Fractional shares enable investors to buy partial ownership of expensive stocks, making diversification accessible with limited capital, while Dividend Reinvestment Plans (DRIPs) automatically use dividends to purchase additional shares, compounding investment growth over time. Both strategies maximize portfolio efficiency and growth potential through reinvestment and lower entry barriers. Explore these investment tools to enhance your financial strategy and optimize returns.

Why it is important

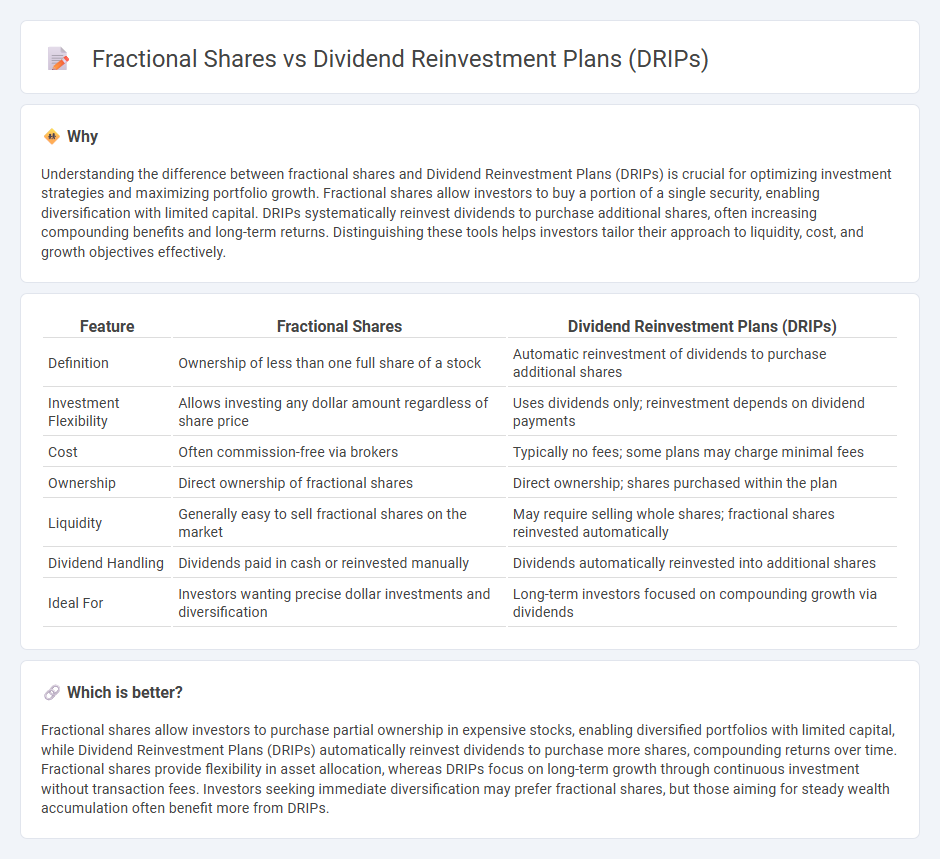

Understanding the difference between fractional shares and Dividend Reinvestment Plans (DRIPs) is crucial for optimizing investment strategies and maximizing portfolio growth. Fractional shares allow investors to buy a portion of a single security, enabling diversification with limited capital. DRIPs systematically reinvest dividends to purchase additional shares, often increasing compounding benefits and long-term returns. Distinguishing these tools helps investors tailor their approach to liquidity, cost, and growth objectives effectively.

Comparison Table

| Feature | Fractional Shares | Dividend Reinvestment Plans (DRIPs) |

|---|---|---|

| Definition | Ownership of less than one full share of a stock | Automatic reinvestment of dividends to purchase additional shares |

| Investment Flexibility | Allows investing any dollar amount regardless of share price | Uses dividends only; reinvestment depends on dividend payments |

| Cost | Often commission-free via brokers | Typically no fees; some plans may charge minimal fees |

| Ownership | Direct ownership of fractional shares | Direct ownership; shares purchased within the plan |

| Liquidity | Generally easy to sell fractional shares on the market | May require selling whole shares; fractional shares reinvested automatically |

| Dividend Handling | Dividends paid in cash or reinvested manually | Dividends automatically reinvested into additional shares |

| Ideal For | Investors wanting precise dollar investments and diversification | Long-term investors focused on compounding growth via dividends |

Which is better?

Fractional shares allow investors to purchase partial ownership in expensive stocks, enabling diversified portfolios with limited capital, while Dividend Reinvestment Plans (DRIPs) automatically reinvest dividends to purchase more shares, compounding returns over time. Fractional shares provide flexibility in asset allocation, whereas DRIPs focus on long-term growth through continuous investment without transaction fees. Investors seeking immediate diversification may prefer fractional shares, but those aiming for steady wealth accumulation often benefit more from DRIPs.

Connection

Fractional shares enable investors to purchase partial shares, making it easier to participate in Dividend Reinvestment Plans (DRIPs), where dividends are automatically used to buy more shares. DRIPs maximize compounding by reinvesting dividends into additional fractional shares, increasing the total investment value over time. This connection allows investors to grow their portfolios continuously, even with small dividend payments.

Key Terms

Automatic Reinvestment

Dividend reinvestment plans (DRIPs) enable investors to automatically reinvest dividends into additional shares, often without commission fees, promoting compound growth over time. Fractional share investing allows purchasing portions of shares, enhancing portfolio diversification even with limited capital, but may not always offer automatic dividend reinvestment. Explore the nuances between DRIPs and fractional shares to optimize your investment strategy.

Partial Share Ownership

Dividend Reinvestment Plans (DRIPs) enable investors to automatically reinvest dividends into additional shares, often allowing partial share ownership without brokerage fees. Fractional shares also provide access to partial ownership by enabling investors to purchase less than one full share, increasing portfolio diversity with smaller capital. Explore how each option can enhance your investment strategy through deeper insights.

Compounding Returns

Dividend reinvestment plans (DRIPs) maximize compounding returns by automatically reinvesting dividends into additional shares, often without commission fees, ensuring continuous growth of investment holdings. Fractional shares allow investors to buy precise portions of shares, enabling consistent reinvestment of dividends and smaller initial investments, which also supports compounding by accumulating ownership over time. Explore how each strategy enhances portfolio growth and long-term wealth accumulation.

Source and External Links

How a Dividend Reinvestment Plan Works - Charles Schwab - A Dividend Reinvestment Plan (DRIP) automatically reinvests dividends into additional shares of the company's stock, helping investors potentially grow their portfolio through compounding returns without commission fees, though dividends reinvested are still taxable events.

Dividend Reinvestment Plan (DRIP) - Corporate Finance Institute - A DRIP allows shareholders to automatically reinvest cash dividends into additional shares, often commission-free and sometimes at a discount, with plans operated by companies, third parties, or brokers.

Dividend Reinvestment Plans: What They Are and How They Work - DRIPs can be set up either directly with the company offering the plan or through brokerage accounts, enabling automatic reinvestment of dividends to accumulate more shares without requiring a brokerage account when using direct company plans.

dowidth.com

dowidth.com