Climate-linked derivatives offer investors financial instruments designed to hedge risks associated with climate change, leveraging weather and environmental data to drive pricing models. Impact investing funds focus on generating measurable environmental benefits alongside financial returns by allocating capital to sustainable projects and companies. Explore how these innovative financial tools align with sustainability goals and risk management strategies.

Why it is important

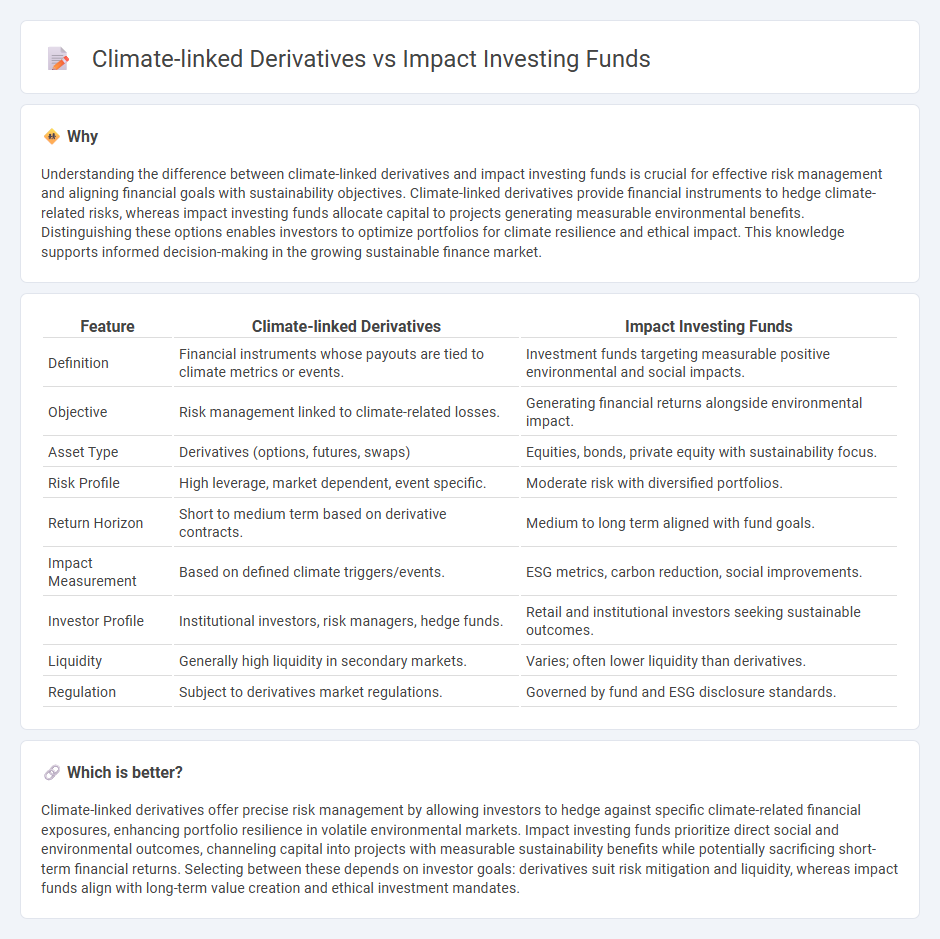

Understanding the difference between climate-linked derivatives and impact investing funds is crucial for effective risk management and aligning financial goals with sustainability objectives. Climate-linked derivatives provide financial instruments to hedge climate-related risks, whereas impact investing funds allocate capital to projects generating measurable environmental benefits. Distinguishing these options enables investors to optimize portfolios for climate resilience and ethical impact. This knowledge supports informed decision-making in the growing sustainable finance market.

