Climate-linked derivatives specifically address long-term climate risks by allowing companies to hedge against changes in temperature, precipitation, and other climate variables that impact business operations over years or decades. Weather derivatives focus on short-term weather fluctuations such as daily temperature or rainfall variations, providing financial protection against immediate weather-related losses. Explore how these financial instruments mitigate environmental risks and support strategic planning.

Why it is important

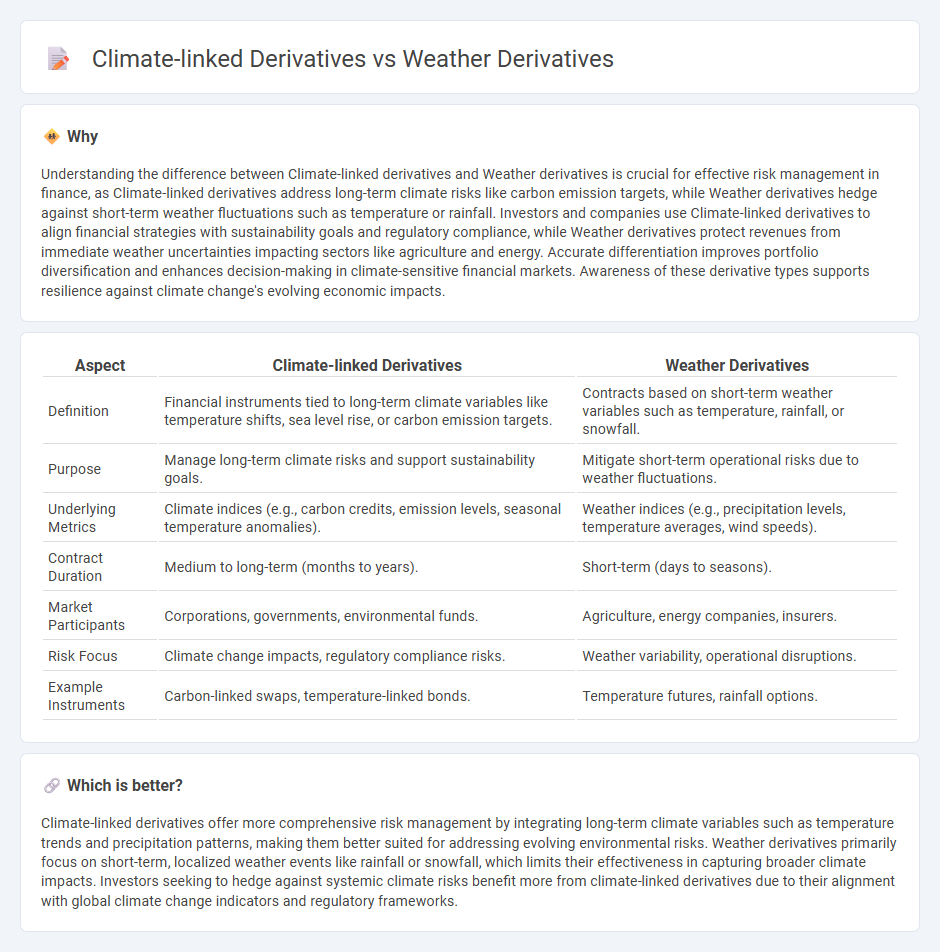

Understanding the difference between Climate-linked derivatives and Weather derivatives is crucial for effective risk management in finance, as Climate-linked derivatives address long-term climate risks like carbon emission targets, while Weather derivatives hedge against short-term weather fluctuations such as temperature or rainfall. Investors and companies use Climate-linked derivatives to align financial strategies with sustainability goals and regulatory compliance, while Weather derivatives protect revenues from immediate weather uncertainties impacting sectors like agriculture and energy. Accurate differentiation improves portfolio diversification and enhances decision-making in climate-sensitive financial markets. Awareness of these derivative types supports resilience against climate change's evolving economic impacts.

