Tokenization transforms tangible assets or financial instruments into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity. Crowdfunding aggregates small investments from a large group of people to fund projects or ventures without issuing tradable tokens. Explore the distinct advantages and applications of tokenization and crowdfunding to optimize your investment strategy.

Why it is important

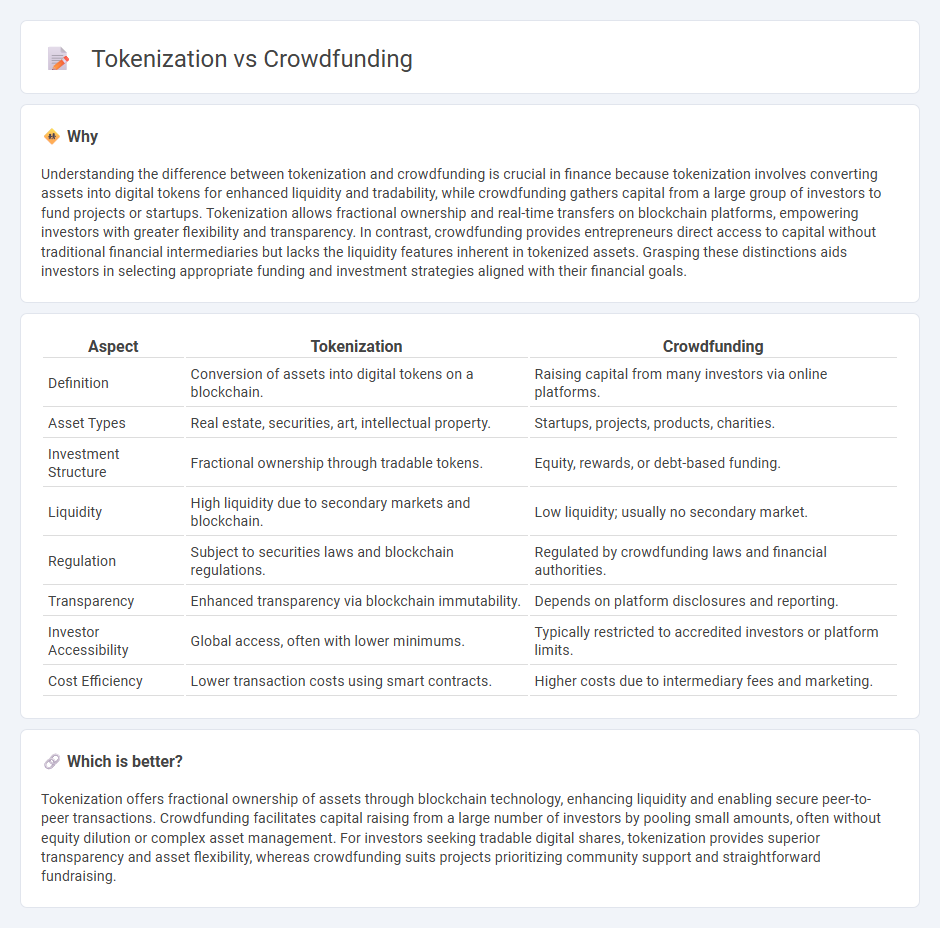

Understanding the difference between tokenization and crowdfunding is crucial in finance because tokenization involves converting assets into digital tokens for enhanced liquidity and tradability, while crowdfunding gathers capital from a large group of investors to fund projects or startups. Tokenization allows fractional ownership and real-time transfers on blockchain platforms, empowering investors with greater flexibility and transparency. In contrast, crowdfunding provides entrepreneurs direct access to capital without traditional financial intermediaries but lacks the liquidity features inherent in tokenized assets. Grasping these distinctions aids investors in selecting appropriate funding and investment strategies aligned with their financial goals.

Comparison Table

| Aspect | Tokenization | Crowdfunding |

|---|---|---|

| Definition | Conversion of assets into digital tokens on a blockchain. | Raising capital from many investors via online platforms. |

| Asset Types | Real estate, securities, art, intellectual property. | Startups, projects, products, charities. |

| Investment Structure | Fractional ownership through tradable tokens. | Equity, rewards, or debt-based funding. |

| Liquidity | High liquidity due to secondary markets and blockchain. | Low liquidity; usually no secondary market. |

| Regulation | Subject to securities laws and blockchain regulations. | Regulated by crowdfunding laws and financial authorities. |

| Transparency | Enhanced transparency via blockchain immutability. | Depends on platform disclosures and reporting. |

| Investor Accessibility | Global access, often with lower minimums. | Typically restricted to accredited investors or platform limits. |

| Cost Efficiency | Lower transaction costs using smart contracts. | Higher costs due to intermediary fees and marketing. |

Which is better?

Tokenization offers fractional ownership of assets through blockchain technology, enhancing liquidity and enabling secure peer-to-peer transactions. Crowdfunding facilitates capital raising from a large number of investors by pooling small amounts, often without equity dilution or complex asset management. For investors seeking tradable digital shares, tokenization provides superior transparency and asset flexibility, whereas crowdfunding suits projects prioritizing community support and straightforward fundraising.

Connection

Tokenization transforms tangible and intangible assets into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Crowdfunding leverages these tokens to democratize investment opportunities, allowing a broad base of contributors to fund projects with transparent, secure transactions. This synergy enhances access to capital markets by reducing barriers and fostering investor participation through decentralized platforms.

Key Terms

Capital Raising

Crowdfunding leverages small investments from a large number of backers to raise capital, often through platforms like Kickstarter or Indiegogo. Tokenization transforms assets into digital tokens on a blockchain, enabling fractional ownership and liquidity in capital raising efforts. Explore how these methods reshape fundraising strategies and investor engagement.

Ownership Representation

Crowdfunding enables multiple investors to pool funds for a project without direct ownership stakes, typically resulting in limited control or profit sharing. Tokenization converts ownership interests into digital tokens on a blockchain, offering fractional, transparent, and tradable shares that enhance liquidity and investor engagement. Explore the advantages of tokenization over crowdfunding to understand how digital ownership is transforming investment models.

Liquidity

Crowdfunding typically offers limited liquidity as investors often wait until the project's completion or exit event to realize returns, whereas tokenization enables fractional ownership with tokens that can be traded on secondary markets, enhancing liquidity. Tokenized assets provide continuous access to a broader pool of investors and faster transaction settlements, increasing market efficiency compared to traditional crowdfunding. Explore more about how tokenization revolutionizes liquidity in investment finance.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, involving a project initiator, supporters, and a moderating platform; it funds a wide range of ventures including creative projects and social entrepreneurship.

What is crowdfunding? Here are four types to know - Stripe - Crowdfunding is a popular way for startups to raise funding through collective efforts of a large pool of individuals online, enabling projects to be financed without relying on traditional funding sources.

Small Business Financing: A Resource Guide: Crowdfunding - Library of Congress - Crowdfunding uses online platforms to collect small amounts of money from many individuals and can be donation-based, rewards-based, or equity-based, allowing investors to support projects in exchange for rewards or ownership stakes.

dowidth.com

dowidth.com