Dim sum bonds are renminbi-denominated debt instruments issued outside mainland China, primarily in Hong Kong, allowing foreign investors access to Chinese currency assets. Maple bonds are Canadian dollar-denominated bonds issued by foreign entities in the Canadian market, facilitating international issuers' entry into North American capital markets. Discover more about the unique features and investment opportunities of dim sum bonds and Maple bonds.

Why it is important

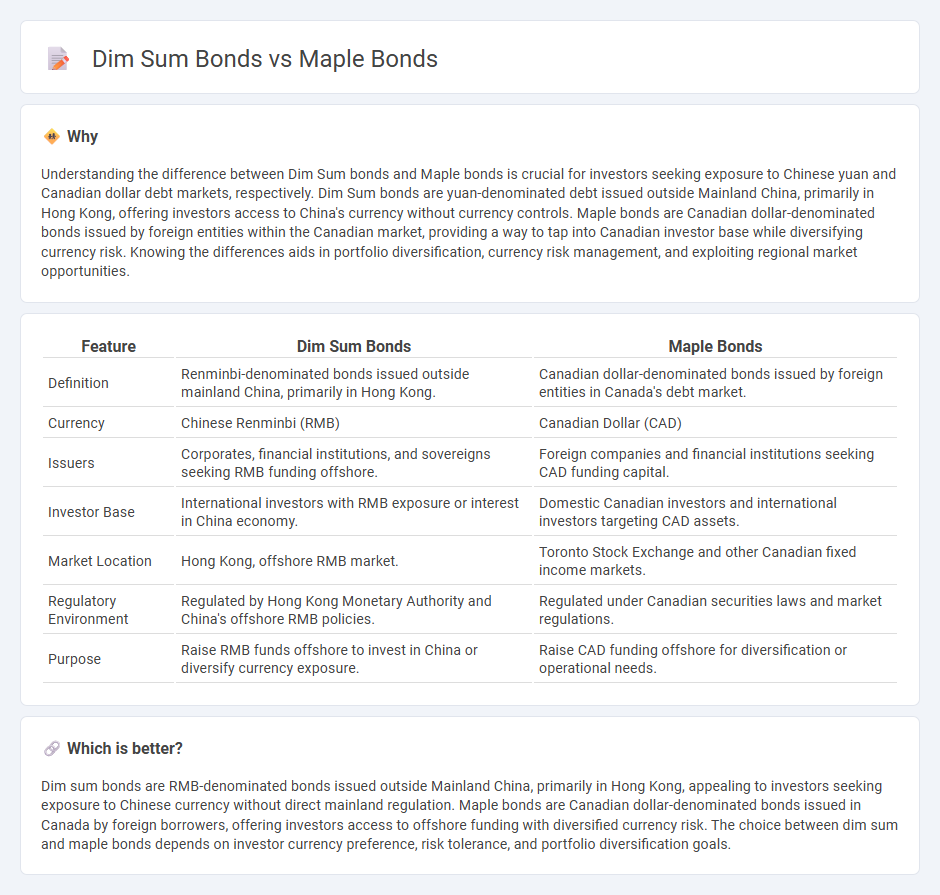

Understanding the difference between Dim Sum bonds and Maple bonds is crucial for investors seeking exposure to Chinese yuan and Canadian dollar debt markets, respectively. Dim Sum bonds are yuan-denominated debt issued outside Mainland China, primarily in Hong Kong, offering investors access to China's currency without currency controls. Maple bonds are Canadian dollar-denominated bonds issued by foreign entities within the Canadian market, providing a way to tap into Canadian investor base while diversifying currency risk. Knowing the differences aids in portfolio diversification, currency risk management, and exploiting regional market opportunities.

Comparison Table

| Feature | Dim Sum Bonds | Maple Bonds |

|---|---|---|

| Definition | Renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong. | Canadian dollar-denominated bonds issued by foreign entities in Canada's debt market. |

| Currency | Chinese Renminbi (RMB) | Canadian Dollar (CAD) |

| Issuers | Corporates, financial institutions, and sovereigns seeking RMB funding offshore. | Foreign companies and financial institutions seeking CAD funding capital. |

| Investor Base | International investors with RMB exposure or interest in China economy. | Domestic Canadian investors and international investors targeting CAD assets. |

| Market Location | Hong Kong, offshore RMB market. | Toronto Stock Exchange and other Canadian fixed income markets. |

| Regulatory Environment | Regulated by Hong Kong Monetary Authority and China's offshore RMB policies. | Regulated under Canadian securities laws and market regulations. |

| Purpose | Raise RMB funds offshore to invest in China or diversify currency exposure. | Raise CAD funding offshore for diversification or operational needs. |

Which is better?

Dim sum bonds are RMB-denominated bonds issued outside Mainland China, primarily in Hong Kong, appealing to investors seeking exposure to Chinese currency without direct mainland regulation. Maple bonds are Canadian dollar-denominated bonds issued in Canada by foreign borrowers, offering investors access to offshore funding with diversified currency risk. The choice between dim sum and maple bonds depends on investor currency preference, risk tolerance, and portfolio diversification goals.

Connection

Dim sum bonds and Maple bonds are both types of foreign currency-denominated bonds issued in Asian markets to attract international investors. Dim sum bonds are issued in Chinese yuan outside mainland China, primarily in Hong Kong, while Maple bonds are Canadian dollar-denominated bonds issued in Canada by foreign entities, notably Asian issuers. These bond types facilitate cross-border financing by allowing issuers to tap into investor bases in different currencies and markets, enhancing liquidity and diversifying funding sources.

Key Terms

Currency denomination

Maple bonds are debt securities issued by foreign entities and denominated in Canadian dollars (CAD), primarily targeting Canadian investors. Dim sum bonds are bonds issued outside of China but denominated in Chinese yuan (CNY), aimed at offshore investors seeking exposure to Chinese currency assets. Explore the key differences in currency denomination and market implications between Maple and Dim Sum bonds to enhance your investment strategy.

Issuing location

Maple bonds are issued by foreign entities in the Canadian capital markets, primarily in Canadian dollars, providing access to Canadian investors. Dim sum bonds are issued outside of mainland China but denominated in Chinese yuan, often issued in Hong Kong to tap into China's offshore yuan liquidity. Explore more about the regulatory frameworks and investor bases shaping these distinct bond markets.

Foreign issuer

Foreign issuers prefer Maple bonds issued in Canadian dollars in Canada for easier access to North American investors and regulatory advantages. Dim Sum bonds, denominated in Chinese yuan and issued in Hong Kong, attract foreign entities seeking exposure to Chinese currency without mainland China restrictions. Explore the distinct benefits of each bond type for foreign issuers to optimize your investment strategy.

Source and External Links

Maple Bonds - Cbonds - Maple Bonds are Canadian dollar-denominated bonds issued by foreign entities in the Canadian market, allowing foreign issuers to raise funds in CAD while Canadian investors avoid currency risk and diversify their fixed-income portfolios.

What Is a Maple Bond? - Financial Pipeline - Maple Bonds are Canadian dollar bonds issued by foreign issuers, providing access to the Canadian debt market and offering investors foreign exposure without currency exchange risk.

The "Maple Bond" Market - Bank of Canada - Maple Bonds are Canadian-dollar bonds issued by foreign borrowers, with rapid growth since 2005, forming a key component of Canada's fixed-income market similar to Yankee Bonds or Samurai Bonds in other countries.

dowidth.com

dowidth.com