Sovereign debt restructuring involves renegotiating the terms of a nation's outstanding debt to improve repayment conditions and restore fiscal stability, often including interest rate reductions or maturity extensions. Debt buyback refers to a government repurchasing its debt securities from creditors at a discount, effectively reducing total debt obligations and interest burdens. Explore the differences and strategic implications of these debt management approaches to understand their impact on national economies.

Why it is important

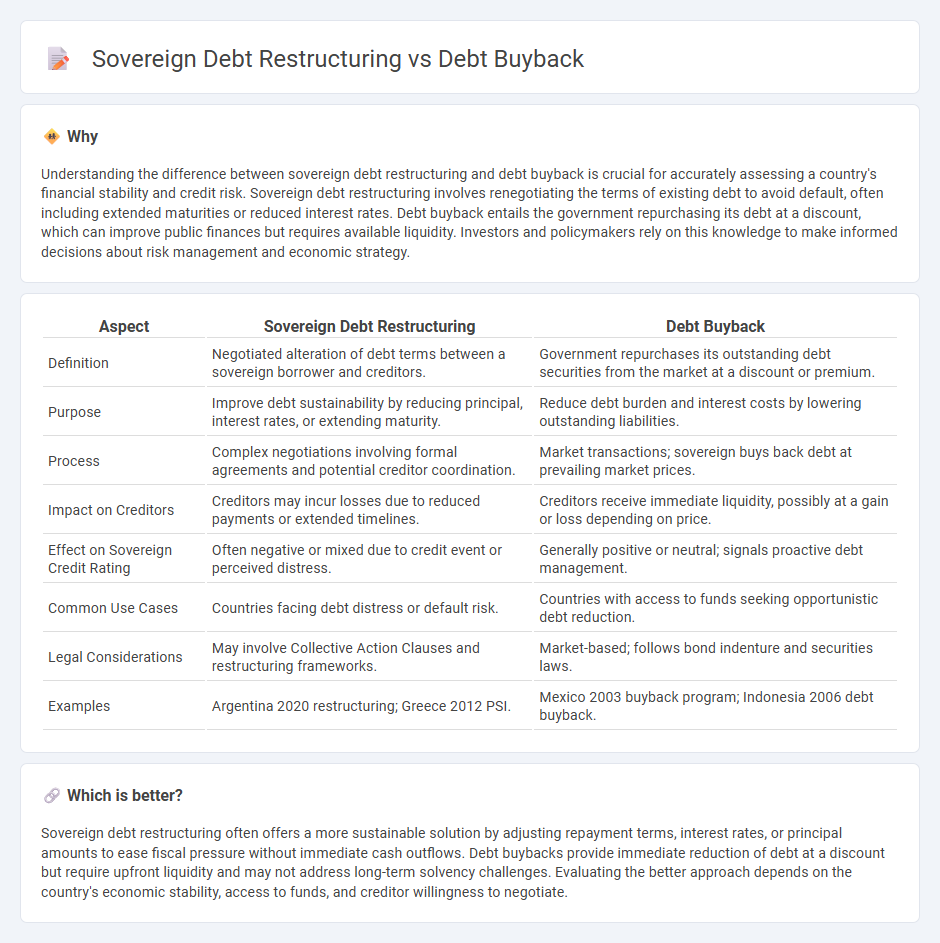

Understanding the difference between sovereign debt restructuring and debt buyback is crucial for accurately assessing a country's financial stability and credit risk. Sovereign debt restructuring involves renegotiating the terms of existing debt to avoid default, often including extended maturities or reduced interest rates. Debt buyback entails the government repurchasing its debt at a discount, which can improve public finances but requires available liquidity. Investors and policymakers rely on this knowledge to make informed decisions about risk management and economic strategy.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Buyback |

|---|---|---|

| Definition | Negotiated alteration of debt terms between a sovereign borrower and creditors. | Government repurchases its outstanding debt securities from the market at a discount or premium. |

| Purpose | Improve debt sustainability by reducing principal, interest rates, or extending maturity. | Reduce debt burden and interest costs by lowering outstanding liabilities. |

| Process | Complex negotiations involving formal agreements and potential creditor coordination. | Market transactions; sovereign buys back debt at prevailing market prices. |

| Impact on Creditors | Creditors may incur losses due to reduced payments or extended timelines. | Creditors receive immediate liquidity, possibly at a gain or loss depending on price. |

| Effect on Sovereign Credit Rating | Often negative or mixed due to credit event or perceived distress. | Generally positive or neutral; signals proactive debt management. |

| Common Use Cases | Countries facing debt distress or default risk. | Countries with access to funds seeking opportunistic debt reduction. |

| Legal Considerations | May involve Collective Action Clauses and restructuring frameworks. | Market-based; follows bond indenture and securities laws. |

| Examples | Argentina 2020 restructuring; Greece 2012 PSI. | Mexico 2003 buyback program; Indonesia 2006 debt buyback. |

Which is better?

Sovereign debt restructuring often offers a more sustainable solution by adjusting repayment terms, interest rates, or principal amounts to ease fiscal pressure without immediate cash outflows. Debt buybacks provide immediate reduction of debt at a discount but require upfront liquidity and may not address long-term solvency challenges. Evaluating the better approach depends on the country's economic stability, access to funds, and creditor willingness to negotiate.

Connection

Sovereign debt restructuring and debt buyback are interconnected financial strategies aimed at managing a country's debt burden more sustainably. Debt restructuring involves negotiations to modify the terms of debt agreements, often extending maturities or reducing interest rates, while debt buyback allows the sovereign to repurchase outstanding debt at a discount, lowering total liabilities. Both mechanisms serve to restore fiscal stability and improve creditworthiness by alleviating repayment pressures.

Key Terms

Face Value

Debt buyback involves repurchasing sovereign debt at a discount to its face value, allowing governments to reduce their outstanding liabilities more flexibly. Sovereign debt restructuring typically adjusts the face value through negotiated terms like haircuts or maturity extensions, aiming to restore debt sustainability without immediate repurchases. Explore how different approaches to face value impact debt relief strategies and financial recovery.

Haircut

Debt buyback involves a government repurchasing its sovereign bonds at a discount, effectively reducing the principal amount owed and creating a direct haircut on the debt. Sovereign debt restructuring often negotiates terms with creditors to extend maturities, lower interest rates, or reduce the principal through a consensual haircut, aiming to improve debt sustainability. Explore the key differences and implications of haircuts in debt buyback and sovereign debt restructuring to understand their impact on fiscal health.

Default

Debt buyback involves a country repurchasing its own sovereign bonds at a discount, often aimed at reducing debt levels before a full default occurs, thus improving fiscal sustainability. Sovereign debt restructuring typically follows a default or imminent default, seeking to renegotiate terms with creditors to avoid legal disputes and restore debt service capacity. Explore more to understand the strategic financial implications of debt management options.

Source and External Links

Debt buyback - The repurchase by a debtor of its own debt, usually at a substantial discount, reducing the debtor's obligations while giving the creditor a one-time payment.

The Strategy of Debt Buy-Backs: A Theoretical Analysis of the ... - Analyzes debt buyback strategies where debtor countries repurchase their debt at market prices, concluding sustainable debt reduction requires buybacks exceeding interest rolled over and typically at par.

Debt buy-back | Practical Law - Thomson Reuters - Defined as a process where a borrower or related party purchases the borrower's debt from lenders, usually at a discount to par value.

dowidth.com

dowidth.com