Risk parity portfolios distribute risk equally across asset classes, aiming to reduce portfolio volatility by balancing risk contributions rather than capital allocation. The Black-Litterman model combines investor views with market equilibrium to generate optimized asset allocation estimates, enhancing portfolio diversification and expected returns. Explore the detailed comparisons and applications of these portfolio strategies to improve your investment decisions.

Why it is important

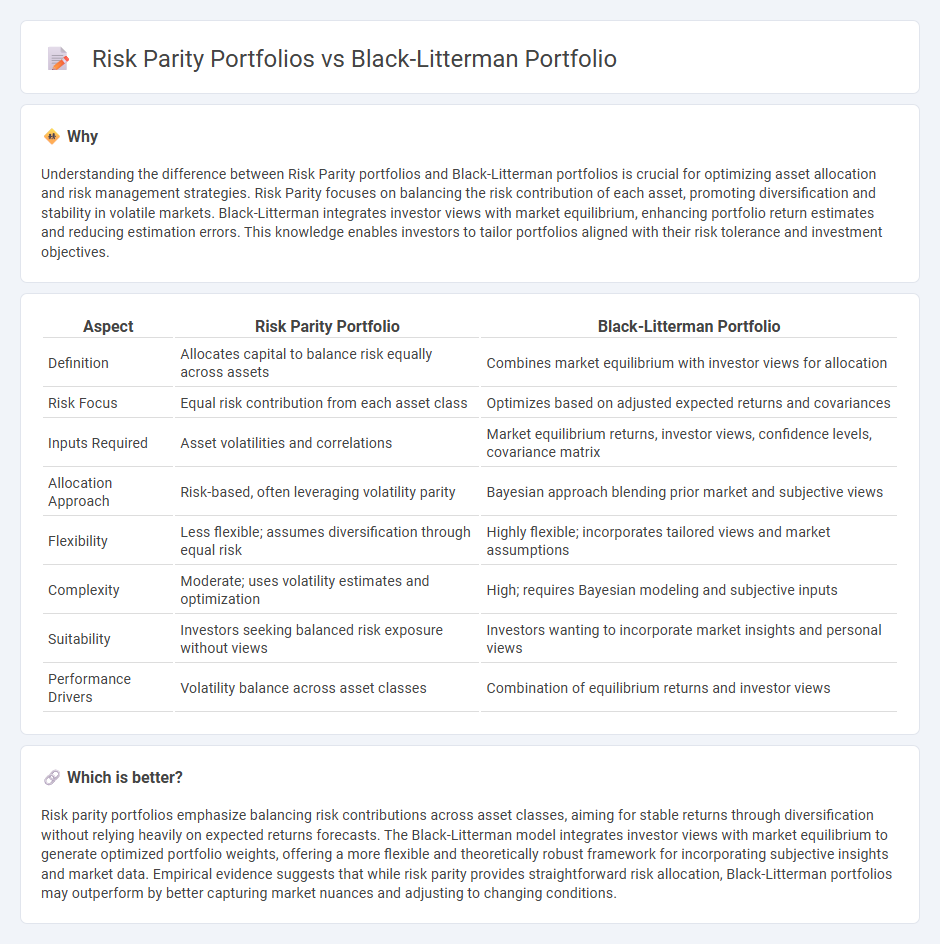

Understanding the difference between Risk Parity portfolios and Black-Litterman portfolios is crucial for optimizing asset allocation and risk management strategies. Risk Parity focuses on balancing the risk contribution of each asset, promoting diversification and stability in volatile markets. Black-Litterman integrates investor views with market equilibrium, enhancing portfolio return estimates and reducing estimation errors. This knowledge enables investors to tailor portfolios aligned with their risk tolerance and investment objectives.

