Decentralized over-the-counter (OTC) trading offers direct peer-to-peer asset transactions without intermediaries, enhancing privacy and reducing counterparty risk compared to centralized exchanges that rely on third-party backbones for order matching and custody. Centralized exchanges provide increased liquidity, user-friendly interfaces, and regulated environments but often face vulnerabilities like hacking and regulatory restrictions. Explore further to understand the advantages and challenges unique to each trading paradigm.

Why it is important

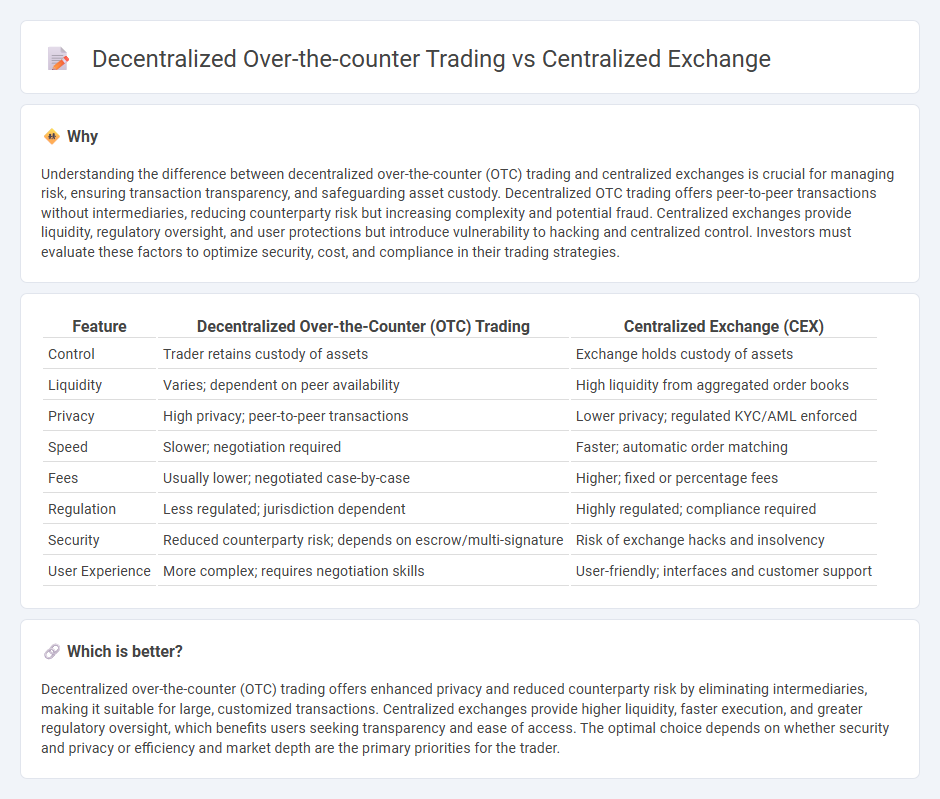

Understanding the difference between decentralized over-the-counter (OTC) trading and centralized exchanges is crucial for managing risk, ensuring transaction transparency, and safeguarding asset custody. Decentralized OTC trading offers peer-to-peer transactions without intermediaries, reducing counterparty risk but increasing complexity and potential fraud. Centralized exchanges provide liquidity, regulatory oversight, and user protections but introduce vulnerability to hacking and centralized control. Investors must evaluate these factors to optimize security, cost, and compliance in their trading strategies.

Comparison Table

| Feature | Decentralized Over-the-Counter (OTC) Trading | Centralized Exchange (CEX) |

|---|---|---|

| Control | Trader retains custody of assets | Exchange holds custody of assets |

| Liquidity | Varies; dependent on peer availability | High liquidity from aggregated order books |

| Privacy | High privacy; peer-to-peer transactions | Lower privacy; regulated KYC/AML enforced |

| Speed | Slower; negotiation required | Faster; automatic order matching |

| Fees | Usually lower; negotiated case-by-case | Higher; fixed or percentage fees |

| Regulation | Less regulated; jurisdiction dependent | Highly regulated; compliance required |

| Security | Reduced counterparty risk; depends on escrow/multi-signature | Risk of exchange hacks and insolvency |

| User Experience | More complex; requires negotiation skills | User-friendly; interfaces and customer support |

Which is better?

Decentralized over-the-counter (OTC) trading offers enhanced privacy and reduced counterparty risk by eliminating intermediaries, making it suitable for large, customized transactions. Centralized exchanges provide higher liquidity, faster execution, and greater regulatory oversight, which benefits users seeking transparency and ease of access. The optimal choice depends on whether security and privacy or efficiency and market depth are the primary priorities for the trader.

Connection

Decentralized over-the-counter (OTC) trading and centralized exchanges (CEX) are interconnected through their complementary roles in the financial ecosystem, facilitating asset liquidity and market access. OTC trading offers personalized, large-volume transactions with privacy and fewer regulations, while CEX provides transparent, regulated platforms with real-time order books and higher liquidity for retail investors. Integration between these systems enhances market efficiency, enabling seamless asset transfers and arbitrage opportunities across decentralized and centralized environments.

Key Terms

Custodianship

Centralized exchanges provide custodianship by holding users' assets, offering enhanced security measures but introducing counterparty risk due to third-party control. Decentralized over-the-counter (OTC) trading enables peer-to-peer transactions without intermediaries, preserving user ownership of private keys and reducing custodial risk but requiring higher personal responsibility for security. Explore deeper insights into custodianship differences between centralized and decentralized trading platforms to optimize asset management strategies.

Counterparty Risk

Centralized exchanges carry significant counterparty risk due to reliance on a single entity to manage trades, custody assets, and execute settlements, exposing users to potential hacks, insolvency, or mismanagement. Decentralized over-the-counter (OTC) trading mitigates counterparty risk by enabling peer-to-peer transactions directly between traders, often facilitated by smart contracts on blockchain platforms that ensure transparency and enforce trade terms without intermediaries. Discover how counterparty risk influences your trading strategy and the security of your digital assets.

Liquidity

Centralized exchanges offer high liquidity due to aggregated order books and market makers, facilitating quick trades with minimal slippage. Decentralized over-the-counter trading provides enhanced privacy and direct counterparty interactions but often faces lower liquidity and higher price volatility. Explore the detailed liquidity comparisons to understand which trading method suits your needs best.

Source and External Links

Cryptocurrency Exchanges - Overview, Advantages, Top 10 - Centralized cryptocurrency exchanges (CEX) act as intermediaries between buyers and sellers, facilitate trading through an order book system, and generate revenue from commissions and transaction fees, with examples like Binance, Coinbase, and Kraken.

Centralized Crypto Exchanges Examined - Gemini - Centralized exchanges facilitate buying and selling of cryptocurrencies for fiat or other digital assets, act as trusted intermediaries by storing and protecting funds, and execute the vast majority of digital asset trades worldwide while complying with security and regulatory standards.

Centralized vs. Decentralized Crypto Exchanges - CoinLedger - Centralized exchanges are user-friendly platforms ideal for beginner investors to buy, sell, and trade crypto easily, and are typically owned and operated by a centralized entity like Coinbase Global or Binance Holdings.

dowidth.com

dowidth.com