Degen Boxes and leverage tokens are innovative financial instruments designed to amplify exposure to underlying assets while managing risk differently. Degen Boxes offer automated risk management through smart contracts, enabling users to engage in leveraged trading with defined liquidation parameters. Explore the distinct mechanisms and potential benefits of Degen Boxes versus leverage tokens to enhance your trading strategy.

Why it is important

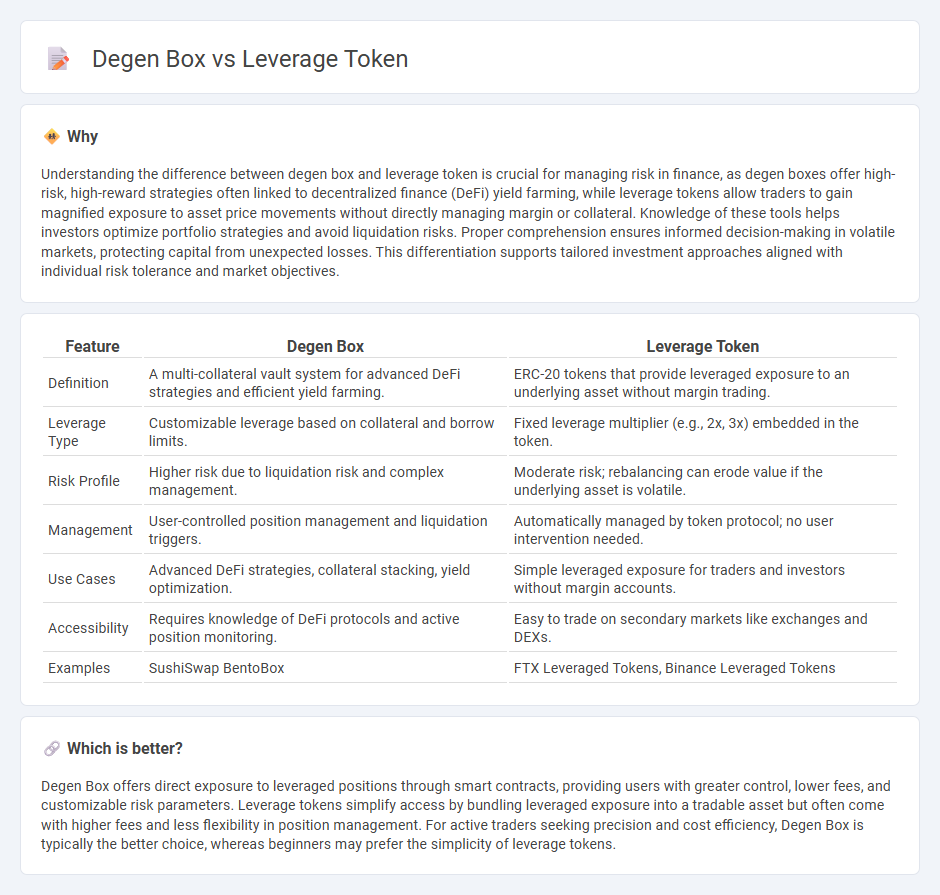

Understanding the difference between degen box and leverage token is crucial for managing risk in finance, as degen boxes offer high-risk, high-reward strategies often linked to decentralized finance (DeFi) yield farming, while leverage tokens allow traders to gain magnified exposure to asset price movements without directly managing margin or collateral. Knowledge of these tools helps investors optimize portfolio strategies and avoid liquidation risks. Proper comprehension ensures informed decision-making in volatile markets, protecting capital from unexpected losses. This differentiation supports tailored investment approaches aligned with individual risk tolerance and market objectives.

Comparison Table

| Feature | Degen Box | Leverage Token |

|---|---|---|

| Definition | A multi-collateral vault system for advanced DeFi strategies and efficient yield farming. | ERC-20 tokens that provide leveraged exposure to an underlying asset without margin trading. |

| Leverage Type | Customizable leverage based on collateral and borrow limits. | Fixed leverage multiplier (e.g., 2x, 3x) embedded in the token. |

| Risk Profile | Higher risk due to liquidation risk and complex management. | Moderate risk; rebalancing can erode value if the underlying asset is volatile. |

| Management | User-controlled position management and liquidation triggers. | Automatically managed by token protocol; no user intervention needed. |

| Use Cases | Advanced DeFi strategies, collateral stacking, yield optimization. | Simple leveraged exposure for traders and investors without margin accounts. |

| Accessibility | Requires knowledge of DeFi protocols and active position monitoring. | Easy to trade on secondary markets like exchanges and DEXs. |

| Examples | SushiSwap BentoBox | FTX Leveraged Tokens, Binance Leveraged Tokens |

Which is better?

Degen Box offers direct exposure to leveraged positions through smart contracts, providing users with greater control, lower fees, and customizable risk parameters. Leverage tokens simplify access by bundling leveraged exposure into a tradable asset but often come with higher fees and less flexibility in position management. For active traders seeking precision and cost efficiency, Degen Box is typically the better choice, whereas beginners may prefer the simplicity of leverage tokens.

Connection

Degen box and leverage tokens are connected through their use in decentralized finance (DeFi) platforms to amplify trading positions and maximize yield. The Degen box acts as a smart contract vault enabling users to deposit assets as collateral for leveraged positions, while leverage tokens represent a synthetic derivative that tracks the leveraged exposure of an underlying asset. Together, they facilitate automated leveraged trading and risk management within DeFi ecosystems, often enhancing capital efficiency and increasing potential returns.

Key Terms

Margin

Leverage tokens offer simplified exposure to margin trading by embedding leverage in a single token, reducing liquidation risks and management complexity compared to degen boxes, which are more complex synthetic asset protocols allowing higher margin flexibility but increased liquidation vulnerabilities. Degen boxes enable traders to optimize capital efficiency through pooled collateral and customizable leverage, useful for advanced margin strategies but requiring active risk management due to price volatility and liquidation cascades. Explore the nuances of leverage tokens versus degen boxes to understand which margin trading approach aligns best with your risk tolerance and trading goals.

Collateral

Leverage tokens use underlying assets as collateral to amplify exposure without directly managing positions, while Degen Box involves locking collateral within a lending protocol to borrow funds and increase leverage. The collateral quality and management strategy differ, impacting risk profiles and liquidation thresholds. Explore deeper insights on how collateral mechanisms influence leverage efficiency and safety.

Risk

Leverage tokens amplify exposure to underlying assets by automatically adjusting leverage, increasing potential returns and risks through price volatility. Degen Boxes offer more complex DeFi positions with variable collateralization and liquidation risks tied to smart contract interactions and market conditions. Explore detailed comparisons to understand which risk profile aligns best with your investment strategy.

Source and External Links

Leveraged Tokens - Bitget - Leveraged tokens are cryptocurrency derivatives that offer traders leveraged exposure to cryptocurrencies like Bitcoin without managing margin requirements, automatically adjusting leverage via algorithms to multiply daily price changes.

Leveraged Tokens - Binance Academy - These tokens provide a simplified way to trade leveraged long or short positions on crypto assets without managing margins, but carry high volatility and risk of magnified losses as well as gains.

Leverage Tokens Overview - Toros Finance - Toros leveraged tokens offer amplified exposure to blockchain assets with automated leverage management that dynamically adjusts positions to reduce risk and avoid forced liquidations, optimizing performance especially in strong market trends.

dowidth.com

dowidth.com