Tokenization transforms physical assets into digital tokens on blockchain platforms, enabling seamless trading and increased liquidity within financial markets. Fractional ownership divides an asset into smaller shares, allowing multiple investors to hold portions without transferring the entire title. Explore deeper insights on how tokenization and fractional ownership are reshaping investment strategies today.

Why it is important

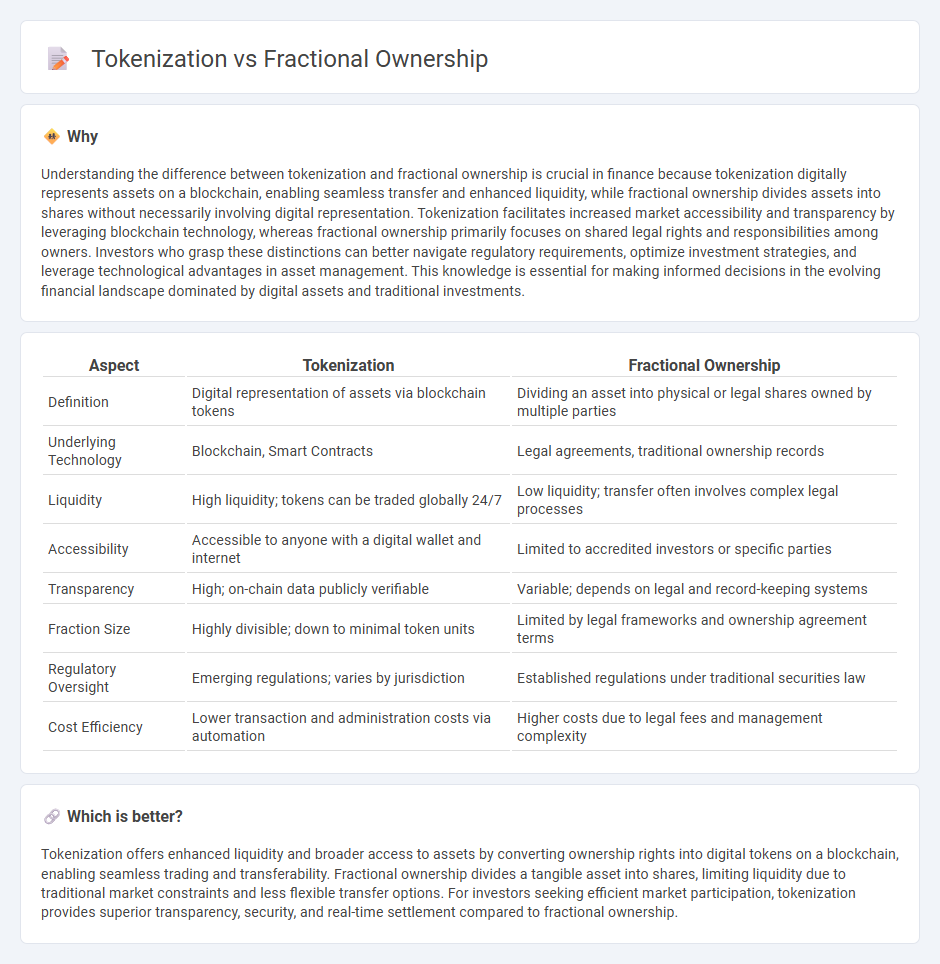

Understanding the difference between tokenization and fractional ownership is crucial in finance because tokenization digitally represents assets on a blockchain, enabling seamless transfer and enhanced liquidity, while fractional ownership divides assets into shares without necessarily involving digital representation. Tokenization facilitates increased market accessibility and transparency by leveraging blockchain technology, whereas fractional ownership primarily focuses on shared legal rights and responsibilities among owners. Investors who grasp these distinctions can better navigate regulatory requirements, optimize investment strategies, and leverage technological advantages in asset management. This knowledge is essential for making informed decisions in the evolving financial landscape dominated by digital assets and traditional investments.

Comparison Table

| Aspect | Tokenization | Fractional Ownership |

|---|---|---|

| Definition | Digital representation of assets via blockchain tokens | Dividing an asset into physical or legal shares owned by multiple parties |

| Underlying Technology | Blockchain, Smart Contracts | Legal agreements, traditional ownership records |

| Liquidity | High liquidity; tokens can be traded globally 24/7 | Low liquidity; transfer often involves complex legal processes |

| Accessibility | Accessible to anyone with a digital wallet and internet | Limited to accredited investors or specific parties |

| Transparency | High; on-chain data publicly verifiable | Variable; depends on legal and record-keeping systems |

| Fraction Size | Highly divisible; down to minimal token units | Limited by legal frameworks and ownership agreement terms |

| Regulatory Oversight | Emerging regulations; varies by jurisdiction | Established regulations under traditional securities law |

| Cost Efficiency | Lower transaction and administration costs via automation | Higher costs due to legal fees and management complexity |

Which is better?

Tokenization offers enhanced liquidity and broader access to assets by converting ownership rights into digital tokens on a blockchain, enabling seamless trading and transferability. Fractional ownership divides a tangible asset into shares, limiting liquidity due to traditional market constraints and less flexible transfer options. For investors seeking efficient market participation, tokenization provides superior transparency, security, and real-time settlement compared to fractional ownership.

Connection

Tokenization transforms physical and digital assets into blockchain-based tokens, enabling fractional ownership by dividing assets into smaller, tradable units. This process increases liquidity in traditionally illiquid markets like real estate and art by allowing investors to buy partial stakes. Smart contracts automate transactions and ensure transparency, fostering trust and reducing barriers to entry in finance.

Key Terms

Divisibility

Fractional ownership allows multiple investors to hold shares in a physical asset, typically divided into large, indivisible units, which can limit flexibility in trading and liquidity. Tokenization leverages blockchain technology to break assets into highly divisible digital tokens, enabling micro-investments and seamless transfer of ownership fractions in real-time. Explore how tokenization's enhanced divisibility transforms asset accessibility and investment strategies.

Liquidity

Fractional ownership allows investors to buy shares of high-value assets, while tokenization converts asset rights into blockchain-based digital tokens, offering enhanced liquidity through faster and more transparent trading. Tokenized assets benefit from 24/7 markets and programmable smart contracts that automate transactions and reduce intermediaries, increasing market accessibility. Explore how tokenization reshapes liquidity in asset investment to unlock new opportunities.

Asset Representation

Fractional ownership divides a tangible asset into legally recognized shares, allowing multiple investors to hold proportional stakes, while tokenization converts asset rights into digital tokens on a blockchain, enhancing liquidity and enabling seamless transfers. Tokenization also offers greater transparency, automatic enforcement of smart contracts, and broader access to global markets compared to traditional fractional ownership. Discover how these innovative methods transform asset representation and investment opportunities.

Source and External Links

Fractional ownership - Wikipedia - Fractional ownership allows multiple unrelated parties to share the costs and benefits of owning a high-value asset, such as a jet, yacht, or resort property, with each owner receiving a defined amount of access and sharing in maintenance and management responsibilities.

The Definitive Guide to Fractional Ownership - Through a fractional ownership agreement, two or more individuals co-own a property (such as a vacation home), each holding a deeded, freehold share that determines usage time and proportional responsibility for upkeep and costs, often managed by a professional company.

Fractional Ownership - Answers To Frequently Asked Questions - Fractional ownership typically describes shared, timed usage rights to a vacation or resort property, with arrangements varying from single homes to multi-unit developments, and is distinguished from traditional timeshares by actual deeded ownership and the ability to sell or will the share.

dowidth.com

dowidth.com