Shadow banking operates outside traditional regulatory frameworks, providing credit through non-bank financial intermediaries such as hedge funds, money market funds, and private equity firms. Universal banking combines commercial and investment banking activities under one roof, enabling institutions to offer a wide range of financial services including loans, underwriting, and asset management. Explore more to understand the differences in risk, regulation, and impact on the global financial system.

Why it is important

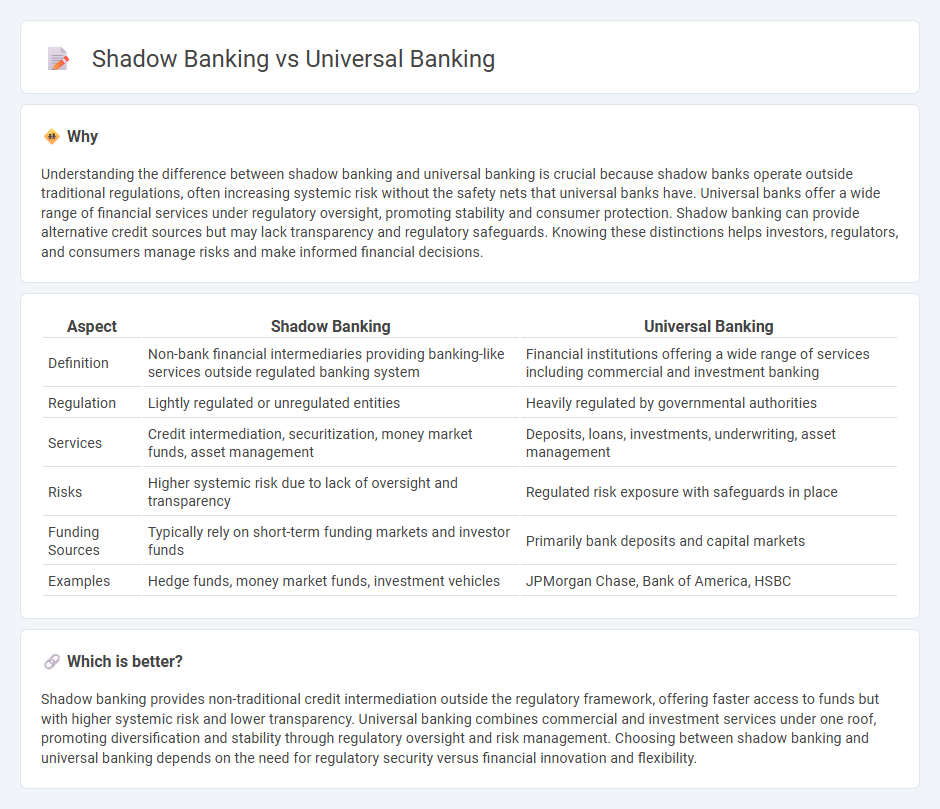

Understanding the difference between shadow banking and universal banking is crucial because shadow banks operate outside traditional regulations, often increasing systemic risk without the safety nets that universal banks have. Universal banks offer a wide range of financial services under regulatory oversight, promoting stability and consumer protection. Shadow banking can provide alternative credit sources but may lack transparency and regulatory safeguards. Knowing these distinctions helps investors, regulators, and consumers manage risks and make informed financial decisions.

Comparison Table

| Aspect | Shadow Banking | Universal Banking |

|---|---|---|

| Definition | Non-bank financial intermediaries providing banking-like services outside regulated banking system | Financial institutions offering a wide range of services including commercial and investment banking |

| Regulation | Lightly regulated or unregulated entities | Heavily regulated by governmental authorities |

| Services | Credit intermediation, securitization, money market funds, asset management | Deposits, loans, investments, underwriting, asset management |

| Risks | Higher systemic risk due to lack of oversight and transparency | Regulated risk exposure with safeguards in place |

| Funding Sources | Typically rely on short-term funding markets and investor funds | Primarily bank deposits and capital markets |

| Examples | Hedge funds, money market funds, investment vehicles | JPMorgan Chase, Bank of America, HSBC |

Which is better?

Shadow banking provides non-traditional credit intermediation outside the regulatory framework, offering faster access to funds but with higher systemic risk and lower transparency. Universal banking combines commercial and investment services under one roof, promoting diversification and stability through regulatory oversight and risk management. Choosing between shadow banking and universal banking depends on the need for regulatory security versus financial innovation and flexibility.

Connection

Shadow banking and universal banking intersect through their roles in providing credit outside traditional regulatory frameworks, with shadow banks engaging in non-bank financial activities such as asset management and securitization. Universal banks combine commercial and investment banking activities, blurring lines with shadow banking entities by offering diverse financial services and credit products often linked to capital markets. Both systems impact financial stability by influencing liquidity, credit distribution, and systemic risk within the global financial ecosystem.

Key Terms

Regulation

Universal banking operates under rigorous regulatory frameworks enforced by central banks and financial authorities, ensuring transparency, risk management, and consumer protection. Shadow banking, encompassing non-bank financial intermediaries like hedge funds and money market funds, typically faces less stringent regulation, increasing systemic risk. Explore further to understand the regulatory nuances shaping these financial sectors.

Risk Management

Universal banking integrates commercial and investment services under one entity, allowing diversified risk management through regulatory oversight and capital requirements. Shadow banking operates outside traditional regulations, often engaging in higher-risk lending and leverage without capital buffers, increasing systemic risk and vulnerability to financial shocks. Explore the detailed strategies and implications of risk management in both systems for a comprehensive understanding.

Financial Intermediation

Universal banking integrates a wide range of financial services including commercial banking, investment banking, and insurance, facilitating comprehensive financial intermediation through regulated channels. Shadow banking operates outside traditional regulatory frameworks, providing credit and liquidity via non-bank financial intermediaries such as hedge funds, money market funds, and securitization vehicles, often involving higher risk. Discover how these two distinct systems impact economic stability and credit flow.

Source and External Links

Universal bank - Wikipedia - A universal bank is a financial institution that combines commercial and investment banking services along with other financial services such as insurance, offering a full range of banking activities under one roof.

What is Universal Banking? | Metropolitan Capital Bank & Trust - Universal banking integrates a variety of financial services into a single platform to create efficiencies and deliver tailored solutions for clients, especially effective for growing organizations and small to medium-sized businesses.

Universal banking - EBF (PDF) - Universal banks provide a comprehensive set of services including retail, commercial, and investment banking, delivering benefits of diversification and one-stop banking while enhancing financial sector resilience and competitiveness.

dowidth.com

dowidth.com