Crowdlending enables businesses to access funds directly from a broad base of individual investors through online platforms, offering flexible loan terms without diluting ownership. Venture capital involves raising substantial equity investments from professional investors in exchange for a share of company ownership, often providing strategic guidance alongside funding. Explore the advantages and limitations of crowdlending versus venture capital to determine the best financing option for your business growth.

Why it is important

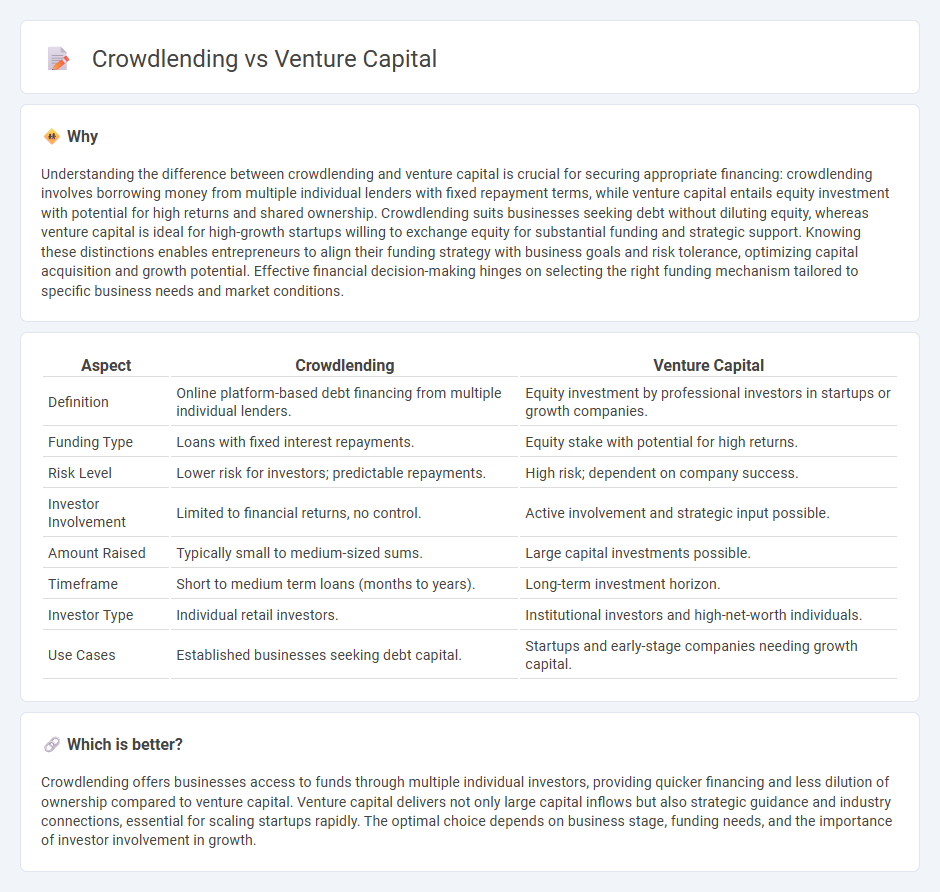

Understanding the difference between crowdlending and venture capital is crucial for securing appropriate financing: crowdlending involves borrowing money from multiple individual lenders with fixed repayment terms, while venture capital entails equity investment with potential for high returns and shared ownership. Crowdlending suits businesses seeking debt without diluting equity, whereas venture capital is ideal for high-growth startups willing to exchange equity for substantial funding and strategic support. Knowing these distinctions enables entrepreneurs to align their funding strategy with business goals and risk tolerance, optimizing capital acquisition and growth potential. Effective financial decision-making hinges on selecting the right funding mechanism tailored to specific business needs and market conditions.

Comparison Table

| Aspect | Crowdlending | Venture Capital |

|---|---|---|

| Definition | Online platform-based debt financing from multiple individual lenders. | Equity investment by professional investors in startups or growth companies. |

| Funding Type | Loans with fixed interest repayments. | Equity stake with potential for high returns. |

| Risk Level | Lower risk for investors; predictable repayments. | High risk; dependent on company success. |

| Investor Involvement | Limited to financial returns, no control. | Active involvement and strategic input possible. |

| Amount Raised | Typically small to medium-sized sums. | Large capital investments possible. |

| Timeframe | Short to medium term loans (months to years). | Long-term investment horizon. |

| Investor Type | Individual retail investors. | Institutional investors and high-net-worth individuals. |

| Use Cases | Established businesses seeking debt capital. | Startups and early-stage companies needing growth capital. |

Which is better?

Crowdlending offers businesses access to funds through multiple individual investors, providing quicker financing and less dilution of ownership compared to venture capital. Venture capital delivers not only large capital inflows but also strategic guidance and industry connections, essential for scaling startups rapidly. The optimal choice depends on business stage, funding needs, and the importance of investor involvement in growth.

Connection

Crowdlending and venture capital are connected through their shared role in providing alternative funding sources for startups and small businesses beyond traditional bank loans, enabling entrepreneurs to access capital more efficiently. Both financing methods involve investors seeking equity or returns by funding innovative companies with growth potential while diversifying risk across multiple ventures. The growing integration of crowdlending platforms with venture capital firms enhances deal flow, accelerates funding rounds, and optimizes portfolio management in the modern financial ecosystem.

Key Terms

Equity

Venture capital involves investors providing equity funding in exchange for ownership stakes and potential high returns from business growth, whereas crowdlending offers debt-based financing where lenders receive interest payments without ownership rights. Equity in venture capital aligns investor and entrepreneur interests through shared risk and profit, making it suitable for startups seeking significant capital and strategic support. Discover deeper insights into how equity shapes financing choices and impacts business growth strategies.

Debt

Venture capital primarily involves equity financing, where investors receive ownership stakes, while crowdlending centers on debt financing, with companies borrowing funds that are repaid with interest. Debt-focused crowdlending provides predictable cash flow for lenders and less dilution of ownership for borrowers compared to venture capital investments. Explore the key differences between venture capital and crowdlending to determine which debt option best fits your financing needs.

Risk

Venture capital involves high-risk investments in startups with the potential for substantial returns, while crowdlending offers more predictable, fixed interest income through peer-to-peer loans but carries risks like borrower default. VC investors face liquidity challenges and market volatility, whereas crowdlending participants must consider credit risk and platform reliability. Explore detailed risk profiles and strategic considerations to choose the right funding approach.

Source and External Links

What is Venture Capital? - Venture capital is a type of financing that supports the development of high-growth companies by turning ideas and research into transformative products and services, with investors providing long-term equity and operational support to startups.

Fund your business | U.S. Small Business Administration - Venture capital involves investors providing capital in exchange for equity and an active role in the company, typically focusing on high-growth firms and taking higher risks for potentially higher returns with a longer investment horizon.

What is venture capital? - Silicon Valley Bank - Venture capital is private equity investment in startups and early-stage companies with rapid growth potential, offering financial, technical, and managerial support while gaining ownership stakes and often board involvement.

dowidth.com

dowidth.com