Tax loss harvesting involves selling investments at a loss to offset capital gains tax liabilities, effectively reducing taxable income within the current fiscal year. Tax deferral strategies postpone the recognition of income or gains to future periods, allowing for delayed tax payments and potentially lower tax rates. Explore expert insights to understand which approach aligns best with your financial goals.

Why it is important

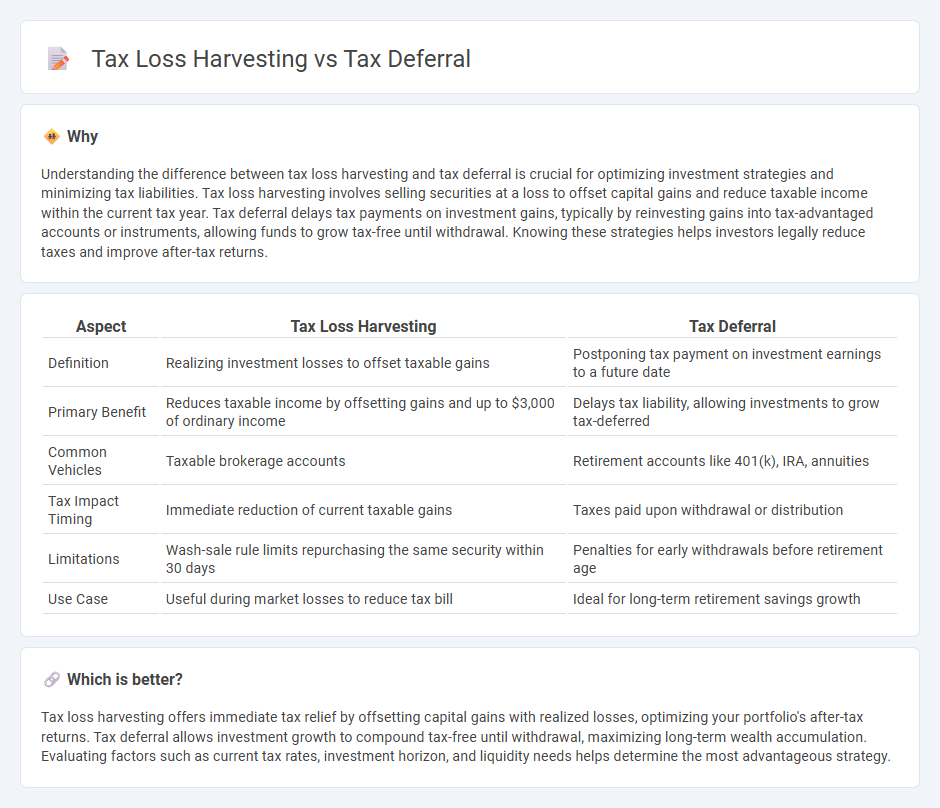

Understanding the difference between tax loss harvesting and tax deferral is crucial for optimizing investment strategies and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income within the current tax year. Tax deferral delays tax payments on investment gains, typically by reinvesting gains into tax-advantaged accounts or instruments, allowing funds to grow tax-free until withdrawal. Knowing these strategies helps investors legally reduce taxes and improve after-tax returns.

Comparison Table

| Aspect | Tax Loss Harvesting | Tax Deferral |

|---|---|---|

| Definition | Realizing investment losses to offset taxable gains | Postponing tax payment on investment earnings to a future date |

| Primary Benefit | Reduces taxable income by offsetting gains and up to $3,000 of ordinary income | Delays tax liability, allowing investments to grow tax-deferred |

| Common Vehicles | Taxable brokerage accounts | Retirement accounts like 401(k), IRA, annuities |

| Tax Impact Timing | Immediate reduction of current taxable gains | Taxes paid upon withdrawal or distribution |

| Limitations | Wash-sale rule limits repurchasing the same security within 30 days | Penalties for early withdrawals before retirement age |

| Use Case | Useful during market losses to reduce tax bill | Ideal for long-term retirement savings growth |

Which is better?

Tax loss harvesting offers immediate tax relief by offsetting capital gains with realized losses, optimizing your portfolio's after-tax returns. Tax deferral allows investment growth to compound tax-free until withdrawal, maximizing long-term wealth accumulation. Evaluating factors such as current tax rates, investment horizon, and liquidity needs helps determine the most advantageous strategy.

Connection

Tax loss harvesting and tax deferral are connected through their combined ability to optimize investment tax efficiency by minimizing short-term capital gains taxes and postponing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing immediate taxable income, while tax deferral strategies delay the recognition of income or gains to future periods, often through retirement accounts or specific investment vehicles. Together, these strategies enhance after-tax returns by managing the timing of income realization and tax payments.

Key Terms

Capital Gains

Tax deferral strategies allow investors to postpone paying capital gains taxes by delaying the sale of assets, maximizing investment growth potential over time. Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income and enhancing after-tax returns. Explore more about how these techniques can optimize your capital gains tax management.

Cost Basis

Tax deferral strategies postpone tax liabilities by delaying income recognition, effectively managing the cost basis for future tax events, while tax loss harvesting involves selling securities at a loss to offset gains, directly adjusting the cost basis to reduce taxable income. Both methods aim to optimize after-tax returns by strategically timing gains and losses in relation to the cost basis, with tax loss harvesting offering more immediate tax benefits through realized losses. Explore detailed comparisons to better understand how cost basis impacts your long-term tax planning.

Realized Losses

Realized losses in tax deferral involve postponing income to future periods to reduce current tax liability, while tax loss harvesting strategically sells securities at a loss to offset realized gains and optimize tax outcomes. Both methods leverage realized losses to minimize taxes but differ in timing and application--tax deferral delays income recognition, and tax loss harvesting immediately uses losses for tax benefits. Explore detailed strategies to maximize your tax efficiency through understanding realized losses and their impact on your investment portfolio.

Source and External Links

Tax deferral - Wikipedia - Tax deferral allows taxpayers to delay paying taxes to a future period, often resulting in the same total tax paid but potentially taxed at a lower rate or deferred indefinitely, commonly through mechanisms like accelerated depreciation for corporations.

The Benefits of Tax Deferral - Ameritas - Tax deferral is a strategy to delay taxes on investment gains, allowing compounding growth over time, as seen in retirement accounts like 401(k)s or IRAs, ultimately yielding greater long-term value than taxable accounts.

How Tax Deferral Works | SecurityBenefit.com - Tax deferral postpones taxation on asset growth until withdrawal, often at retirement, enabling full compounding of investment returns without annual tax drag, thereby supporting enhanced growth through lower tax impact at distribution time.

dowidth.com

dowidth.com