokenization within insurtech enables digital representation of insurance policies on blockchain, enhancing transparency and efficiency in claims processing. In decentralized finance (DeFi), tokenization facilitates asset liquidity by converting physical or financial assets into tradable digital tokens, expanding investment accessibility. Explore how tokenization transforms both insurtech and DeFi for innovative financial solutions.

Source and External Links

What Is Insurtech? A Guide For Brokers and Carriers | Salesforce US - Insurtech uses technology like AI and automation to modernize insurance processes, improving efficiency, personalization, and customer experience for underwriters, brokers, and policyholders.

What is insurtech? | NEXT - Next Insurance - Insurtech refers to technological innovations rapidly transforming the insurance industry and includes startups focused on changing how insurance is bought and managed through technology.

What is InsurTech? - Overview, Importance, Applications - InsurTech transforms traditional insurance by leveraging technology to modernize policy creation, underwriting, and management while offering personalized insurance products based on individual risk profiles.

dowidth.com

dowidth.com