Structured credit involves pooling various debt instruments into a single security to diversify risk and enhance returns, often tailored to investor needs. Syndicated loans are large loans provided by multiple lenders to a single borrower, distributing risk and facilitating substantial capital access. Discover more about the distinctions and benefits of structured credit and syndicated loans in finance.

Why it is important

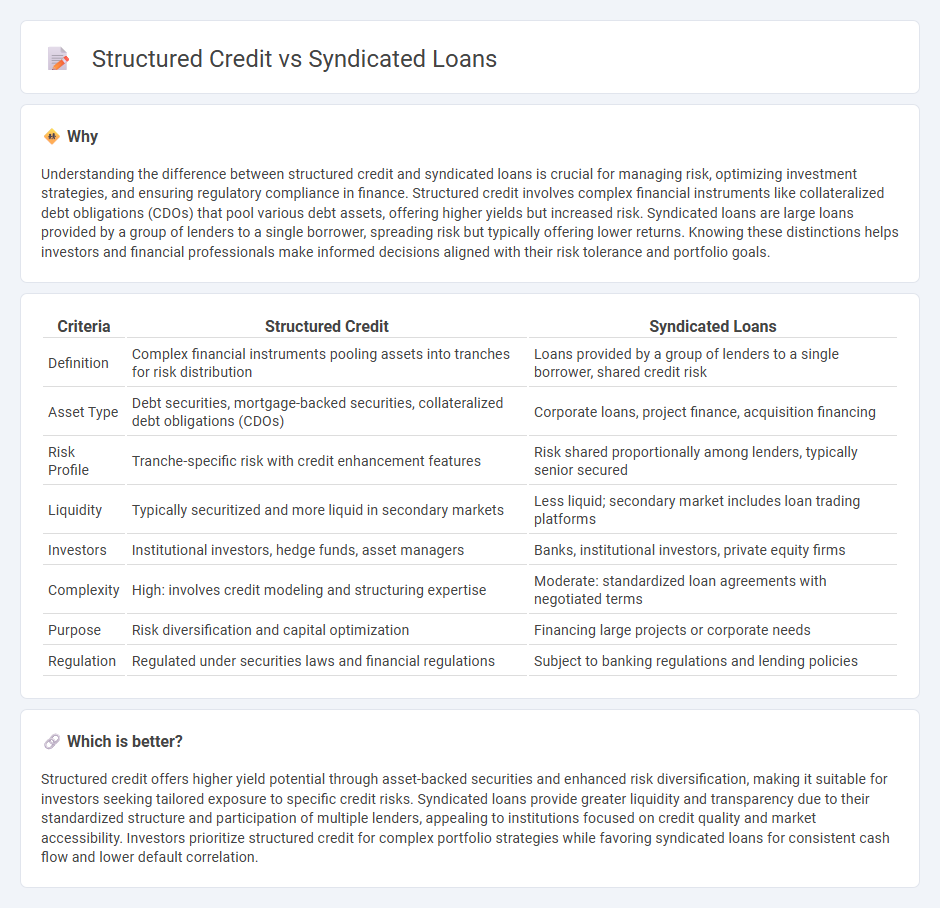

Understanding the difference between structured credit and syndicated loans is crucial for managing risk, optimizing investment strategies, and ensuring regulatory compliance in finance. Structured credit involves complex financial instruments like collateralized debt obligations (CDOs) that pool various debt assets, offering higher yields but increased risk. Syndicated loans are large loans provided by a group of lenders to a single borrower, spreading risk but typically offering lower returns. Knowing these distinctions helps investors and financial professionals make informed decisions aligned with their risk tolerance and portfolio goals.

Comparison Table

| Criteria | Structured Credit | Syndicated Loans |

|---|---|---|

| Definition | Complex financial instruments pooling assets into tranches for risk distribution | Loans provided by a group of lenders to a single borrower, shared credit risk |

| Asset Type | Debt securities, mortgage-backed securities, collateralized debt obligations (CDOs) | Corporate loans, project finance, acquisition financing |

| Risk Profile | Tranche-specific risk with credit enhancement features | Risk shared proportionally among lenders, typically senior secured |

| Liquidity | Typically securitized and more liquid in secondary markets | Less liquid; secondary market includes loan trading platforms |

| Investors | Institutional investors, hedge funds, asset managers | Banks, institutional investors, private equity firms |

| Complexity | High: involves credit modeling and structuring expertise | Moderate: standardized loan agreements with negotiated terms |

| Purpose | Risk diversification and capital optimization | Financing large projects or corporate needs |

| Regulation | Regulated under securities laws and financial regulations | Subject to banking regulations and lending policies |

Which is better?

Structured credit offers higher yield potential through asset-backed securities and enhanced risk diversification, making it suitable for investors seeking tailored exposure to specific credit risks. Syndicated loans provide greater liquidity and transparency due to their standardized structure and participation of multiple lenders, appealing to institutions focused on credit quality and market accessibility. Investors prioritize structured credit for complex portfolio strategies while favoring syndicated loans for consistent cash flow and lower default correlation.

Connection

Structured credit and syndicated loans are interconnected through the mechanism of risk distribution and capital raising in finance. Syndicated loans pool resources from multiple lenders to fund significant credit exposures, while structured credit repackages these exposures into tranches with varying risk profiles, enhancing liquidity and investor access. This synergy enables efficient capital allocation, improved credit risk management, and diversification within financial markets.

Key Terms

Syndication

Syndicated loans involve multiple lenders pooling resources to provide a single borrower with substantial capital, spreading risk across participants and enabling large-scale financing. These loans are typically utilized by corporations and governments for acquisitions, refinancing, or large infrastructure projects, with lead arrangers managing the syndication process and maintaining borrower relationships. Discover the detailed mechanisms and benefits of syndicated loan structures for optimized financial strategy.

Tranching

Syndicated loans involve multiple lenders pooling funds to provide a single loan to a borrower, typically without extensive tranching, resulting in a more straightforward credit structure with shared risk among participants. Structured credit products, such as collateralized debt obligations (CDOs), utilize complex tranching to divide pooled assets into slices with varying risk and return profiles, enabling tailored investment strategies for different investor risk appetites. Explore detailed comparisons of syndicated loans and structured credit tranching to optimize portfolio diversification and risk management strategies.

Credit Risk

Syndicated loans distribute credit risk among multiple lenders by pooling resources to finance large borrowers, reducing individual lender exposure. Structured credit instruments, such as collateralized loan obligations (CLOs), repackage and redistribute credit risk through tranching, enabling tailored risk-return profiles for investors. Discover how credit risk management differs between these two financing vehicles to optimize portfolio resilience.

Source and External Links

Exploring the Power of Syndicated Loans - Truist Bank - Syndicated loans involve multiple lenders forming a syndicate to offer a single, large loan to a borrower for purposes such as capital expenditures, acquisitions, leveraged buyouts, or refinancing, with flexible terms and shared risk among lenders.

Syndicated loans - Managed Funds Association - A syndicated loan is financing provided by a group of lenders to a single borrower when the required amount exceeds what any one lender can or will provide, allowing risk to be spread and offering flexible interest rate and repayment options.

Syndicated Financing | Loan Agency | Funding the Future - In a syndicated loan, one bank acts as the arranger to organize multiple lenders, who each take a portion of the loan, with the arranger often holding the largest share and managing the administrative process, while the loan may later be assigned to other institutional investors.

dowidth.com

dowidth.com