Liability Driven Investing (LDI) focuses on aligning investment strategies with future liabilities to manage risks and ensure sufficient cash flows. Immunization strategy aims to protect a portfolio's value from interest rate fluctuations by matching asset durations to liability durations. Explore the differences and applications of these strategies to enhance your financial risk management knowledge.

Why it is important

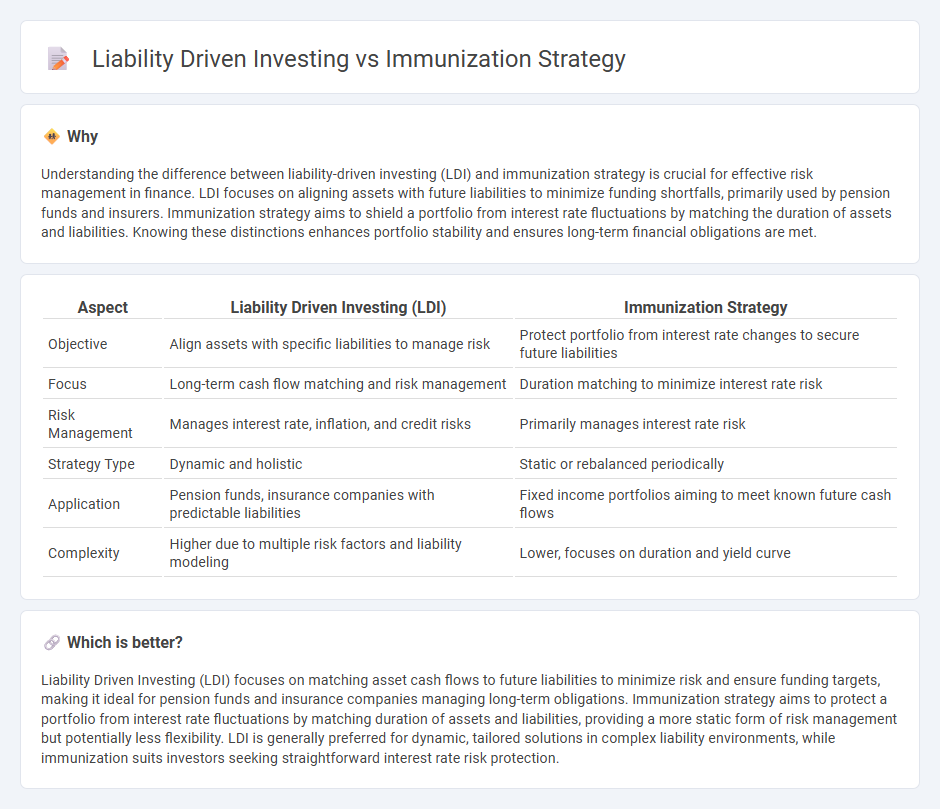

Understanding the difference between liability-driven investing (LDI) and immunization strategy is crucial for effective risk management in finance. LDI focuses on aligning assets with future liabilities to minimize funding shortfalls, primarily used by pension funds and insurers. Immunization strategy aims to shield a portfolio from interest rate fluctuations by matching the duration of assets and liabilities. Knowing these distinctions enhances portfolio stability and ensures long-term financial obligations are met.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Immunization Strategy |

|---|---|---|

| Objective | Align assets with specific liabilities to manage risk | Protect portfolio from interest rate changes to secure future liabilities |

| Focus | Long-term cash flow matching and risk management | Duration matching to minimize interest rate risk |

| Risk Management | Manages interest rate, inflation, and credit risks | Primarily manages interest rate risk |

| Strategy Type | Dynamic and holistic | Static or rebalanced periodically |

| Application | Pension funds, insurance companies with predictable liabilities | Fixed income portfolios aiming to meet known future cash flows |

| Complexity | Higher due to multiple risk factors and liability modeling | Lower, focuses on duration and yield curve |

Which is better?

Liability Driven Investing (LDI) focuses on matching asset cash flows to future liabilities to minimize risk and ensure funding targets, making it ideal for pension funds and insurance companies managing long-term obligations. Immunization strategy aims to protect a portfolio from interest rate fluctuations by matching duration of assets and liabilities, providing a more static form of risk management but potentially less flexibility. LDI is generally preferred for dynamic, tailored solutions in complex liability environments, while immunization suits investors seeking straightforward interest rate risk protection.

Connection

Liability-driven investing (LDI) aligns asset allocation with future liabilities to ensure adequate funding of obligations, while immunization strategy minimizes interest rate risk by matching the duration of assets and liabilities. Both approaches focus on protecting the financial position of pension funds and insurance companies from market volatility and interest rate fluctuations. Integrating LDI with immunization techniques enhances portfolio resilience by securing cash flows to meet long-term liabilities.

Key Terms

Duration Matching

Immunization strategy and liability-driven investing (LDI) both prioritize duration matching to shield portfolios from interest rate fluctuations, ensuring assets align with future liabilities' timing and magnitude. Immunization targets a fixed time horizon to guarantee asset value covers liabilities despite rate changes, while LDI integrates broader financial goals, including liability cash flow projections and risk appetite. Explore the nuances of these approaches to master effective duration matching for robust financial planning.

Cash Flow Matching

Cash flow matching in immunization strategy involves structuring bond portfolios so that cash inflows precisely align with future liabilities, minimizing interest rate risk. Liability Driven Investing (LDI) incorporates cash flow matching alongside duration matching and hedging techniques to manage overall financial risk related to pension obligations or insurance claims. Discover how integrating cash flow matching enhances portfolio resilience in managing liabilities.

Interest Rate Risk

Immunization strategy and liability-driven investing both prioritize managing interest rate risk to protect portfolio value against changes in interest rates, but immunization aligns asset duration precisely to liabilities to ensure portfolio value covers future obligations at a specific time. Liability-driven investing extends this by incorporating a broader range of liabilities, including long-term obligations, and dynamically adjusts the portfolio to hedge interest rate risk over varying time horizons. Explore detailed techniques and benefits of each approach to effectively mitigate interest rate risk in your investment strategy.

Source and External Links

2.3 Immunization strategies - Immunization strategies include routine vaccination at fixed, outreach, and mobile sites, mass vaccination campaigns like catch-up and outbreak response to cover different population needs and outbreak risks.

CDC Global Immunization Strategic Framework - The CDC framework aims globally to prevent, detect, respond to, sustain, and innovate immunization programs to protect everyone from vaccine-preventable diseases using data-guided, integrated, partnership-based, and focused investment principles.

Chapter 3: Immunization Strategies for Healthcare Providers - Strategies to increase vaccine uptake in healthcare settings include system-level interventions, scheduling follow-ups, use of immunization information systems, strong provider recommendations, and community-tailored approaches like the IQIP process.

dowidth.com

dowidth.com