Carbon credits represent a market-based mechanism allowing companies to earn or purchase allowances for greenhouse gas emissions, promoting environmental responsibility through tradeable permits. The cap and trade system sets an overall emissions limit, where companies must hold enough allowances to cover their emissions, creating a financial incentive to reduce pollution within a regulated cap. Explore deeper insights into how these frameworks drive sustainable finance and regulatory compliance.

Why it is important

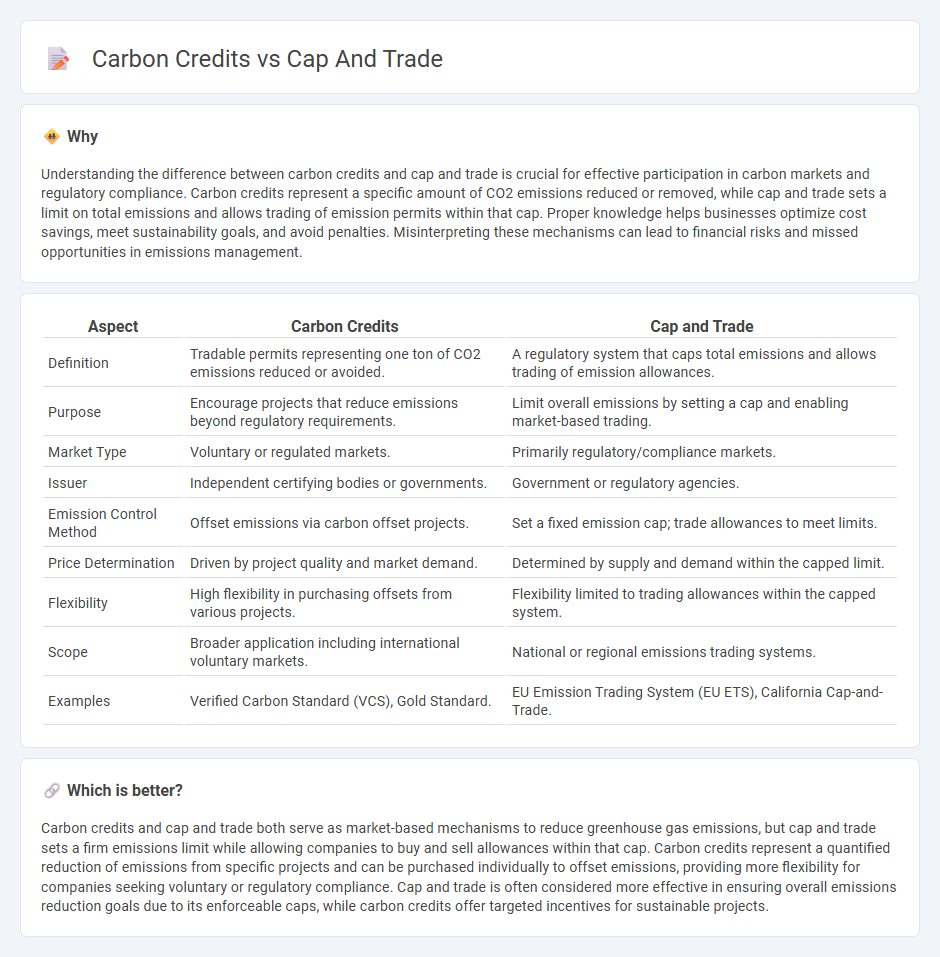

Understanding the difference between carbon credits and cap and trade is crucial for effective participation in carbon markets and regulatory compliance. Carbon credits represent a specific amount of CO2 emissions reduced or removed, while cap and trade sets a limit on total emissions and allows trading of emission permits within that cap. Proper knowledge helps businesses optimize cost savings, meet sustainability goals, and avoid penalties. Misinterpreting these mechanisms can lead to financial risks and missed opportunities in emissions management.

