Liability Driven Investing (LDI) focuses on managing assets to match future liabilities, often used by pension funds to ensure long-term payment obligations are met with minimized risk. Active investing involves continuous portfolio adjustments aiming to outperform market benchmarks through strategic asset selection and market timing. Explore how these distinct strategies align with risk tolerance and financial goals to determine the best approach for your investment portfolio.

Why it is important

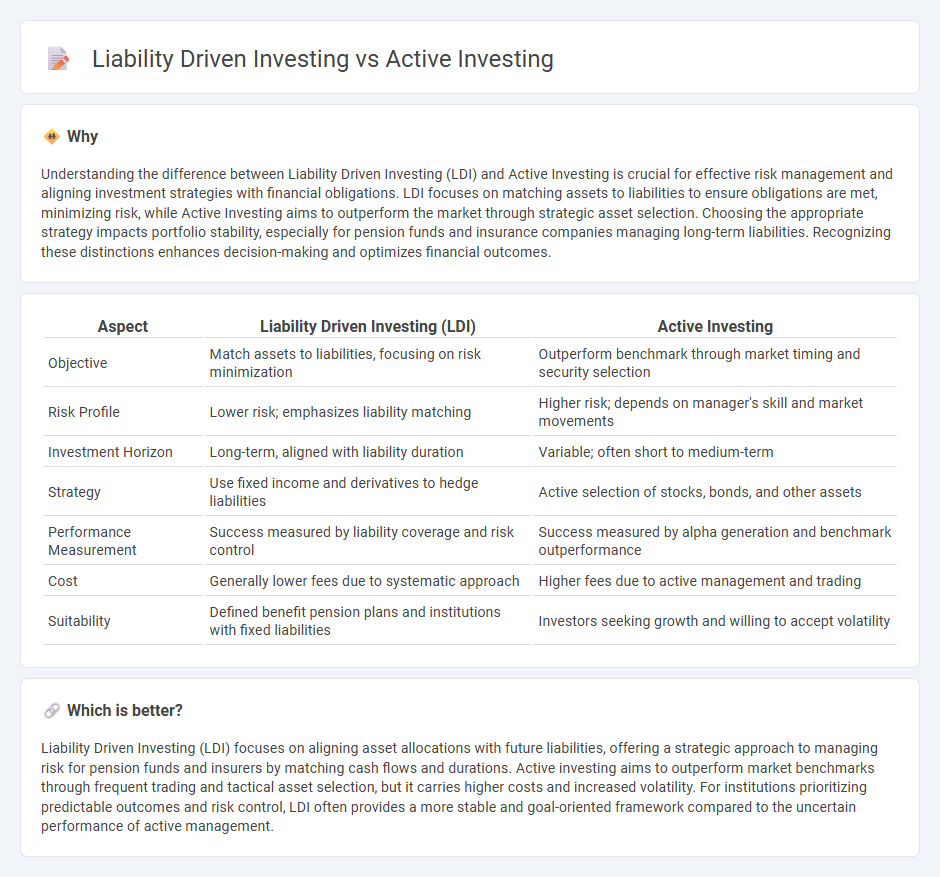

Understanding the difference between Liability Driven Investing (LDI) and Active Investing is crucial for effective risk management and aligning investment strategies with financial obligations. LDI focuses on matching assets to liabilities to ensure obligations are met, minimizing risk, while Active Investing aims to outperform the market through strategic asset selection. Choosing the appropriate strategy impacts portfolio stability, especially for pension funds and insurance companies managing long-term liabilities. Recognizing these distinctions enhances decision-making and optimizes financial outcomes.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Active Investing |

|---|---|---|

| Objective | Match assets to liabilities, focusing on risk minimization | Outperform benchmark through market timing and security selection |

| Risk Profile | Lower risk; emphasizes liability matching | Higher risk; depends on manager's skill and market movements |

| Investment Horizon | Long-term, aligned with liability duration | Variable; often short to medium-term |

| Strategy | Use fixed income and derivatives to hedge liabilities | Active selection of stocks, bonds, and other assets |

| Performance Measurement | Success measured by liability coverage and risk control | Success measured by alpha generation and benchmark outperformance |

| Cost | Generally lower fees due to systematic approach | Higher fees due to active management and trading |

| Suitability | Defined benefit pension plans and institutions with fixed liabilities | Investors seeking growth and willing to accept volatility |

Which is better?

Liability Driven Investing (LDI) focuses on aligning asset allocations with future liabilities, offering a strategic approach to managing risk for pension funds and insurers by matching cash flows and durations. Active investing aims to outperform market benchmarks through frequent trading and tactical asset selection, but it carries higher costs and increased volatility. For institutions prioritizing predictable outcomes and risk control, LDI often provides a more stable and goal-oriented framework compared to the uncertain performance of active management.

Connection

Liability Driven Investing (LDI) and active investing intersect through the strategic management of assets to meet future liabilities, with LDI focusing on aligning investment portfolios to cover pension obligations or debt schedules. Active investing enhances LDI by enabling dynamic asset allocation and security selection, aiming to optimize returns and manage risks relative to projected liabilities. This synergy ensures a tailored investment approach that balances stable income generation with growth opportunities, crucial for meeting long-term financial commitments.

Key Terms

Alpha

Active investing emphasizes generating alpha by selecting securities expected to outperform benchmarks through research and market analysis. Liability-driven investing (LDI) prioritizes managing portfolio risk to meet future liabilities, often using fixed income strategies to align assets with obligations rather than seeking alpha. Explore strategic approaches to alpha generation and risk management in both investment styles to optimize portfolio outcomes.

Benchmark

Active investing targets outperforming a market benchmark through strategic asset selection and timing, seeking higher returns than standardized indices like the S&P 500. Liability-driven investing (LDI) prioritizes aligning asset allocations with future liabilities, emphasizing risk reduction and ensuring funding status stability rather than benchmark performance. Explore the fundamental distinctions between active and liability-driven investing to optimize portfolio strategies.

Duration

Active investing in fixed income prioritizes generating excess returns by frequently adjusting portfolio duration in response to market forecasts and interest rate expectations. Liability Driven Investing (LDI) primarily focuses on matching the portfolio's duration to the duration of liabilities, minimizing interest rate risk and ensuring cash flow alignment for future obligations. Explore how aligning duration strategies between active investing and LDI can optimize risk management and return potential in your fixed income portfolio.

Source and External Links

Active vs. Passive Investing Strategies | KAR - Active investing involves expert analysts actively buying and selling stocks to potentially achieve bigger rewards, flexibility, and tax management benefits, especially in volatile markets where quality stocks and manager expertise can create alpha.

Active vs. Passive Investing - Active investing means frequently buying and selling to respond quickly to market opportunities and movements, often involving individual securities or actively managed funds, contrasted with passive investing which aims to match market performance over the long term.

A New Take on the Active vs. Passive Investing Debate - Active investing focuses on selecting investments based on independent assessment to outperform benchmarks, usually at higher costs, while passive investing aims to simply match index returns with lower fees, and a blended approach may benefit portfolios.

dowidth.com

dowidth.com