Special Purpose Acquisition Companies (SPACs) and Regulation A+ offerings present distinct pathways for companies seeking capital; SPACs involve shell companies that raise funds to acquire private firms, while Regulation A+ provides an exemption allowing smaller companies to raise up to $75 million from the public with reduced regulatory burdens. SPACs offer faster access to public markets but may involve higher risk and scrutiny, whereas Regulation A+ offerings cater to early-stage businesses aiming for smaller fundraising with simplified disclosures. Explore the detailed differences and strategic implications between SPACs and Regulation A+ offerings to optimize your financing decisions.

Why it is important

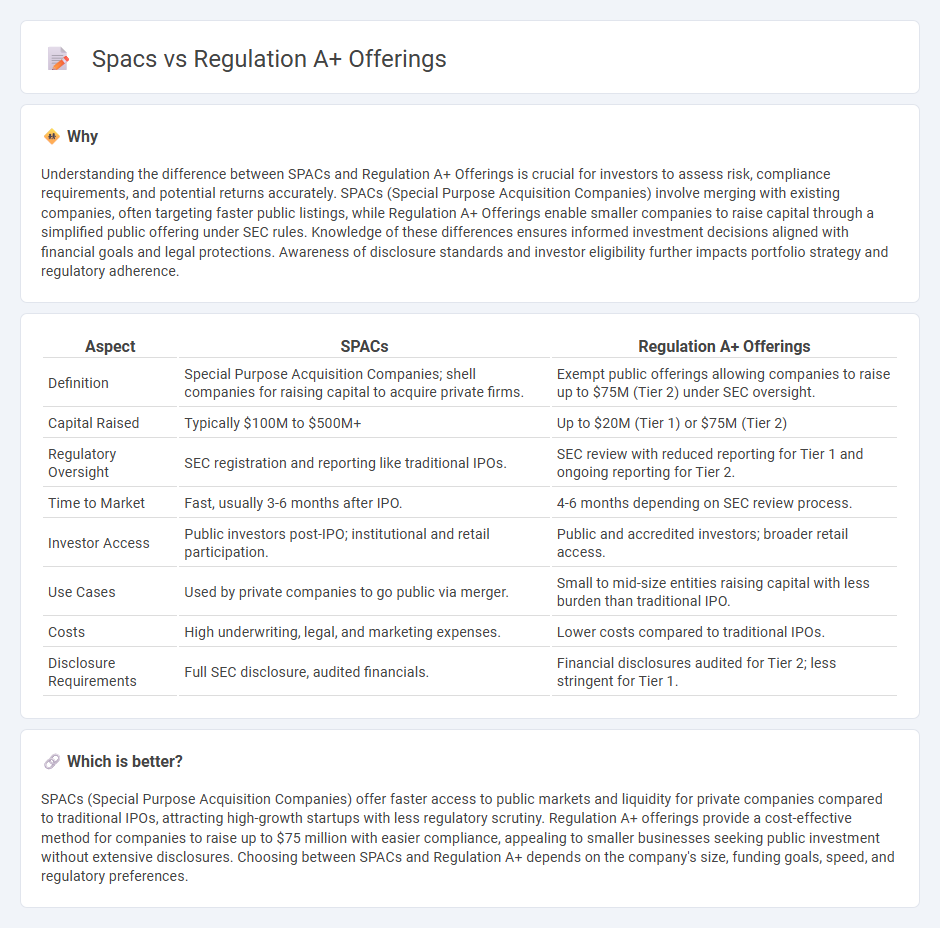

Understanding the difference between SPACs and Regulation A+ Offerings is crucial for investors to assess risk, compliance requirements, and potential returns accurately. SPACs (Special Purpose Acquisition Companies) involve merging with existing companies, often targeting faster public listings, while Regulation A+ Offerings enable smaller companies to raise capital through a simplified public offering under SEC rules. Knowledge of these differences ensures informed investment decisions aligned with financial goals and legal protections. Awareness of disclosure standards and investor eligibility further impacts portfolio strategy and regulatory adherence.

