Structured credit involves complex financial instruments created by pooling various debt obligations, while asset-backed securities (ABS) are a type of structured credit specifically linked to pools of assets like loans or receivables. These securities provide investors with cash flows derived from underlying assets, offering diversification and risk management opportunities. Explore further to understand their distinct structures and impact on investment strategies.

Why it is important

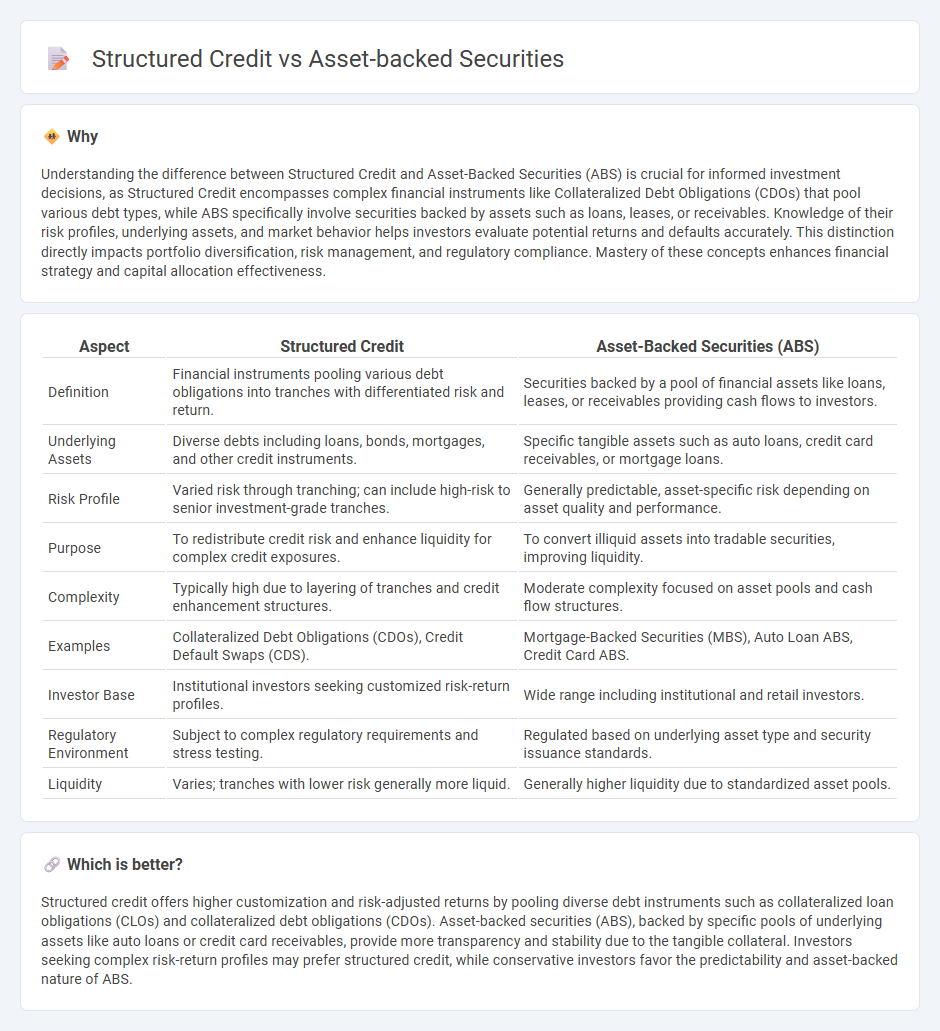

Understanding the difference between Structured Credit and Asset-Backed Securities (ABS) is crucial for informed investment decisions, as Structured Credit encompasses complex financial instruments like Collateralized Debt Obligations (CDOs) that pool various debt types, while ABS specifically involve securities backed by assets such as loans, leases, or receivables. Knowledge of their risk profiles, underlying assets, and market behavior helps investors evaluate potential returns and defaults accurately. This distinction directly impacts portfolio diversification, risk management, and regulatory compliance. Mastery of these concepts enhances financial strategy and capital allocation effectiveness.

