Nonfungible tokens (NFTs) fractionalization allows investors to own partial shares of unique digital assets, increasing liquidity and accessibility compared to traditional whole ownership. Asset-backed securities (ABS) pool financial assets like loans or receivables, offering diversified risk and steady income through structured tranches sold to investors. Explore the differences and advantages between NFTs fractionalization and ABS to understand their impact on modern finance.

Why it is important

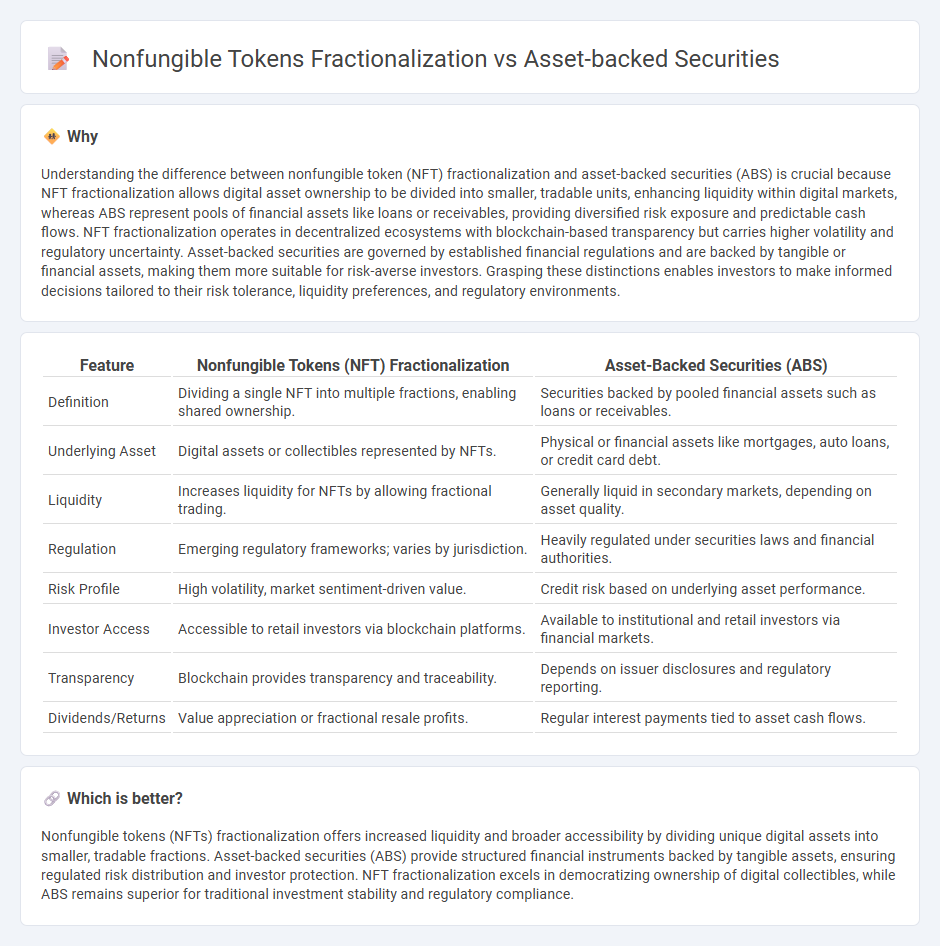

Understanding the difference between nonfungible token (NFT) fractionalization and asset-backed securities (ABS) is crucial because NFT fractionalization allows digital asset ownership to be divided into smaller, tradable units, enhancing liquidity within digital markets, whereas ABS represent pools of financial assets like loans or receivables, providing diversified risk exposure and predictable cash flows. NFT fractionalization operates in decentralized ecosystems with blockchain-based transparency but carries higher volatility and regulatory uncertainty. Asset-backed securities are governed by established financial regulations and are backed by tangible or financial assets, making them more suitable for risk-averse investors. Grasping these distinctions enables investors to make informed decisions tailored to their risk tolerance, liquidity preferences, and regulatory environments.

