Dark pool routing enables institutional investors to execute large trades anonymously within private liquidity pools, minimizing market impact and price slippage. Interdealer brokers facilitate real-time price discovery and liquidity by matching buy and sell orders between financial institutions in over-the-counter markets. Explore the distinct advantages and mechanisms of dark pool routing and interdealer brokers to optimize your trading strategies.

Why it is important

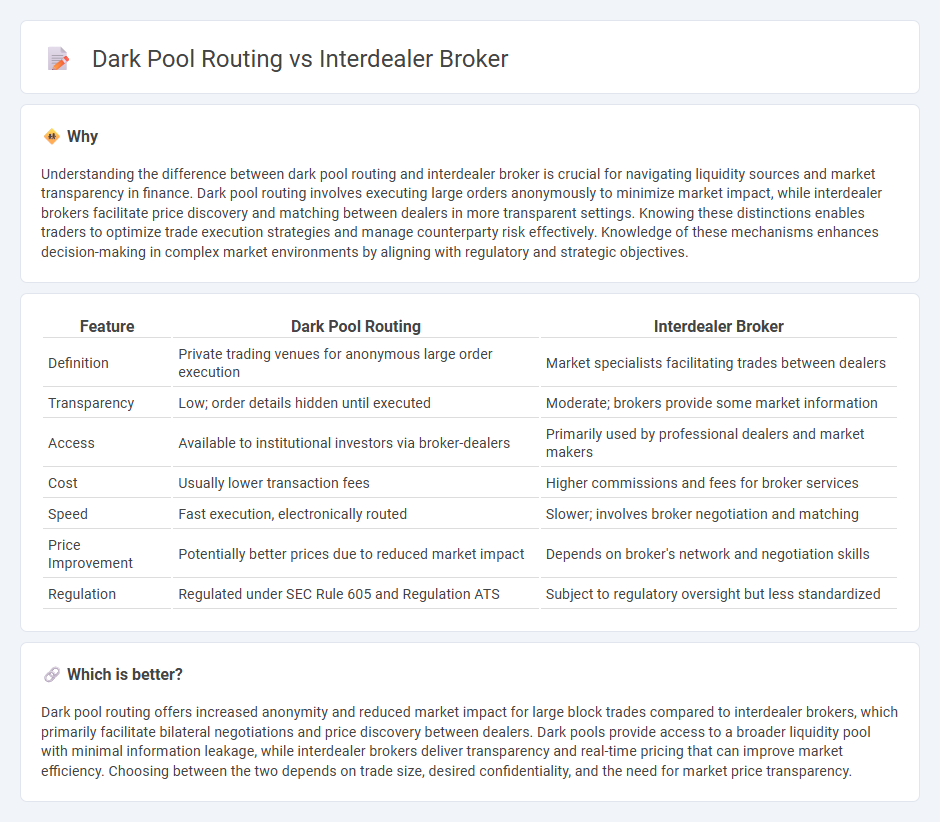

Understanding the difference between dark pool routing and interdealer broker is crucial for navigating liquidity sources and market transparency in finance. Dark pool routing involves executing large orders anonymously to minimize market impact, while interdealer brokers facilitate price discovery and matching between dealers in more transparent settings. Knowing these distinctions enables traders to optimize trade execution strategies and manage counterparty risk effectively. Knowledge of these mechanisms enhances decision-making in complex market environments by aligning with regulatory and strategic objectives.

Comparison Table

| Feature | Dark Pool Routing | Interdealer Broker |

|---|---|---|

| Definition | Private trading venues for anonymous large order execution | Market specialists facilitating trades between dealers |

| Transparency | Low; order details hidden until executed | Moderate; brokers provide some market information |

| Access | Available to institutional investors via broker-dealers | Primarily used by professional dealers and market makers |

| Cost | Usually lower transaction fees | Higher commissions and fees for broker services |

| Speed | Fast execution, electronically routed | Slower; involves broker negotiation and matching |

| Price Improvement | Potentially better prices due to reduced market impact | Depends on broker's network and negotiation skills |

| Regulation | Regulated under SEC Rule 605 and Regulation ATS | Subject to regulatory oversight but less standardized |

Which is better?

Dark pool routing offers increased anonymity and reduced market impact for large block trades compared to interdealer brokers, which primarily facilitate bilateral negotiations and price discovery between dealers. Dark pools provide access to a broader liquidity pool with minimal information leakage, while interdealer brokers deliver transparency and real-time pricing that can improve market efficiency. Choosing between the two depends on trade size, desired confidentiality, and the need for market price transparency.

Connection

Dark pool routing and interdealer brokers are interconnected through their roles in facilitating large, non-public financial transactions. Dark pool routing enables institutional investors to execute sizable trades anonymously within private liquidity pools, minimizing market impact. Interdealer brokers act as intermediaries in these over-the-counter trades, connecting buyers and sellers while maintaining confidentiality and efficiency in the execution process.

Key Terms

Liquidity

Interdealer brokers provide centralized liquidity by matching large institutional buy and sell orders anonymously, enhancing market transparency and price discovery. Dark pool routing directs orders to private exchanges where liquidity is hidden, reducing market impact but potentially limiting price transparency. Explore the nuances of liquidity provision in these trading venues to optimize execution strategies.

Anonymity

Interdealer brokers (IDBs) maintain high anonymity by facilitating trades between financial institutions without revealing participant identities. Dark pool routing also prioritizes anonymity, enabling large orders to be executed away from public exchanges to minimize market impact. Discover how these two trading methods balance confidentiality and liquidity in modern finance.

Price Discovery

Interdealer brokers facilitate price discovery by matching large institutional orders anonymously in transparent, open-outcry or electronic platforms, promoting market efficiency. Dark pool routing hides order details, reducing market impact but potentially delaying price discovery due to limited pre-trade transparency. Explore the nuances of these trading venues to understand their impact on price formation and market dynamics.

Source and External Links

Inter-dealer broker: Explained - An inter-dealer broker (IDB) is a neutral intermediary that facilitates transactions between financial institutions, matching buyers and sellers to maintain market liquidity across various financial instruments.

Inter-Dealer Brokers (Examples) - IDBs provide key functions such as maintaining anonymity of counterparties, aggregating liquidity, aiding price discovery, and offering market intelligence in wholesale financial markets.

Inter-dealer broker - Specialist intermediaries in financial markets, IDBs facilitate trades between broker-dealers and dealer banks, especially in markets without centralized exchanges, e.g., the bond market, with major firms like TP ICAP and BGC Partners leading the sector.

dowidth.com

dowidth.com