Catastrophe bonds are high-yield debt instruments designed to raise capital for insurance companies in the event of natural disasters, transferring risk from insurers to investors. Mortgage-backed securities (MBS) pool home loans to provide investors with income derived from mortgage payments, offering diversification but significant exposure to the housing market's volatility. Explore the distinct mechanisms and risk-return profiles of catastrophe bonds and mortgage-backed securities to better understand their roles in financial markets.

Why it is important

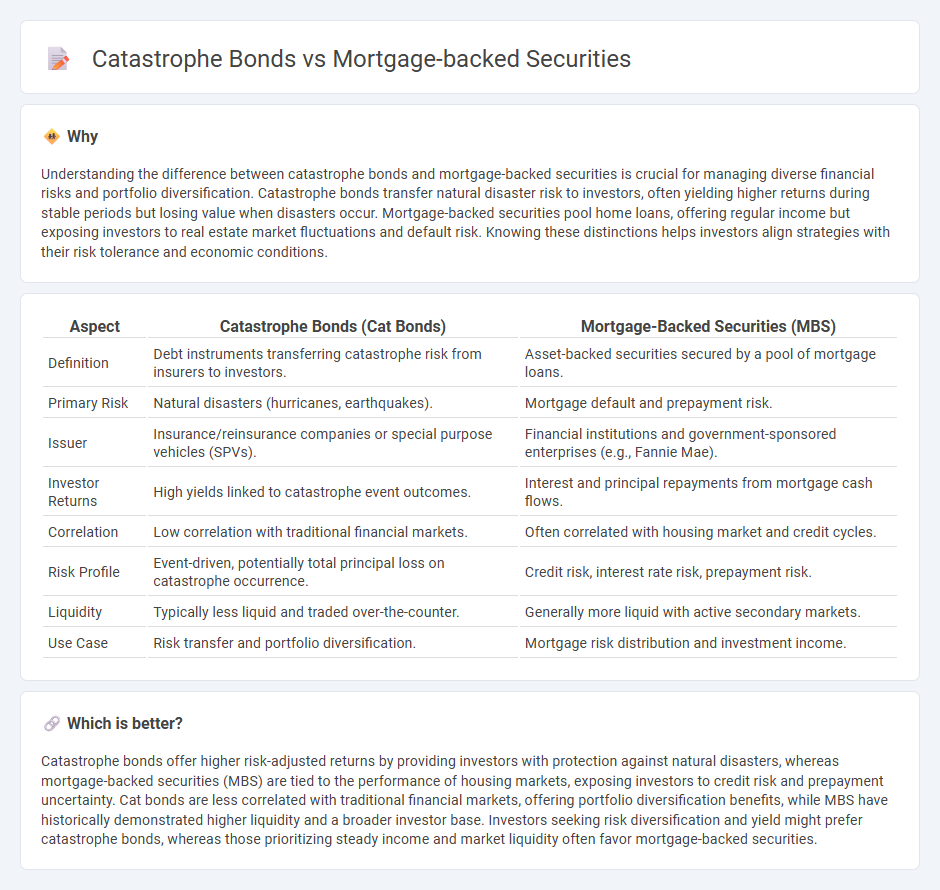

Understanding the difference between catastrophe bonds and mortgage-backed securities is crucial for managing diverse financial risks and portfolio diversification. Catastrophe bonds transfer natural disaster risk to investors, often yielding higher returns during stable periods but losing value when disasters occur. Mortgage-backed securities pool home loans, offering regular income but exposing investors to real estate market fluctuations and default risk. Knowing these distinctions helps investors align strategies with their risk tolerance and economic conditions.

