Decentralized exchanges (DEXs) enable peer-to-peer trading directly on blockchain networks, eliminating intermediaries and enhancing security. Automated market makers (AMMs) use algorithmic liquidity pools instead of traditional order books, providing continuous trading and reduced slippage. Explore how these innovations reshape financial markets and empower traders.

Why it is important

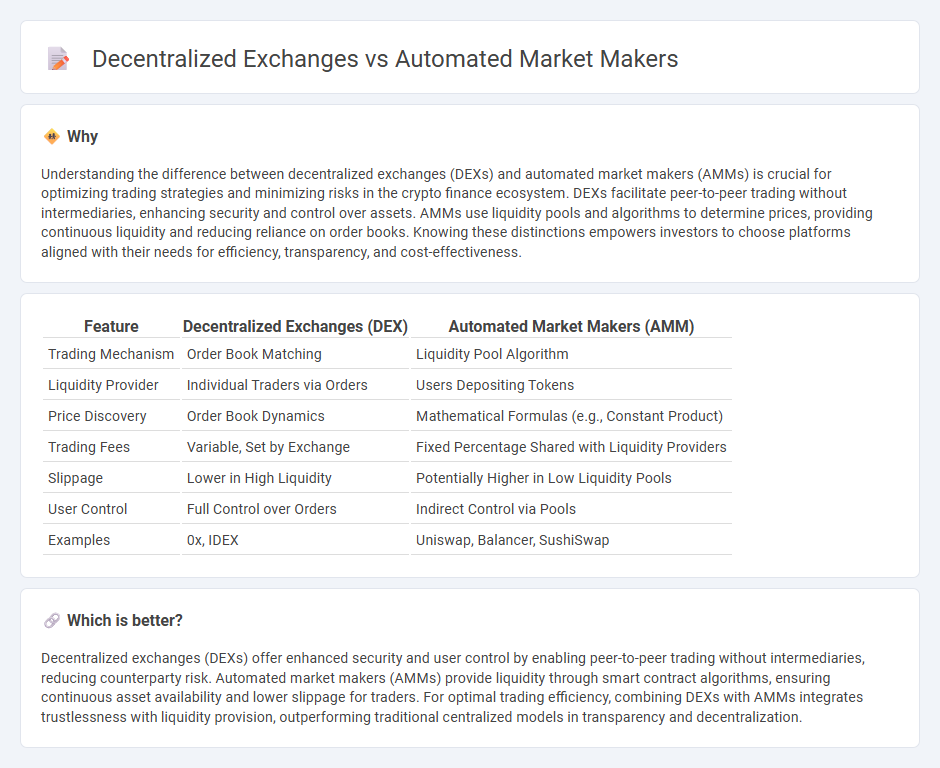

Understanding the difference between decentralized exchanges (DEXs) and automated market makers (AMMs) is crucial for optimizing trading strategies and minimizing risks in the crypto finance ecosystem. DEXs facilitate peer-to-peer trading without intermediaries, enhancing security and control over assets. AMMs use liquidity pools and algorithms to determine prices, providing continuous liquidity and reducing reliance on order books. Knowing these distinctions empowers investors to choose platforms aligned with their needs for efficiency, transparency, and cost-effectiveness.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Automated Market Makers (AMM) |

|---|---|---|

| Trading Mechanism | Order Book Matching | Liquidity Pool Algorithm |

| Liquidity Provider | Individual Traders via Orders | Users Depositing Tokens |

| Price Discovery | Order Book Dynamics | Mathematical Formulas (e.g., Constant Product) |

| Trading Fees | Variable, Set by Exchange | Fixed Percentage Shared with Liquidity Providers |

| Slippage | Lower in High Liquidity | Potentially Higher in Low Liquidity Pools |

| User Control | Full Control over Orders | Indirect Control via Pools |

| Examples | 0x, IDEX | Uniswap, Balancer, SushiSwap |

Which is better?

Decentralized exchanges (DEXs) offer enhanced security and user control by enabling peer-to-peer trading without intermediaries, reducing counterparty risk. Automated market makers (AMMs) provide liquidity through smart contract algorithms, ensuring continuous asset availability and lower slippage for traders. For optimal trading efficiency, combining DEXs with AMMs integrates trustlessness with liquidity provision, outperforming traditional centralized models in transparency and decentralization.

Connection

Decentralized exchanges (DEXs) rely heavily on automated market makers (AMMs) as their core mechanism for liquidity provision and trade execution, eliminating the need for traditional order books. AMMs use smart contracts and liquidity pools to enable seamless token swaps directly between users, enhancing efficiency and reducing reliance on centralized intermediaries. This integration fosters increased market accessibility and continuous asset availability, transforming the landscape of decentralized finance (DeFi).

Key Terms

Liquidity Pools

Liquidity pools are the core component of automated market makers (AMMs), enabling seamless token swaps without relying on traditional order books, unlike decentralized exchanges (DEXs) that may incorporate multiple trading mechanisms. AMMs use smart contracts to manage liquidity pools where users provide tokens and earn fees, ensuring constant market availability and reducing slippage. Discover how liquidity pools revolutionize trading efficiency and user empowerment within decentralized finance ecosystems.

Smart Contracts

Automated Market Makers (AMMs) operate as smart contracts on blockchain platforms, enabling seamless token swaps without relying on traditional order books, thus enhancing liquidity and reducing transaction times. Decentralized exchanges (DEXs) also utilize smart contracts to facilitate peer-to-peer trading, but often combine AMMs with order book models to offer diverse trading mechanisms and improved market efficiency. Explore the intricate role of smart contracts in AMMs and DEXs to understand their impact on decentralized finance innovation.

Peer-to-Peer Trading

Automated Market Makers (AMMs) utilize smart contracts to provide liquidity and enable seamless token swaps without relying on traditional order books, enhancing efficiency and accessibility in decentralized exchanges (DEXs). Decentralized exchanges facilitate Peer-to-Peer (P2P) trading by allowing users to transact directly with one another, reducing counterparty risk and increasing transparency through blockchain technology. Explore in-depth comparisons to understand how AMMs and DEXs shape the future of P2P trading ecosystems.

Source and External Links

What is an Automated Market Maker? - Uniswap Blog - Automated market makers (AMMs) are decentralized exchanges that use smart contracts and mathematical formulas to price assets automatically, enabling 24/7 on-chain trading without order books or intermediaries, allowing anyone to provide liquidity and earn fees.

The Ecology of Automated Market Makers - Bank of Canada - AMMs are the leading decentralized exchange model in DeFi, with platforms like Uniswap, Curve, Sushiswap, and Balancer offering different designs, governance, and incentives while posing unique regulatory considerations.

Automated Market Makers (AMMs) Explained - Chainlink - Variants of AMMs include dynamic AMMs adjusting liquidity by market volatility, proactive AMMs mimicking traditional order books to improve liquidity, and virtual AMMs allowing synthetic asset exposure, all using algorithmic pricing and smart contracts.

dowidth.com

dowidth.com