Comparison Table

| Aspect | Risk Parity Portfolio | Black-Litterman Portfolio |

|---|---|---|

| Definition | Allocates capital to balance risk equally across assets | Combines market equilibrium with investor views for allocation |

| Risk Focus | Equal risk contribution from each asset class | Optimizes based on adjusted expected returns and covariances |

| Inputs Required | Asset volatilities and correlations | Market equilibrium returns, investor views, confidence levels, covariance matrix |

| Allocation Approach | Risk-based, often leveraging volatility parity | Bayesian approach blending prior market and subjective views |

| Flexibility | Less flexible; assumes diversification through equal risk | Highly flexible; incorporates tailored views and market assumptions |

| Complexity | Moderate; uses volatility estimates and optimization | High; requires Bayesian modeling and subjective inputs |

| Suitability | Investors seeking balanced risk exposure without views | Investors wanting to incorporate market insights and personal views |

| Performance Drivers | Volatility balance across asset classes | Combination of equilibrium returns and investor views |

Which is better?

Risk parity portfolios emphasize balancing risk contributions across asset classes, aiming for stable returns through diversification without relying heavily on expected returns forecasts. The Black-Litterman model integrates investor views with market equilibrium to generate optimized portfolio weights, offering a more flexible and theoretically robust framework for incorporating subjective insights and market data. Empirical evidence suggests that while risk parity provides straightforward risk allocation, Black-Litterman portfolios may outperform by better capturing market nuances and adjusting to changing conditions.

Connection

Risk parity portfolios focus on equalizing risk contributions across asset classes, providing diversified exposure based on volatility measures. The Black-Litterman model integrates investor views with market equilibrium to generate optimized asset allocations that balance expected returns and risks. Combining these approaches allows portfolio managers to incorporate subjective insights into a risk-balanced framework, enhancing diversification and potentially improving risk-adjusted returns.

Key Terms

Expected Returns

The Black-Litterman portfolio model integrates investor views with market equilibrium expected returns, providing more stable and diversified allocation by blending subjective insights and objective data. Risk parity portfolios focus on equalizing risk contributions across assets without explicitly forecasting expected returns, emphasizing balanced volatility rather than return expectations. Explore the nuances between these approaches to optimize portfolio construction and risk management strategies.

Covariance Matrix

The Black-Litterman model integrates investor views with a prior market equilibrium covariance matrix, enhancing portfolio optimization by adjusting asset weightings based on subjective forecasts while maintaining diversification. In contrast, Risk Parity portfolios emphasize equal risk contribution from each asset by utilizing the covariance matrix to balance volatility, often resulting in more stable allocation in varying market conditions. Discover how these covariance-driven approaches can refine your investment strategy.

Risk Allocation

Black-Litterman portfolio combines investor views with market equilibrium to generate optimized asset weights, emphasizing expected returns and covariance for balancing risk and reward. Risk parity portfolios allocate capital to equalize risk contributions across assets, focusing purely on risk allocation without predicting returns, often leading to diversified and stable portfolios. Discover how these approaches differ in risk allocation by exploring their methodologies and practical implications.

Source and External Links

Black-Litterman Model - Definition, Example, Formula, Pros ... - The Black-Litterman model, developed by Fisher Black and Robert Litterman in 1990, is an asset allocation tool that combines market equilibrium returns with investors' unique views to produce robust, stable, and efficient portfolio weightings that overcome the sensitivity problems of traditional mean-variance optimization.

Black-Litterman Allocation - PyPortfolioOpt - Read the Docs - The Black-Litterman model uses a Bayesian approach by blending a prior estimate of expected returns (market-implied) with investor views and confidences to create a posterior estimate of returns, leading to more stable portfolios than those based solely on historical returns.

Black-Litterman model - Developed at Goldman Sachs, the model starts with equilibrium market-based returns and adjusts these using investor views and confidence levels to provide a consistent and practical way to derive expected returns for portfolio optimization, addressing difficulties in estimating returns typically faced in modern portfolio theory.

dowidth.com

dowidth.com