Comparison Table

| Aspect | Catastrophe Bonds (Cat Bonds) | Mortgage-Backed Securities (MBS) |

|---|---|---|

| Definition | Debt instruments transferring catastrophe risk from insurers to investors. | Asset-backed securities secured by a pool of mortgage loans. |

| Primary Risk | Natural disasters (hurricanes, earthquakes). | Mortgage default and prepayment risk. |

| Issuer | Insurance/reinsurance companies or special purpose vehicles (SPVs). | Financial institutions and government-sponsored enterprises (e.g., Fannie Mae). |

| Investor Returns | High yields linked to catastrophe event outcomes. | Interest and principal repayments from mortgage cash flows. |

| Correlation | Low correlation with traditional financial markets. | Often correlated with housing market and credit cycles. |

| Risk Profile | Event-driven, potentially total principal loss on catastrophe occurrence. | Credit risk, interest rate risk, prepayment risk. |

| Liquidity | Typically less liquid and traded over-the-counter. | Generally more liquid with active secondary markets. |

| Use Case | Risk transfer and portfolio diversification. | Mortgage risk distribution and investment income. |

Which is better?

Catastrophe bonds offer higher risk-adjusted returns by providing investors with protection against natural disasters, whereas mortgage-backed securities (MBS) are tied to the performance of housing markets, exposing investors to credit risk and prepayment uncertainty. Cat bonds are less correlated with traditional financial markets, offering portfolio diversification benefits, while MBS have historically demonstrated higher liquidity and a broader investor base. Investors seeking risk diversification and yield might prefer catastrophe bonds, whereas those prioritizing steady income and market liquidity often favor mortgage-backed securities.

Connection

Catastrophe bonds and mortgage-backed securities share a foundation in structured finance, allowing risk transfer from issuers to investors to diversify exposure. Both instruments pool underlying assets--natural disaster risks in catastrophe bonds and mortgage loans in mortgage-backed securities--offering investors varying risk-return profiles. The connection lies in their role in spreading financial risk and enhancing capital market efficiency through securitization techniques.

Key Terms

Securitization

Mortgage-backed securities (MBS) pool residential or commercial mortgage loans, converting illiquid assets into tradable securities, facilitating liquidity and risk distribution in real estate finance. Catastrophe bonds (cat bonds) securitize insurance risks related to natural disasters, transferring catastrophe risk from insurers to capital market investors, enhancing risk management and capital efficiency. Explore more about how securitization transforms risk and capital flow in diverse financial sectors.

Credit Risk

Mortgage-backed securities (MBS) carry credit risk primarily linked to the possibility of homebuyers defaulting on their mortgage payments, impacting the cash flow to investors. Catastrophe bonds (cat bonds) involve credit risk tied to the occurrence of predefined natural disasters, where investors might lose principal if a triggering event such as a hurricane or earthquake occurs. Explore the nuances of credit risk in these financial instruments to understand their impact on investment portfolios.

Event Risk

Mortgage-backed securities (MBS) primarily carry prepayment and credit risks linked to housing markets, whereas catastrophe bonds (cat bonds) are designed to transfer event risk related to natural disasters like hurricanes or earthquakes. Cat bonds provide insurance-linked securities that pay out when specific catastrophic events occur, offering investors a way to diversify against event-driven losses. Explore more to understand how these financial instruments manage risk exposure differently in volatile markets.

Source and External Links

Mortgage-Backed Securities and Collateralized ... - Mortgage-backed securities (MBS) are debt obligations representing claims to the cash flows from pools of mortgage loans, often issued by government agencies or enterprises like Ginnie Mae, Fannie Mae, and Freddie Mac, and can range from basic pass-through certificates to complex collateralized mortgage obligations (CMOs) with multiple payment tranches.

Understanding Mortgage-Backed Securities Investing - MBS are investments backed by pools of mortgage loans where monthly payments to investors include both interest and principal, with risks such as prepayment (when borrowers refinance early) and extension (when borrowers repay more slowly), affecting cash flow unpredictability.

Mortgage Backed Securities | MBS | Fannie Mae - Fannie Mae securitizes pools of single-family and multifamily mortgage loans into MBS, which are guaranteed for timely payment of principal and interest by Fannie Mae, although they are not guaranteed by the full faith and credit of the U.S. government.

dowidth.com

dowidth.com