Risk parity portfolios distribute risk evenly across various asset classes to achieve balanced volatility and enhance diversification benefits. The all-weather portfolio, designed to perform well under different economic conditions, combines stocks, bonds, commodities, and inflation-protected securities with fixed asset allocations. Explore the differences in risk management and performance strategies between these two popular portfolio approaches.

Why it is important

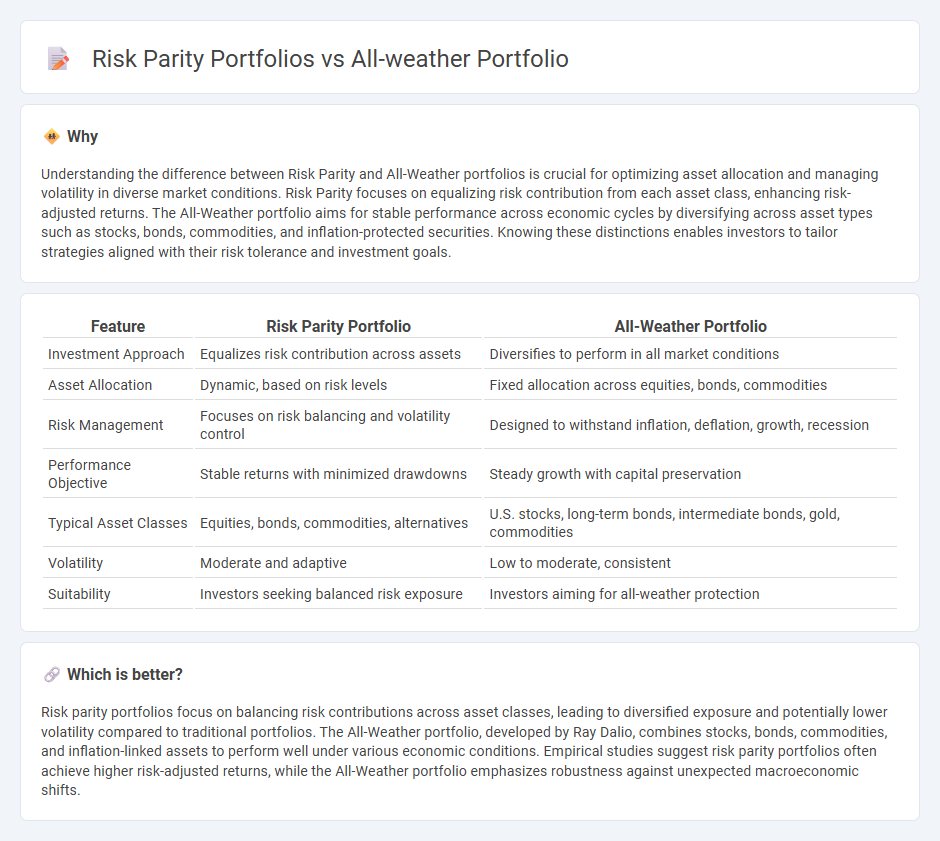

Understanding the difference between Risk Parity and All-Weather portfolios is crucial for optimizing asset allocation and managing volatility in diverse market conditions. Risk Parity focuses on equalizing risk contribution from each asset class, enhancing risk-adjusted returns. The All-Weather portfolio aims for stable performance across economic cycles by diversifying across asset types such as stocks, bonds, commodities, and inflation-protected securities. Knowing these distinctions enables investors to tailor strategies aligned with their risk tolerance and investment goals.

Comparison Table

| Feature | Risk Parity Portfolio | All-Weather Portfolio |

|---|---|---|

| Investment Approach | Equalizes risk contribution across assets | Diversifies to perform in all market conditions |

| Asset Allocation | Dynamic, based on risk levels | Fixed allocation across equities, bonds, commodities |

| Risk Management | Focuses on risk balancing and volatility control | Designed to withstand inflation, deflation, growth, recession |

| Performance Objective | Stable returns with minimized drawdowns | Steady growth with capital preservation |

| Typical Asset Classes | Equities, bonds, commodities, alternatives | U.S. stocks, long-term bonds, intermediate bonds, gold, commodities |

| Volatility | Moderate and adaptive | Low to moderate, consistent |

| Suitability | Investors seeking balanced risk exposure | Investors aiming for all-weather protection |

Which is better?

Risk parity portfolios focus on balancing risk contributions across asset classes, leading to diversified exposure and potentially lower volatility compared to traditional portfolios. The All-Weather portfolio, developed by Ray Dalio, combines stocks, bonds, commodities, and inflation-linked assets to perform well under various economic conditions. Empirical studies suggest risk parity portfolios often achieve higher risk-adjusted returns, while the All-Weather portfolio emphasizes robustness against unexpected macroeconomic shifts.

Connection

Risk parity portfolios and the All-Weather portfolio share a fundamental philosophy of balancing risk across diverse asset classes to achieve stable returns. The All-Weather portfolio, popularized by Ray Dalio, applies risk parity principles by allocating capital based on risk contributions rather than nominal amounts, diversifying among stocks, bonds, commodities, and inflation-linked assets. Both strategies aim to mitigate volatility and drawdowns by equalizing risk, enhancing portfolio resilience in varying market environments.

Key Terms

Asset Allocation

All-weather portfolios emphasize diversification across various asset classes such as stocks, bonds, commodities, and inflation-protected securities to perform steadily in different economic environments. Risk parity portfolios allocate capital based on risk contributions, typically balancing volatility among equities, fixed income, and alternative assets to achieve more consistent returns. Explore further to understand how these strategies optimize asset allocation for risk management and long-term growth.

Risk Weighting

All-weather portfolios maintain fixed risk allocations across asset classes to perform consistently under diverse market conditions, while risk parity portfolios dynamically adjust allocations to equalize risk contributions. Risk weighting in risk parity emphasizes balancing volatility and correlation, aiming to minimize drawdowns by allocating capital where risk is lower. Explore detailed comparisons to understand how different risk weighting approaches impact portfolio resilience and returns.

Diversification

All-weather portfolios emphasize broad diversification across asset classes such as equities, bonds, commodities, and inflation-protected securities to perform well in various economic environments. Risk parity portfolios allocate risk equally among assets, often leveraging low-volatility bonds while balancing higher-risk equities to achieve stable returns with minimized drawdowns. Explore detailed comparisons of diversification strategies and performance outcomes to understand which portfolio aligns best with your financial goals.

Source and External Links

Ray Dalio's All Weather Portfolio (Backtest, Risk, Returns ... - The All Weather Portfolio by Ray Dalio is a diversified investment strategy balancing bonds (55%), U.S. stocks (30%), and hard assets like gold and commodities (15%) to perform consistently in various economic climates including inflation, deflation, and stagflation, offering stability and reduced drawdowns, especially suited for conservative investors prioritizing capital preservation.

The All-Weather Portfolio - What You Need to Know - Porterinv ... - This portfolio uniquely weights assets based on their risk contribution rather than capital, balancing risks across growth, recession, inflation, and deflation economic cycles, with systematic rebalancing to buy low and sell high, emphasizing risk parity and long-term consistent performance.

All Weather Portfolio by Ray Dalio: A Diversified Investment Approach - The All Weather Portfolio emphasizes diversification across stocks, bonds (both short- and long-term), gold, and commodities, combined with regular rebalancing and a systematic investment approach, historically yielding around 9.7% average annual return from 1996 to 2020, outperforming the S&P 500 during certain periods of market stress.

dowidth.com

dowidth.com