Finfluencers leverage social media platforms to provide accessible financial advice, targeting individual investors and promoting personal finance literacy. Credit analysts evaluate creditworthiness using quantitative data and risk assessment models to guide lending decisions in financial institutions. Explore deeper insights into the contrasting roles and impact of finfluencers and credit analysts on the financial ecosystem.

Why it is important

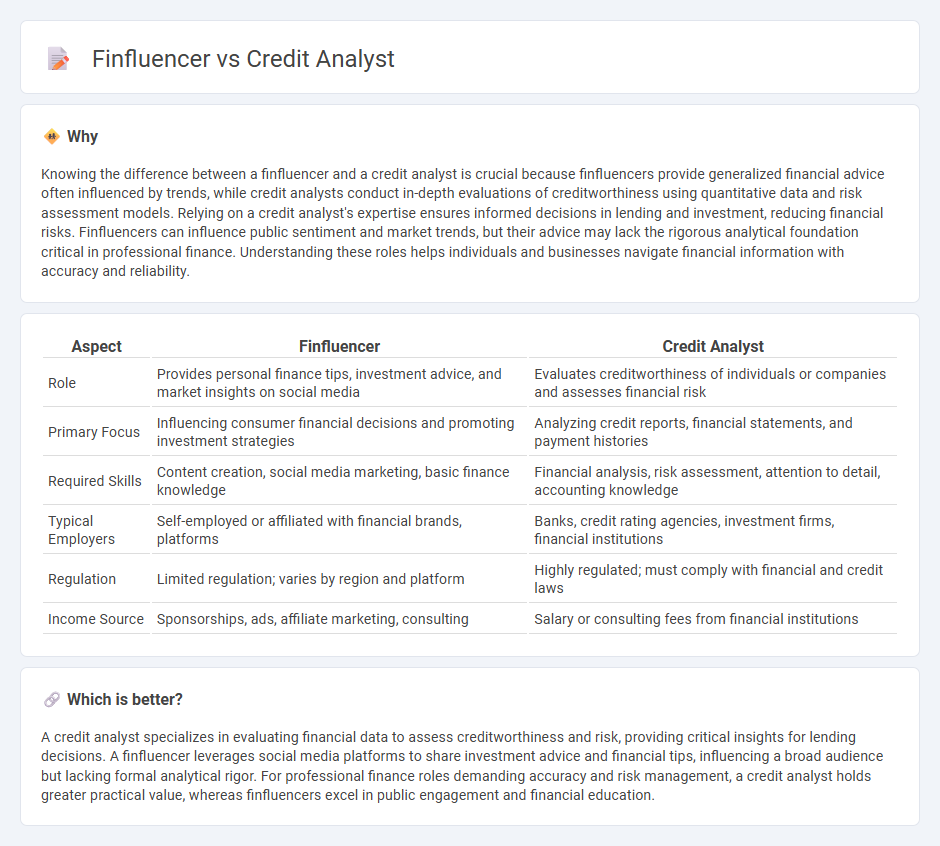

Knowing the difference between a finfluencer and a credit analyst is crucial because finfluencers provide generalized financial advice often influenced by trends, while credit analysts conduct in-depth evaluations of creditworthiness using quantitative data and risk assessment models. Relying on a credit analyst's expertise ensures informed decisions in lending and investment, reducing financial risks. Finfluencers can influence public sentiment and market trends, but their advice may lack the rigorous analytical foundation critical in professional finance. Understanding these roles helps individuals and businesses navigate financial information with accuracy and reliability.

Comparison Table

| Aspect | Finfluencer | Credit Analyst |

|---|---|---|

| Role | Provides personal finance tips, investment advice, and market insights on social media | Evaluates creditworthiness of individuals or companies and assesses financial risk |

| Primary Focus | Influencing consumer financial decisions and promoting investment strategies | Analyzing credit reports, financial statements, and payment histories |

| Required Skills | Content creation, social media marketing, basic finance knowledge | Financial analysis, risk assessment, attention to detail, accounting knowledge |

| Typical Employers | Self-employed or affiliated with financial brands, platforms | Banks, credit rating agencies, investment firms, financial institutions |

| Regulation | Limited regulation; varies by region and platform | Highly regulated; must comply with financial and credit laws |

| Income Source | Sponsorships, ads, affiliate marketing, consulting | Salary or consulting fees from financial institutions |

Which is better?

A credit analyst specializes in evaluating financial data to assess creditworthiness and risk, providing critical insights for lending decisions. A finfluencer leverages social media platforms to share investment advice and financial tips, influencing a broad audience but lacking formal analytical rigor. For professional finance roles demanding accuracy and risk management, a credit analyst holds greater practical value, whereas finfluencers excel in public engagement and financial education.

Connection

Finfluencers leverage social media platforms to educate and influence public perceptions about credit health, indirectly shaping consumer behavior relevant to credit analysts. Credit analysts assess the creditworthiness of individuals or businesses, relying on data that can be influenced by the financial trends and advice disseminated by finfluencers. Both roles intersect in the financial ecosystem where consumer credit decisions and risk evaluations are impacted by widely shared financial knowledge and insights.

Key Terms

Credit Analyst:

Credit analysts evaluate borrowers' creditworthiness by analyzing financial statements, credit reports, and economic trends to assess risk and ensure sound lending decisions. They work primarily in banks, credit agencies, and financial institutions, using quantitative models and qualitative judgment to predict default probabilities and recommend credit limits. Discover how credit analysts play a pivotal role in maintaining financial stability and influencing lending standards.

Credit Risk

Credit analysts evaluate credit risk by analyzing financial statements, credit histories, and market trends to determine borrowers' creditworthiness and minimize loan defaults. Finfluencers, however, focus on educating audiences about credit management and risk prevention through social media, often simplifying complex credit risk concepts. Explore more to understand how these roles uniquely impact credit risk assessment and financial decision-making.

Financial Statements

Credit analysts specialize in evaluating financial statements to assess the creditworthiness of individuals or companies, focusing on balance sheets, income statements, and cash flow statements to determine risk and repayment capacity. Finfluencers interpret financial data and trends, often simplifying complex financial statements for a broader audience to educate and influence investment decisions. Explore the differences in their approaches to financial statement analysis to understand their distinct roles in finance.

Source and External Links

Credit analyst - Wikipedia - A credit analyst evaluates the creditworthiness of customers by analyzing financial data, setting credit limits, and monitoring credit risk; typically requires a business-related degree and may involve certifications like Credit Business Associate or FRM.

What Is a Credit Analyst? - Coursera - Credit analysts assess financial risks of individuals or firms by analyzing financial statements and payment history to recommend loan approvals or credit limits based on creditworthiness.

Credit Analysts - Bureau of Labor Statistics - Credit analysts analyze credit data and financial statements to determine lending risks, with median annual wages around $79,420 and employment of approximately 73,200 people.

dowidth.com

dowidth.com