Trader funding programs offer independent traders access to capital through profit-sharing agreements, focusing on short-term trading skills and performance metrics. Hedge funds pool capital from accredited investors to deploy diverse, often long-term strategies managed by professional portfolio managers aiming for risk-adjusted returns. Explore detailed comparisons to understand which funding model aligns best with your financial goals.

Why it is important

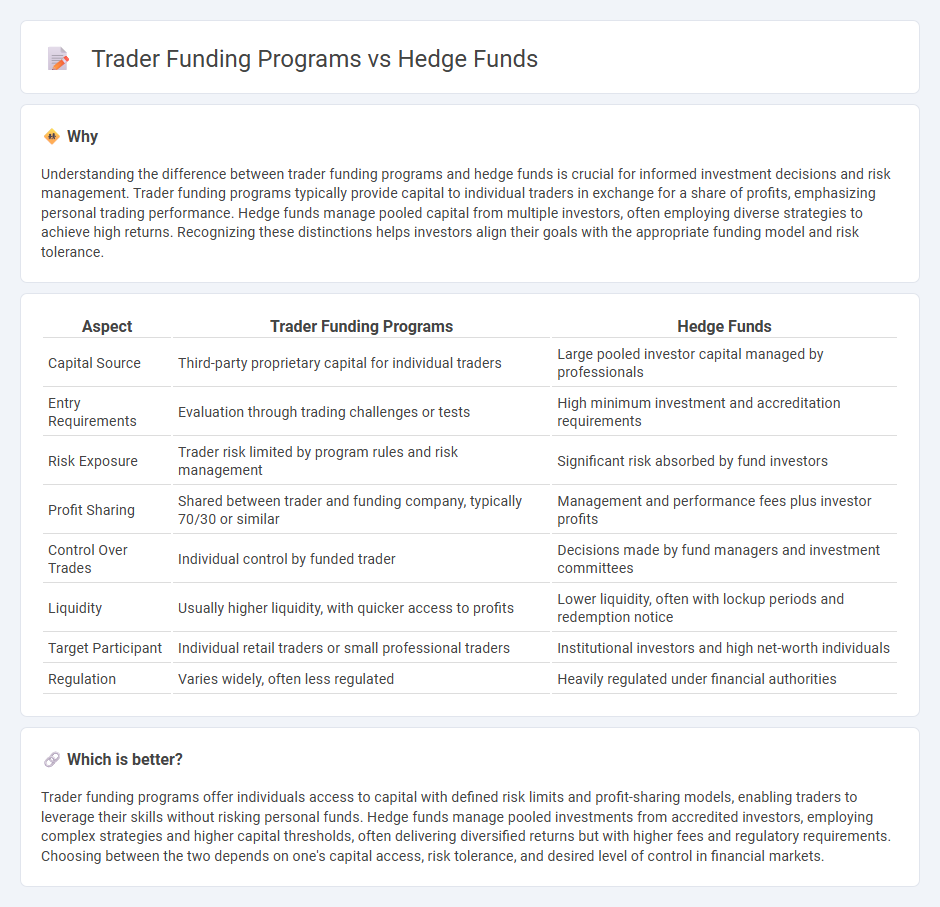

Understanding the difference between trader funding programs and hedge funds is crucial for informed investment decisions and risk management. Trader funding programs typically provide capital to individual traders in exchange for a share of profits, emphasizing personal trading performance. Hedge funds manage pooled capital from multiple investors, often employing diverse strategies to achieve high returns. Recognizing these distinctions helps investors align their goals with the appropriate funding model and risk tolerance.

Comparison Table

| Aspect | Trader Funding Programs | Hedge Funds |

|---|---|---|

| Capital Source | Third-party proprietary capital for individual traders | Large pooled investor capital managed by professionals |

| Entry Requirements | Evaluation through trading challenges or tests | High minimum investment and accreditation requirements |

| Risk Exposure | Trader risk limited by program rules and risk management | Significant risk absorbed by fund investors |

| Profit Sharing | Shared between trader and funding company, typically 70/30 or similar | Management and performance fees plus investor profits |

| Control Over Trades | Individual control by funded trader | Decisions made by fund managers and investment committees |

| Liquidity | Usually higher liquidity, with quicker access to profits | Lower liquidity, often with lockup periods and redemption notice |

| Target Participant | Individual retail traders or small professional traders | Institutional investors and high net-worth individuals |

| Regulation | Varies widely, often less regulated | Heavily regulated under financial authorities |

Which is better?

Trader funding programs offer individuals access to capital with defined risk limits and profit-sharing models, enabling traders to leverage their skills without risking personal funds. Hedge funds manage pooled investments from accredited investors, employing complex strategies and higher capital thresholds, often delivering diversified returns but with higher fees and regulatory requirements. Choosing between the two depends on one's capital access, risk tolerance, and desired level of control in financial markets.

Connection

Trader funding programs provide capital and risk management resources to skilled traders, enabling them to access larger market positions without risking personal funds. Hedge funds often collaborate with or invest in traders benefiting from these programs to enhance portfolio diversification and leverage specialized market strategies. This synergy allows hedge funds to optimize returns by harnessing the expertise and capital efficiency offered through trader funding initiatives.

Key Terms

Leverage

Hedge funds typically use leverage to amplify returns by borrowing capital, often achieving ratios between 2:1 to 5:1, based on sophisticated risk management models. Trader funding programs offer individual traders access to capital with fixed leverage limits, commonly ranging from 5:1 to 10:1, allowing for controlled risk exposure. Explore the nuances of leverage in hedge funds versus trader funding programs to optimize your trading strategy.

Risk Management

Hedge funds employ comprehensive risk management strategies, including diversification, leverage control, and sophisticated quantitative models to minimize exposure and protect investor capital. Trader funding programs often emphasize risk limits and profit-sharing arrangements, enabling aspiring traders to manage drawdowns while accessing capital. Explore our detailed analysis to understand how both approaches manage risk effectively and choose the best option for your trading goals.

Capital Structure

Hedge funds typically employ complex capital structures involving pooled investments from accredited investors, utilizing leverage and diversified asset allocations to maximize returns under regulated frameworks. Trader funding programs offer individual traders capital access with profit-sharing agreements, emphasizing flexible, performance-based funding without substantial upfront capital commitments. Explore the nuances of capital structures in these financial models to optimize your investment or trading strategy.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that raises capital from institutional and accredited investors to invest in financial assets using diverse strategies aiming for absolute returns rather than relative returns like mutual funds.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds that pool money from sophisticated investors and use more flexible and sometimes riskier investment strategies than mutual funds, often not subject to the regulatory protections mutual funds have.

Hedge fund - Wikipedia - Hedge funds use complex trading and risk management techniques, typically charging both a management fee (around 2%) and a performance fee (around 20%), and have grown to manage trillions in assets though they may contribute to systemic risk in financial crises due to leverage and herd behavior.

dowidth.com

dowidth.com