Comparison Table

| Feature | Climate-linked Derivatives | Impact Investing Funds |

|---|---|---|

| Definition | Financial instruments whose payouts are tied to climate metrics or events. | Investment funds targeting measurable positive environmental and social impacts. |

| Objective | Risk management linked to climate-related losses. | Generating financial returns alongside environmental impact. |

| Asset Type | Derivatives (options, futures, swaps) | Equities, bonds, private equity with sustainability focus. |

| Risk Profile | High leverage, market dependent, event specific. | Moderate risk with diversified portfolios. |

| Return Horizon | Short to medium term based on derivative contracts. | Medium to long term aligned with fund goals. |

| Impact Measurement | Based on defined climate triggers/events. | ESG metrics, carbon reduction, social improvements. |

| Investor Profile | Institutional investors, risk managers, hedge funds. | Retail and institutional investors seeking sustainable outcomes. |

| Liquidity | Generally high liquidity in secondary markets. | Varies; often lower liquidity than derivatives. |

| Regulation | Subject to derivatives market regulations. | Governed by fund and ESG disclosure standards. |

Which is better?

Climate-linked derivatives offer precise risk management by allowing investors to hedge against specific climate-related financial exposures, enhancing portfolio resilience in volatile environmental markets. Impact investing funds prioritize direct social and environmental outcomes, channeling capital into projects with measurable sustainability benefits while potentially sacrificing short-term financial returns. Selecting between these depends on investor goals: derivatives suit risk mitigation and liquidity, whereas impact funds align with long-term value creation and ethical investment mandates.

Connection

Climate-linked derivatives and impact investing funds intersect by channeling capital towards mitigating environmental risks and promoting sustainability. These financial instruments enable investors to hedge climate-related risks or gain exposure to green assets, while impact funds allocate resources to projects with measurable environmental benefits, enhancing overall portfolio resilience. Both mechanisms drive the integration of environmental, social, and governance (ESG) criteria within financial markets, fostering sustainable economic growth.

Key Terms

**Impact Investing Funds:**

Impact investing funds allocate capital to projects and companies that generate measurable social and environmental benefits alongside financial returns, targeting sectors like renewable energy, sustainable agriculture, and affordable housing. These funds are assessed based on ESG (Environmental, Social, Governance) criteria and impact metrics such as carbon reduction and social upliftment, attracting investors committed to responsible finance. Explore more about how impact investing funds drive sustainable growth and align profit with purpose.

Social Return on Investment (SROI)

Impact investing funds channel capital into projects generating measurable social and environmental benefits alongside financial returns, leveraging rigorous SROI metrics to evaluate positive community outcomes. Climate-linked derivatives hedge against climate risks while indirectly promoting sustainable practices, though their direct effect on SROI is less quantifiable. Explore the comparative effectiveness of these financial tools in driving social impact and environmental sustainability.

Environmental, Social, and Governance (ESG) Criteria

Impact investing funds channel capital into companies and projects that generate measurable social and environmental benefits, strictly adhering to Environmental, Social, and Governance (ESG) criteria to drive sustainable development. Climate-linked derivatives are financial instruments designed to hedge or speculate on climate-related risks, integrating ESG factors by aligning with carbon reduction targets and regulatory frameworks. Explore how these innovative financial tools contribute to responsible investing and climate change mitigation strategies.

Source and External Links

Impact Investments - Social Finance - Impact investing involves directing capital towards social and environmental outcomes with measurable positive impact, complementing philanthropy and government efforts; Social Finance has mobilized over $400M across 20+ funds to scale solutions for complex societal problems.

78 Impact Investing Firms You Should Know - Causeartist - Impact investing aims to generate both financial returns and measurable social or environmental benefits through investments in diverse sectors and asset classes worldwide, emphasizing accountability through impact measurement and reporting.

Impact Investments Program Strategy - MacArthur Foundation - With $500 million actively managed for impact investments, the strategy prioritizes additionality by investing in high-risk or novel opportunities, mobilizing capital to create systemic social/environmental change, and enabling innovations that serve underserved communities.

dowidth.com

dowidth.com