Comparison Table

| Aspect | SPACs | Regulation A+ Offerings |

|---|---|---|

| Definition | Special Purpose Acquisition Companies; shell companies for raising capital to acquire private firms. | Exempt public offerings allowing companies to raise up to $75M (Tier 2) under SEC oversight. |

| Capital Raised | Typically $100M to $500M+ | Up to $20M (Tier 1) or $75M (Tier 2) |

| Regulatory Oversight | SEC registration and reporting like traditional IPOs. | SEC review with reduced reporting for Tier 1 and ongoing reporting for Tier 2. |

| Time to Market | Fast, usually 3-6 months after IPO. | 4-6 months depending on SEC review process. |

| Investor Access | Public investors post-IPO; institutional and retail participation. | Public and accredited investors; broader retail access. |

| Use Cases | Used by private companies to go public via merger. | Small to mid-size entities raising capital with less burden than traditional IPO. |

| Costs | High underwriting, legal, and marketing expenses. | Lower costs compared to traditional IPOs. |

| Disclosure Requirements | Full SEC disclosure, audited financials. | Financial disclosures audited for Tier 2; less stringent for Tier 1. |

Which is better?

SPACs (Special Purpose Acquisition Companies) offer faster access to public markets and liquidity for private companies compared to traditional IPOs, attracting high-growth startups with less regulatory scrutiny. Regulation A+ offerings provide a cost-effective method for companies to raise up to $75 million with easier compliance, appealing to smaller businesses seeking public investment without extensive disclosures. Choosing between SPACs and Regulation A+ depends on the company's size, funding goals, speed, and regulatory preferences.

Connection

SPACs (Special Purpose Acquisition Companies) and Regulation A+ offerings are both innovative financial instruments designed to facilitate capital raising outside the traditional IPO process. SPACs provide a faster route to public markets by merging with private companies, while Regulation A+ offerings enable smaller companies to raise up to $75 million from the public with less stringent regulatory requirements. Both methods attract emerging businesses seeking flexible access to public capital and investors interested in alternative investment opportunities.

Key Terms

Securities and Exchange Commission (SEC)

Regulation A+ offerings allow companies to raise up to $75 million from the public with fewer regulatory requirements compared to traditional IPOs, providing a streamlined path for smaller enterprises under SEC oversight. Special Purpose Acquisition Companies (SPACs) raise funds through an IPO to acquire or merge with private companies, with the SEC intensifying scrutiny on disclosures and investor protections due to rising market concerns. Explore the evolving SEC regulations and guidelines shaping the landscape of Regulation A+ offerings and SPAC transactions.

Public listing

Regulation A+ offerings provide an alternative path for companies to access public capital markets with reduced regulatory burden compared to traditional IPOs, allowing for fundraising up to $75 million annually while maintaining flexibility in investor outreach. SPACs (Special Purpose Acquisition Companies) facilitate public listings by merging with private companies, effectively bypassing the conventional IPO process but often facing complexities related to shareholder approval and market volatility. Explore the nuanced differences and strategic advantages of Regulation A+ versus SPACs in facilitating efficient and accessible public listings.

Disclosure requirements

Regulation A+ offerings require issuers to provide extensive disclosure documents, including offering circulars reviewed by the SEC to ensure transparency for investors. SPACs, while also needing disclosure, typically file a Form S-1 registration statement and must update investors with material developments during the de-SPAC process. Explore the detailed regulatory frameworks to understand how disclosure obligations differ between Regulation A+ offerings and SPAC transactions.

Source and External Links

SEC Adopts Regulation A+ Rules Creating an Exemption from Registration for Offerings Up to $50M - Regulation A+ allows U.S. and Canadian companies to conduct public securities offerings up to $50 million in a 12-month period, divided into Tier 1 (up to $20 million) and Tier 2 (up to $50 million), with simplified reporting requirements and the ability to advertise the offering.

FAQs ABOUT REGULATION A+ SECURITIES OFFERINGS - Regulation A+ modernizes the original Regulation A exemption by requiring disclosures on EDGAR, allowing confidential review of documents, and permitting "testing the waters" communications, while offering two tiers: Tier 1 ($20 million) and Tier 2 ($50 million) in any 12-month period.

Regulation A+ SEC Developments -- Recent SEC Enforcement - As of November 2020, the SEC increased the Regulation A+ offering limit to $75 million in any 12-month period, with reduced disclosure and ongoing reporting requirements compared to full Exchange Act compliance, while prohibiting at-the-market and delayed offerings.

dowidth.com

dowidth.com