Robo advisory leverages algorithms and artificial intelligence to provide automated, cost-effective financial planning and investment management, appealing to tech-savvy investors seeking low fees and convenience. Traditional wealth management offers personalized advice from human advisors, emphasizing relationship building and tailored strategies for high-net-worth clients. Explore the key differences and advantages of each approach to determine the best fit for your financial goals.

Why it is important

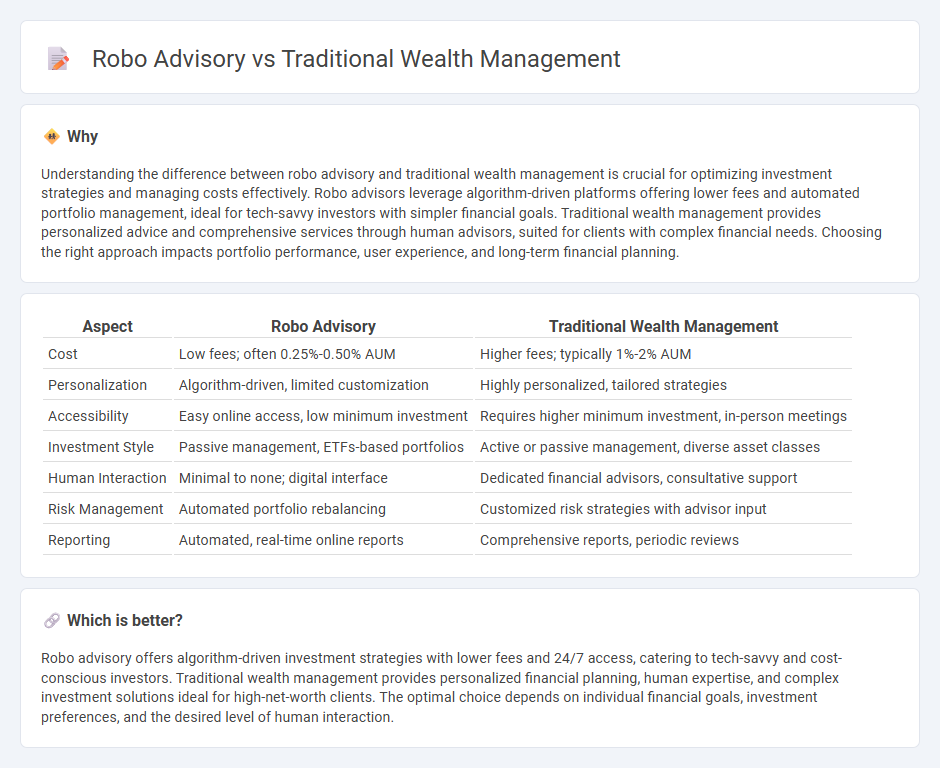

Understanding the difference between robo advisory and traditional wealth management is crucial for optimizing investment strategies and managing costs effectively. Robo advisors leverage algorithm-driven platforms offering lower fees and automated portfolio management, ideal for tech-savvy investors with simpler financial goals. Traditional wealth management provides personalized advice and comprehensive services through human advisors, suited for clients with complex financial needs. Choosing the right approach impacts portfolio performance, user experience, and long-term financial planning.

Comparison Table

| Aspect | Robo Advisory | Traditional Wealth Management |

|---|---|---|

| Cost | Low fees; often 0.25%-0.50% AUM | Higher fees; typically 1%-2% AUM |

| Personalization | Algorithm-driven, limited customization | Highly personalized, tailored strategies |

| Accessibility | Easy online access, low minimum investment | Requires higher minimum investment, in-person meetings |

| Investment Style | Passive management, ETFs-based portfolios | Active or passive management, diverse asset classes |

| Human Interaction | Minimal to none; digital interface | Dedicated financial advisors, consultative support |

| Risk Management | Automated portfolio rebalancing | Customized risk strategies with advisor input |

| Reporting | Automated, real-time online reports | Comprehensive reports, periodic reviews |

Which is better?

Robo advisory offers algorithm-driven investment strategies with lower fees and 24/7 access, catering to tech-savvy and cost-conscious investors. Traditional wealth management provides personalized financial planning, human expertise, and complex investment solutions ideal for high-net-worth clients. The optimal choice depends on individual financial goals, investment preferences, and the desired level of human interaction.

Connection

Robo advisory and traditional wealth management intersect through the integration of automated investment algorithms with personalized financial planning, offering clients a blend of technology-driven efficiency and expert human guidance. Hybrid wealth management platforms leverage data analytics to optimize portfolio allocation while providing tailored advice from financial advisors. This connection enhances client experience by combining cost-effective digital solutions with the nuanced expertise of traditional wealth management.

Key Terms

Traditional Wealth Management:

Traditional wealth management offers personalized financial planning through dedicated advisors who assess individual goals, risk tolerance, and complex needs such as estate planning and tax optimization. Clients benefit from tailored investment strategies, face-to-face interactions, and access to a broad range of financial products and services. Discover how traditional wealth management can provide bespoke solutions for your financial future.

Personalized Advisory

Traditional wealth management offers highly personalized advisory services with tailored financial plans based on in-depth client interactions and comprehensive assessments of individual goals, risk tolerance, and market conditions. Robo advisory platforms, by contrast, use algorithm-driven models to provide automated, scalable investment advice with limited customization but at a lower cost and greater accessibility. Discover how personalized advisory approaches can align with your wealth management needs by exploring detailed comparisons today.

Discretionary Portfolio Management

Discretionary Portfolio Management within traditional wealth management offers personalized investment decisions made by experienced portfolio managers, tailoring strategies to individual client objectives and risk tolerance. In contrast, robo advisory uses algorithm-driven platforms to automate portfolio allocation, often providing lower fees and increased accessibility but with less customization. Discover how these approaches can align with your financial goals and investment preferences.

Source and External Links

Wealth management - Wikipedia - Traditional wealth management involves structured planning and advice to grow, preserve, and protect wealth for high-net-worth individuals, including estate planning and tax strategies tailored to individual investor needs and time horizons.

What Is Wealth Management and How Does It Work? - Raisin - Traditional wealth management offers a comprehensive advisory service focusing on diversification, risk management, tax optimization, and legacy planning designed to preserve and transfer wealth efficiently.

Wealth Management: What It Is And How To Find A ... - Bankrate - Traditional wealth management is a holistic approach that combines investment management, financial goal setting, tax and estate planning, retirement and succession planning to help clients grow and preserve wealth.

dowidth.com

dowidth.com