Comparison Table

| Feature | Nonfungible Tokens (NFT) Fractionalization | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Dividing a single NFT into multiple fractions, enabling shared ownership. | Securities backed by pooled financial assets such as loans or receivables. |

| Underlying Asset | Digital assets or collectibles represented by NFTs. | Physical or financial assets like mortgages, auto loans, or credit card debt. |

| Liquidity | Increases liquidity for NFTs by allowing fractional trading. | Generally liquid in secondary markets, depending on asset quality. |

| Regulation | Emerging regulatory frameworks; varies by jurisdiction. | Heavily regulated under securities laws and financial authorities. |

| Risk Profile | High volatility, market sentiment-driven value. | Credit risk based on underlying asset performance. |

| Investor Access | Accessible to retail investors via blockchain platforms. | Available to institutional and retail investors via financial markets. |

| Transparency | Blockchain provides transparency and traceability. | Depends on issuer disclosures and regulatory reporting. |

| Dividends/Returns | Value appreciation or fractional resale profits. | Regular interest payments tied to asset cash flows. |

Which is better?

Nonfungible tokens (NFTs) fractionalization offers increased liquidity and broader accessibility by dividing unique digital assets into smaller, tradable fractions. Asset-backed securities (ABS) provide structured financial instruments backed by tangible assets, ensuring regulated risk distribution and investor protection. NFT fractionalization excels in democratizing ownership of digital collectibles, while ABS remains superior for traditional investment stability and regulatory compliance.

Connection

Nonfungible token (NFT) fractionalization allows dividing a unique digital asset into smaller, tradable shares, creating liquidity similar to asset-backed securities (ABS), which pool financial assets to issue tradable securities backed by those assets. Both mechanisms enable investors to gain partial ownership and diversify risk by trading fractions of high-value assets on secondary markets. The connection lies in their shared principle of tokenizing illiquid assets to enhance market accessibility and financial innovation.

Key Terms

Securitization

Asset-backed securities (ABS) involve pooling financial assets like loans or receivables to create tradable securities that offer investors predictable cash flows, while nonfungible token (NFT) fractionalization converts unique digital assets into smaller ownership shares using blockchain technology. Securitization in ABS provides structured finance benefits such as credit enhancement and liquidity, whereas NFT fractionalization introduces programmable ownership and transparency to digital asset markets. Explore the evolving landscape of securitization by understanding how tokenization and traditional ABS reshape asset liquidity and investor access.

Tokenization

Asset-backed securities (ABS) represent financial instruments backed by a pool of tangible assets like loans, providing investors with predictable cash flows and regulated market transparency. Nonfungible tokens (NFTs) fractionalization divides digital ownership of unique assets into smaller shares, enabling broader participation in high-value digital art or collectibles through blockchain-based tokenization. Explore the evolving landscape of tokenization to understand its impact on asset liquidity and investor accessibility.

Ownership Rights

Asset-backed securities (ABS) offer investors fractional ownership through legally enforceable claims on asset pools, enhancing liquidity and risk diversification. Nonfungible tokens (NFTs) fractionalization divides unique digital assets into shares, enabling shared ownership but often facing regulatory uncertainties and varying degrees of ownership rights clarity. Explore the nuances of ownership rights in ABS and NFT fractionalization to understand their implications on investment security.

Source and External Links

Asset-backed securities: Definition, types and examples - StoneX - Asset-backed securities (ABS) are financial pools created by grouping similar asset types like auto loans, aircraft leases, credit card receivables, mortgages, and business loans, which represent contractual obligations to pay investors and allow institutions to convert illiquid assets into liquid securities.

The ABCs of Asset-Backed Securities | Guggenheim Investments - ABS finance pools of familiar asset types that typically rank senior to traditional debt, feature investor protections such as tranching and overcollateralization, and offer higher yields than similarly rated bonds despite their complexity and the lessons learned from the 2008 financial crisis.

Asset-backed security - Wikipedia - ABS convert illiquid financial assets into tradable securities by pooling them together, allowing originators to free up capital and lower risk, with tranching providing various risk/return profiles for investors.

dowidth.com

dowidth.com