Hard rug pulls involve cryptocurrency projects where developers abruptly withdraw all funds, leaving investors with worthless tokens. Ponzi schemes rely on paying returns to earlier investors using the capital of new participants, rather than genuine profits, creating a cycle destined to collapse. Explore deeper insights into these financial frauds to protect your investments effectively.

Why it is important

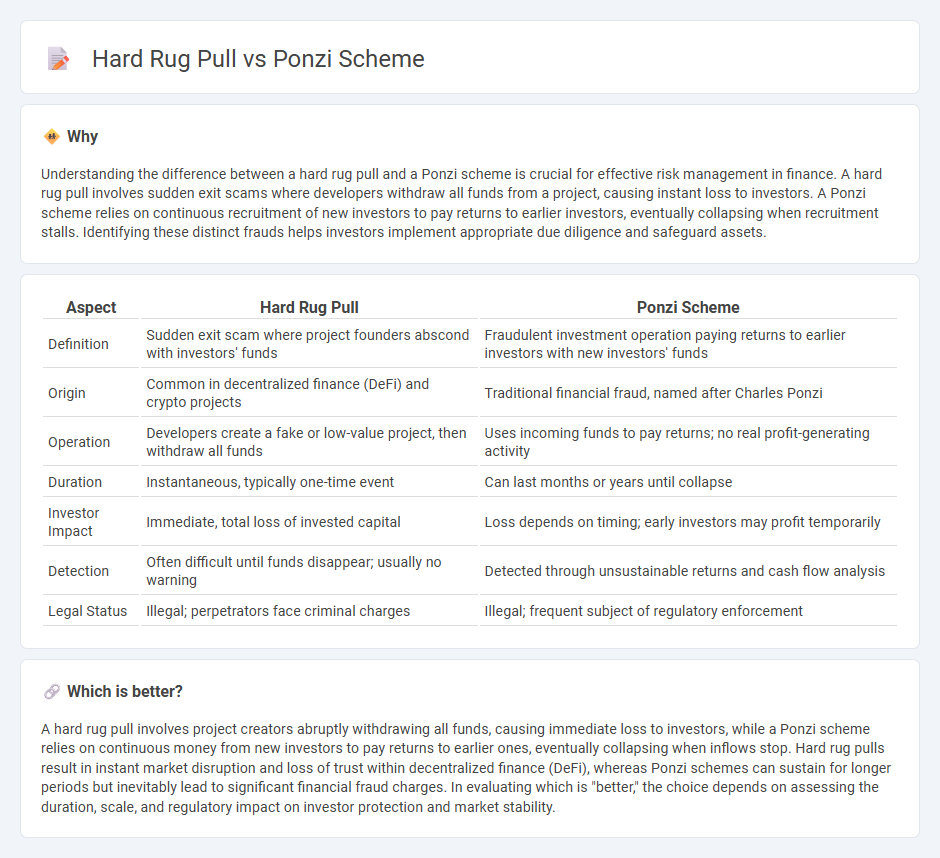

Understanding the difference between a hard rug pull and a Ponzi scheme is crucial for effective risk management in finance. A hard rug pull involves sudden exit scams where developers withdraw all funds from a project, causing instant loss to investors. A Ponzi scheme relies on continuous recruitment of new investors to pay returns to earlier investors, eventually collapsing when recruitment stalls. Identifying these distinct frauds helps investors implement appropriate due diligence and safeguard assets.

Comparison Table

| Aspect | Hard Rug Pull | Ponzi Scheme |

|---|---|---|

| Definition | Sudden exit scam where project founders abscond with investors' funds | Fraudulent investment operation paying returns to earlier investors with new investors' funds |

| Origin | Common in decentralized finance (DeFi) and crypto projects | Traditional financial fraud, named after Charles Ponzi |

| Operation | Developers create a fake or low-value project, then withdraw all funds | Uses incoming funds to pay returns; no real profit-generating activity |

| Duration | Instantaneous, typically one-time event | Can last months or years until collapse |

| Investor Impact | Immediate, total loss of invested capital | Loss depends on timing; early investors may profit temporarily |

| Detection | Often difficult until funds disappear; usually no warning | Detected through unsustainable returns and cash flow analysis |

| Legal Status | Illegal; perpetrators face criminal charges | Illegal; frequent subject of regulatory enforcement |

Which is better?

A hard rug pull involves project creators abruptly withdrawing all funds, causing immediate loss to investors, while a Ponzi scheme relies on continuous money from new investors to pay returns to earlier ones, eventually collapsing when inflows stop. Hard rug pulls result in instant market disruption and loss of trust within decentralized finance (DeFi), whereas Ponzi schemes can sustain for longer periods but inevitably lead to significant financial fraud charges. In evaluating which is "better," the choice depends on assessing the duration, scale, and regulatory impact on investor protection and market stability.

Connection

Rug pulls and Ponzi schemes are both deceptive financial frauds that exploit investor trust in cryptocurrencies and investment platforms. Rug pulls abruptly withdraw liquidity from a crypto project, causing token values to collapse, while Ponzi schemes use funds from new investors to pay returns to earlier investors, creating a false sense of profitability. Both schemes rely on manipulation and false promises, leading to significant financial losses for unsuspecting participants.

Key Terms

Fraud

Ponzi schemes exploit new investors' funds to pay returns to earlier investors, creating an illusion of profitability while lacking genuine business activity. Hard rug pulls involve malicious developers abruptly withdrawing all liquidity from a decentralized finance (DeFi) project, causing token value to plummet and investors to lose their capital instantly. Explore detailed comparisons to understand how these fraudulent practices impact the crypto ecosystem.

Investor funds

Investor funds in a Ponzi scheme are continuously recycled to pay returns to earlier investors, creating a facade of profitability without actual profit-generating activities. In a hard rug pull, founders or developers abruptly withdraw all investor funds, leaving the project and investors with significant losses and no recovery options. Explore more to understand the critical differences and protect your investments effectively.

Exit strategy

Ponzi schemes primarily rely on a continuous influx of new investors to pay returns to earlier participants, with the exit strategy centered on organizers absconding once recruitment slows. Hard rug pulls occur when developers abruptly withdraw all funds from a project's liquidity pool, leaving investors with worthless tokens and no recourse. Explore detailed distinctions and warning signs to safeguard your investments effectively.

Source and External Links

Ponzi scheme - Wikipedia - A Ponzi scheme is a form of fraud that pays profits to earlier investors with funds from newer investors, creating the illusion of a sustainable business, named after Charles Ponzi who popularized this scam in the 1920s.

Ponzi Schemes | Investor.gov - Ponzi schemes are investment frauds that pay returns to existing investors from funds collected from new investors, often promising high returns with little or no risk, and collapse when new investments dry up.

Ponzi Schemes - FAU College of Business - Ponzi schemes create the illusion of a profitable business by using money from new investors to pay earlier investors, ultimately failing when new investor recruitment slows or large numbers demand their money back.

dowidth.com

dowidth.com