Comparison Table

| Aspect | Carbon Credits | Cap and Trade |

|---|---|---|

| Definition | Tradable permits representing one ton of CO2 emissions reduced or avoided. | A regulatory system that caps total emissions and allows trading of emission allowances. |

| Purpose | Encourage projects that reduce emissions beyond regulatory requirements. | Limit overall emissions by setting a cap and enabling market-based trading. |

| Market Type | Voluntary or regulated markets. | Primarily regulatory/compliance markets. |

| Issuer | Independent certifying bodies or governments. | Government or regulatory agencies. |

| Emission Control Method | Offset emissions via carbon offset projects. | Set a fixed emission cap; trade allowances to meet limits. |

| Price Determination | Driven by project quality and market demand. | Determined by supply and demand within the capped limit. |

| Flexibility | High flexibility in purchasing offsets from various projects. | Flexibility limited to trading allowances within the capped system. |

| Scope | Broader application including international voluntary markets. | National or regional emissions trading systems. |

| Examples | Verified Carbon Standard (VCS), Gold Standard. | EU Emission Trading System (EU ETS), California Cap-and-Trade. |

Which is better?

Carbon credits and cap and trade both serve as market-based mechanisms to reduce greenhouse gas emissions, but cap and trade sets a firm emissions limit while allowing companies to buy and sell allowances within that cap. Carbon credits represent a quantified reduction of emissions from specific projects and can be purchased individually to offset emissions, providing more flexibility for companies seeking voluntary or regulatory compliance. Cap and trade is often considered more effective in ensuring overall emissions reduction goals due to its enforceable caps, while carbon credits offer targeted incentives for sustainable projects.

Connection

Carbon credits serve as tradable certificates representing the right to emit one metric ton of carbon dioxide or its equivalent, forming the core asset in cap and trade systems designed to limit overall greenhouse gas emissions. Cap and trade programs set a maximum emissions cap for industries, distributing or auctioning carbon credits that entities must hold to cover their emissions, thereby creating a financial incentive to reduce pollution. The trading mechanism allows companies to buy and sell carbon credits, promoting cost-effective emission reductions while aligning environmental goals with market dynamics in the finance sector.

Key Terms

Emissions Allowance

Emissions Allowance in cap and trade systems represents a mandatory limit set by regulators on the total greenhouse gases companies can emit, enabling them to trade these permits to meet compliance efficiently. Carbon credits differ as voluntary offsets generated through projects that reduce or capture emissions, which can be purchased to compensate for emissions outside of regulatory mandates. Explore deeper insights into how these mechanisms impact climate policy and business strategies.

Compliance Market

The compliance market utilizes cap and trade systems by setting a maximum allowable level of greenhouse gas emissions and permitting entities to buy and sell emission allowances to meet regulatory requirements. Carbon credits represent quantified emission reductions or removals verified to offset emissions and can be traded in this market to achieve compliance targets. Explore how these mechanisms drive emission reductions within regulatory frameworks.

Offset

Cap and trade systems set a maximum limit on greenhouse gas emissions, allowing companies to buy and sell emission allowances within that cap, while carbon credits specifically represent reductions from offset projects such as reforestation or renewable energy. Offsets generate carbon credits by funding activities that remove or prevent greenhouse gases, providing a flexible compliance option within cap and trade frameworks. Explore our detailed analysis to understand how offsets function in achieving emission reduction targets.

Source and External Links

Cap and Trade Basics - C2ES - Cap and trade is a market-based approach to reduce emissions cost-effectively by setting a cap on total emissions and allowing entities to buy and sell emission allowances, providing price signals to innovate and invest in emissions reduction.

How cap and trade works - Environmental Defense Fund - Cap and trade limits total pollution by issuing allowances equal to a cap, which companies can trade to incentivize faster emissions cuts and innovation, with the overall pollution level declining as the cap is lowered over time.

Cap-and-trade programme | UNFCCC - An Emission Trading System (ETS), or cap and trade, sets a limit on greenhouse gas emissions and allocates tradable allowances that companies must hold per ton emitted, allowing flexibility through buying and selling within the cap to achieve emission reductions.

dowidth.com

dowidth.com