Comparison Table

| Aspect | Structured Credit | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Financial instruments pooling various debt obligations into tranches with differentiated risk and return. | Securities backed by a pool of financial assets like loans, leases, or receivables providing cash flows to investors. |

| Underlying Assets | Diverse debts including loans, bonds, mortgages, and other credit instruments. | Specific tangible assets such as auto loans, credit card receivables, or mortgage loans. |

| Risk Profile | Varied risk through tranching; can include high-risk to senior investment-grade tranches. | Generally predictable, asset-specific risk depending on asset quality and performance. |

| Purpose | To redistribute credit risk and enhance liquidity for complex credit exposures. | To convert illiquid assets into tradable securities, improving liquidity. |

| Complexity | Typically high due to layering of tranches and credit enhancement structures. | Moderate complexity focused on asset pools and cash flow structures. |

| Examples | Collateralized Debt Obligations (CDOs), Credit Default Swaps (CDS). | Mortgage-Backed Securities (MBS), Auto Loan ABS, Credit Card ABS. |

| Investor Base | Institutional investors seeking customized risk-return profiles. | Wide range including institutional and retail investors. |

| Regulatory Environment | Subject to complex regulatory requirements and stress testing. | Regulated based on underlying asset type and security issuance standards. |

| Liquidity | Varies; tranches with lower risk generally more liquid. | Generally higher liquidity due to standardized asset pools. |

Which is better?

Structured credit offers higher customization and risk-adjusted returns by pooling diverse debt instruments such as collateralized loan obligations (CLOs) and collateralized debt obligations (CDOs). Asset-backed securities (ABS), backed by specific pools of underlying assets like auto loans or credit card receivables, provide more transparency and stability due to the tangible collateral. Investors seeking complex risk-return profiles may prefer structured credit, while conservative investors favor the predictability and asset-backed nature of ABS.

Connection

Structured credit involves pooling various debt instruments, and asset-backed securities (ABS) are a key type of structured credit product created by securitizing assets such as loans or receivables. These securities convert illiquid assets into tradable instruments, enhancing liquidity and risk distribution for financial institutions. The connection lies in ABS being a primary vehicle through which structured credit markets facilitate capital flow and risk transfer.

Key Terms

Securitization

Asset-backed securities (ABS) are financial instruments backed by pools of underlying assets like loans, leases, or receivables, providing investors with cash flows derived from these assets. Structured credit involves the creation of complex financial products, including ABS, collateralized debt obligations (CDOs), and other securitized instruments designed to redistribute credit risk. Explore the intricacies of securitization to enhance your understanding of these sophisticated investment vehicles.

Tranches

Asset-backed securities (ABS) and structured credit products both utilize tranches to allocate risk and returns according to investor preferences, with ABS typically backed by pools of financial assets like loans or receivables. Structured credit extends beyond traditional ABS by incorporating complex derivatives and diverse asset classes, allowing for more tailored tranche structures with varying degrees of credit risk and maturity profiles. Explore in-depth analysis of tranche mechanisms and credit enhancements to better understand their impact on investment strategies.

Credit enhancement

Credit enhancement in asset-backed securities (ABS) involves techniques such as overcollateralization, reserve funds, and subordination to improve the creditworthiness of the issued securities, reducing default risk for investors. Structured credit broadly encompasses these mechanisms but also integrates complex derivatives and tranche structures to reallocate and manage risk across different investor classes. Explore our detailed analysis to understand how credit enhancement strategies impact risk and returns in ABS and structured credit markets.

Source and External Links

Asset-backed securities: Definition, types and examples - StoneX - Asset-backed securities (ABS) are pools of financial assets like auto loans, credit card receivables, and mortgages that are securitized and sold to investors, offering a way to turn illiquid assets into liquid securities with contractual obligations to pay returns.

The ABCs of Asset-Backed Securities (ABS) - Guggenheim Investments - ABS are financing vehicles backed by contracts on future cash flows from assets such as automobile loans, allowing customization of financing terms, and offering investors claims on specific assets rather than general corporate credit.

Asset-backed security - Wikipedia - ABS transform pools of illiquid financial assets into tradable securities through securitization and tranching, enabling loan originators to reduce risk and free capital, while investors receive securities with varied risk/return profiles backed by the underlying asset pool.

dowidth.com

dowidth.com