Buy now pay later (BNPL) integration offers seamless consumer credit options that enhance cash flow and boost conversion rates, contrasting with traditional invoice billing which often involves longer payment cycles and manual processing. BNPL solutions leverage real-time credit assessments and digital wallets, reducing payment friction and improving customer satisfaction. Explore how integrating BNPL versus traditional invoicing can transform your financial operations and customer experience.

Why it is important

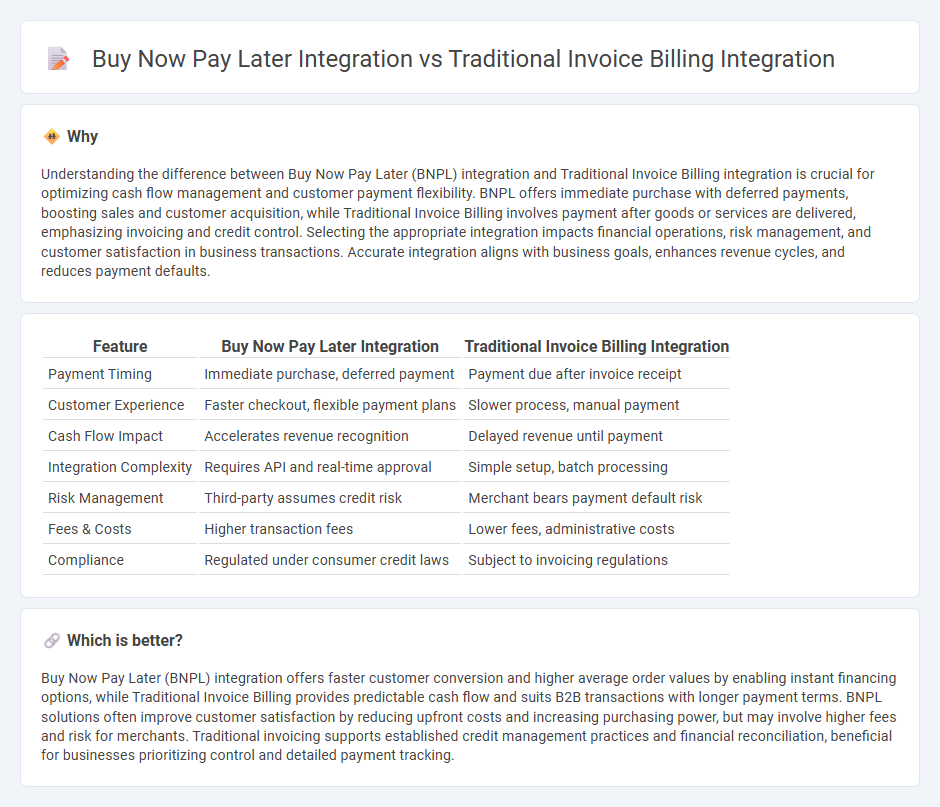

Understanding the difference between Buy Now Pay Later (BNPL) integration and Traditional Invoice Billing integration is crucial for optimizing cash flow management and customer payment flexibility. BNPL offers immediate purchase with deferred payments, boosting sales and customer acquisition, while Traditional Invoice Billing involves payment after goods or services are delivered, emphasizing invoicing and credit control. Selecting the appropriate integration impacts financial operations, risk management, and customer satisfaction in business transactions. Accurate integration aligns with business goals, enhances revenue cycles, and reduces payment defaults.

Comparison Table

| Feature | Buy Now Pay Later Integration | Traditional Invoice Billing Integration |

|---|---|---|

| Payment Timing | Immediate purchase, deferred payment | Payment due after invoice receipt |

| Customer Experience | Faster checkout, flexible payment plans | Slower process, manual payment |

| Cash Flow Impact | Accelerates revenue recognition | Delayed revenue until payment |

| Integration Complexity | Requires API and real-time approval | Simple setup, batch processing |

| Risk Management | Third-party assumes credit risk | Merchant bears payment default risk |

| Fees & Costs | Higher transaction fees | Lower fees, administrative costs |

| Compliance | Regulated under consumer credit laws | Subject to invoicing regulations |

Which is better?

Buy Now Pay Later (BNPL) integration offers faster customer conversion and higher average order values by enabling instant financing options, while Traditional Invoice Billing provides predictable cash flow and suits B2B transactions with longer payment terms. BNPL solutions often improve customer satisfaction by reducing upfront costs and increasing purchasing power, but may involve higher fees and risk for merchants. Traditional invoicing supports established credit management practices and financial reconciliation, beneficial for businesses prioritizing control and detailed payment tracking.

Connection

Buy Now Pay Later (BNPL) integration and traditional invoice billing integration both streamline payment processes by offering flexible financing solutions within digital commerce platforms. BNPL provides consumers with segmented payments over time, while traditional invoices establish clear, itemized payment terms between businesses and clients. Combining these systems enhances cash flow management and improves customer experience by catering to diverse payment preferences in financial transactions.

Key Terms

Accounts Receivable

Traditional invoice billing integration streamlines accounts receivable by automating invoice generation, payment tracking, and reconciliation, reducing manual errors and accelerating cash flow. Buy now pay later integration introduces flexible payment terms within accounts receivable management, providing customers with installment options that enhance purchase power while requiring advanced credit risk assessment and collection processes. Explore how each method impacts cash flow optimization and receivables management efficiency for your business.

Credit Risk

Traditional invoice billing integration relies on credit terms and manual credit risk assessments, potentially leading to delayed payments and higher administrative overhead. Buy now pay later (BNPL) integration leverages real-time credit scoring algorithms and automated risk management, reducing default rates and improving cash flow predictability. Explore more to understand how each method impacts your business's credit risk strategy.

Cash Flow Timing

Traditional invoice billing integration typically results in delayed cash flow as payments are collected after a set billing period, often 30 to 60 days. Buy Now Pay Later (BNPL) integration accelerates cash flow by enabling immediate payment to merchants while customers pay over time, improving liquidity and operational efficiency. Explore how BNPL strategies can optimize your cash flow timing and enhance financial management.

Source and External Links

Billing Software vs. Traditional Paper Invoices - Traditional invoice billing integration involves handling paper-based invoices and physical documentation, which leads to manual errors, time-consuming processes, limited accessibility, and environmental impact compared to digital billing solutions.

Billing Integration For All Your Enterprise Applications - Modern billing integration uses flexible APIs and pre-built connectors to seamlessly connect invoicing with front and back-office systems, streamlining processes and minimizing errors in enterprise environments.

5 Ways Traditional Billing and Invoicing is Holding Your Business Back - Traditional billing's paper-based, manual processes hinder faster order-to-cash cycles, while AR automation platforms offer better accuracy, faster delivery, cost savings, and scalability for invoice billing integration.

dowidth.com

dowidth.com