Crowdlending enables businesses to access capital through loans funded by multiple individual investors, offering a flexible alternative to traditional bank financing. Private equity involves investing large sums from accredited investors or firms in exchange for ownership stakes, often driving strategic growth and management control. Explore how these financing options compare to determine the best fit for your investment goals or business needs.

Why it is important

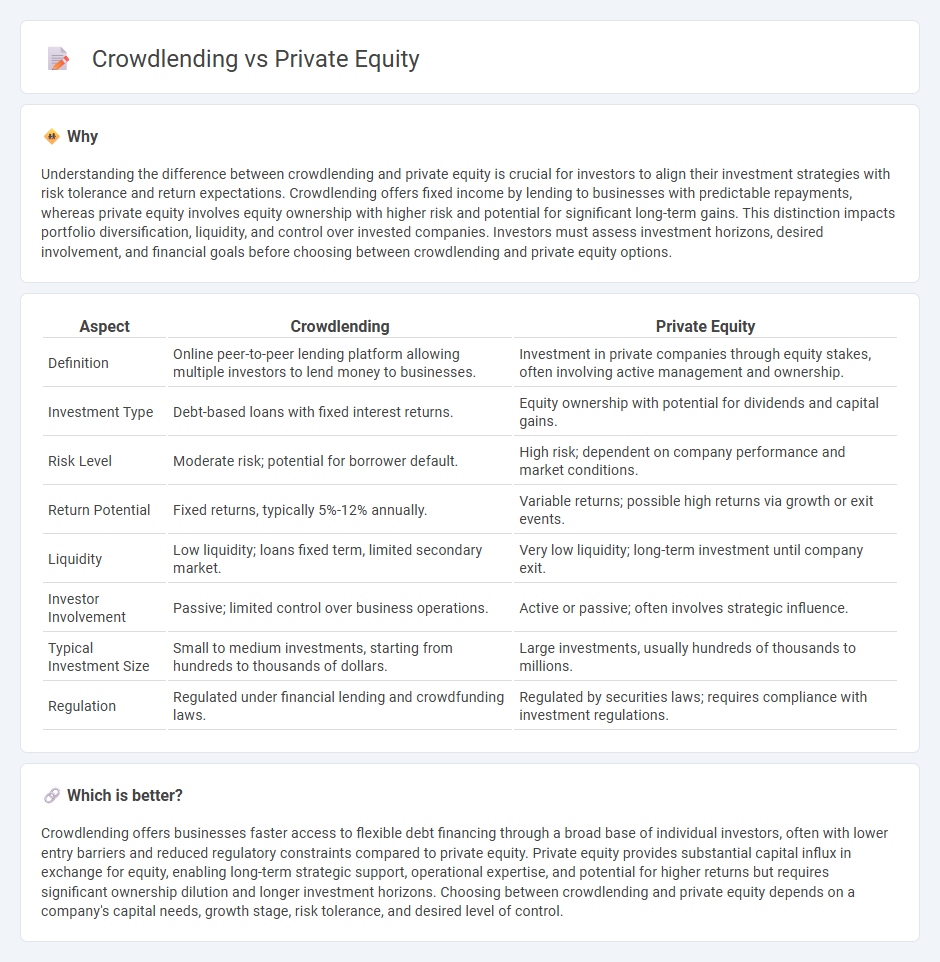

Understanding the difference between crowdlending and private equity is crucial for investors to align their investment strategies with risk tolerance and return expectations. Crowdlending offers fixed income by lending to businesses with predictable repayments, whereas private equity involves equity ownership with higher risk and potential for significant long-term gains. This distinction impacts portfolio diversification, liquidity, and control over invested companies. Investors must assess investment horizons, desired involvement, and financial goals before choosing between crowdlending and private equity options.

Comparison Table

| Aspect | Crowdlending | Private Equity |

|---|---|---|

| Definition | Online peer-to-peer lending platform allowing multiple investors to lend money to businesses. | Investment in private companies through equity stakes, often involving active management and ownership. |

| Investment Type | Debt-based loans with fixed interest returns. | Equity ownership with potential for dividends and capital gains. |

| Risk Level | Moderate risk; potential for borrower default. | High risk; dependent on company performance and market conditions. |

| Return Potential | Fixed returns, typically 5%-12% annually. | Variable returns; possible high returns via growth or exit events. |

| Liquidity | Low liquidity; loans fixed term, limited secondary market. | Very low liquidity; long-term investment until company exit. |

| Investor Involvement | Passive; limited control over business operations. | Active or passive; often involves strategic influence. |

| Typical Investment Size | Small to medium investments, starting from hundreds to thousands of dollars. | Large investments, usually hundreds of thousands to millions. |

| Regulation | Regulated under financial lending and crowdfunding laws. | Regulated by securities laws; requires compliance with investment regulations. |

Which is better?

Crowdlending offers businesses faster access to flexible debt financing through a broad base of individual investors, often with lower entry barriers and reduced regulatory constraints compared to private equity. Private equity provides substantial capital influx in exchange for equity, enabling long-term strategic support, operational expertise, and potential for higher returns but requires significant ownership dilution and longer investment horizons. Choosing between crowdlending and private equity depends on a company's capital needs, growth stage, risk tolerance, and desired level of control.

Connection

Crowdlending and private equity both provide alternative financing options outside traditional banking, targeting startups and SMEs seeking capital for growth. While crowdlending allows multiple investors to lend directly to businesses through online platforms, private equity involves institutional or accredited investors acquiring ownership stakes. These approaches intersect as both facilitate access to funding, with private equity often participating in later-stage financing following initial capital raised via crowdlending.

Key Terms

Ownership Structure

Private equity investments involve acquiring equity stakes, granting investors partial ownership and voting rights in the company, which influence strategic decisions and long-term value creation. Crowdlending, or peer-to-peer lending, provides debt financing without ownership transfer, where investors earn fixed interest payments but lack control over company operations. Explore the detailed differences to understand which investment aligns best with your financial goals and risk appetite.

Investment Horizon

Private equity investments typically involve a longer investment horizon, often ranging from five to ten years, due to the time needed for company growth and exit strategies. Crowdlending, by contrast, usually features shorter durations, commonly between six months and three years, offering quicker returns through loan repayments. Explore further to understand which investment horizon aligns best with your financial goals.

Risk Profile

Private equity investments typically involve higher risk due to their longer lock-in periods and dependence on company performance, but they offer potential for substantial returns through equity appreciation. Crowdlending carries lower risk profiles with fixed income streams from interest payments, yet it exposes investors to borrower default and platform risk. Explore in-depth comparisons of risk factors between private equity and crowdlending to make informed investment decisions.

Source and External Links

Private equity - Wikipedia - Private equity (PE) is an investment in private companies through specialized funds, aiming to generate returns via revenue growth, margin expansion, cash flow generation, and valuation multiple increases over typically 4-7 years.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance for equity stakes in high-growth private companies, working closely with management to drive value creation through operational improvements and governance.

Why Invest in Private Equity: Pros and Cons | Moonfare - Private equity offers higher returns and portfolio diversification benefits due to its lower correlation with public markets, focusing on long-term direct investments and value creation in private companies.

dowidth.com

dowidth.com