Comparison Table

| Aspect | Climate-linked Derivatives | Weather Derivatives |

|---|---|---|

| Definition | Financial instruments tied to long-term climate variables like temperature shifts, sea level rise, or carbon emission targets. | Contracts based on short-term weather variables such as temperature, rainfall, or snowfall. |

| Purpose | Manage long-term climate risks and support sustainability goals. | Mitigate short-term operational risks due to weather fluctuations. |

| Underlying Metrics | Climate indices (e.g., carbon credits, emission levels, seasonal temperature anomalies). | Weather indices (e.g., precipitation levels, temperature averages, wind speeds). |

| Contract Duration | Medium to long-term (months to years). | Short-term (days to seasons). |

| Market Participants | Corporations, governments, environmental funds. | Agriculture, energy companies, insurers. |

| Risk Focus | Climate change impacts, regulatory compliance risks. | Weather variability, operational disruptions. |

| Example Instruments | Carbon-linked swaps, temperature-linked bonds. | Temperature futures, rainfall options. |

Which is better?

Climate-linked derivatives offer more comprehensive risk management by integrating long-term climate variables such as temperature trends and precipitation patterns, making them better suited for addressing evolving environmental risks. Weather derivatives primarily focus on short-term, localized weather events like rainfall or snowfall, which limits their effectiveness in capturing broader climate impacts. Investors seeking to hedge against systemic climate risks benefit more from climate-linked derivatives due to their alignment with global climate change indicators and regulatory frameworks.

Connection

Climate-linked derivatives and weather derivatives both serve as financial instruments designed to hedge risks associated with environmental variables affecting business performance. These derivatives derive their value from climate-related indices such as temperature, precipitation, or other meteorological conditions, enabling companies in agriculture, energy, and insurance sectors to manage exposure to climate variability. By quantifying weather-related risks, they facilitate more accurate financial planning and promote resilience against the economic impacts of climate change.

Key Terms

Hedging

Weather derivatives provide financial protection against short-term weather fluctuations such as temperature, rainfall, or wind, helping businesses mitigate risks in agriculture, energy, and retail sectors. Climate-linked derivatives, however, target long-term climate change impacts, offering hedging solutions against gradual shifts like rising sea levels and increased frequency of extreme events. Explore how these financial instruments can be strategically employed to safeguard your assets and operations against diverse environmental risks.

Payoff Structure

Weather derivatives typically feature payoff structures based on measurable meteorological variables such as temperature, rainfall, or snowfall indices, providing payouts when these variables deviate from predefined thresholds. Climate-linked derivatives extend this concept by incorporating broader and more complex climate risk factors including sea-level rise, extreme weather events, or carbon emission metrics, often resulting in multifaceted payoff mechanisms tied to long-term climate patterns. Explore the distinct payoff frameworks of these derivatives to better understand their risk management applications and market potential.

Risk Transfer

Weather derivatives provide financial protection against short-term weather fluctuations such as temperature, rainfall, or snowfall, enabling businesses to hedge operational risks tied to specific weather events. Climate-linked derivatives extend this concept by addressing longer-term climate change impacts, incorporating variables like rising sea levels or increased frequency of extreme weather patterns, thus offering broader risk transfer solutions. Explore the distinctions and applications of these instruments to enhance your risk management strategies.

Source and External Links

Weathering the Storm: The Rise of $25B Weather Derivatives Market - Weather derivatives are financial contracts that allow businesses to hedge against losses caused by varying weather conditions, such as excessive rain or high temperatures, with the market experiencing rapid growth due to increased climate volatility and demand from sectors like agriculture, energy, and tourism.

What are weather derivatives? - Artemis - Resource Library - Weather derivatives are used to manage financial risks from specific, measurable weather events--such as light snowfall for ski resorts or frost for farmers--by providing payouts based on predefined weather indices, with common types including heating and cooling degree day contracts.

Weather derivative - Wikipedia - These instruments are index-based, using observable weather data (like temperature or rainfall) to determine payouts, and their pricing often involves statistical or hybrid models that account for the unique, non-normal behavior of weather variables.

dowidth.com

dowidth.com