Degen Box is a decentralized finance (DeFi) platform offering automated yield farming with leveraged positions, allowing users to maximize returns on crypto assets. Synthetic assets replicate the value of real-world assets such as stocks, commodities, or cryptocurrencies through smart contracts, enabling exposure without owning the underlying asset. Explore deeper to understand how these innovative financial instruments reshape investment strategies in the DeFi ecosystem.

Why it is important

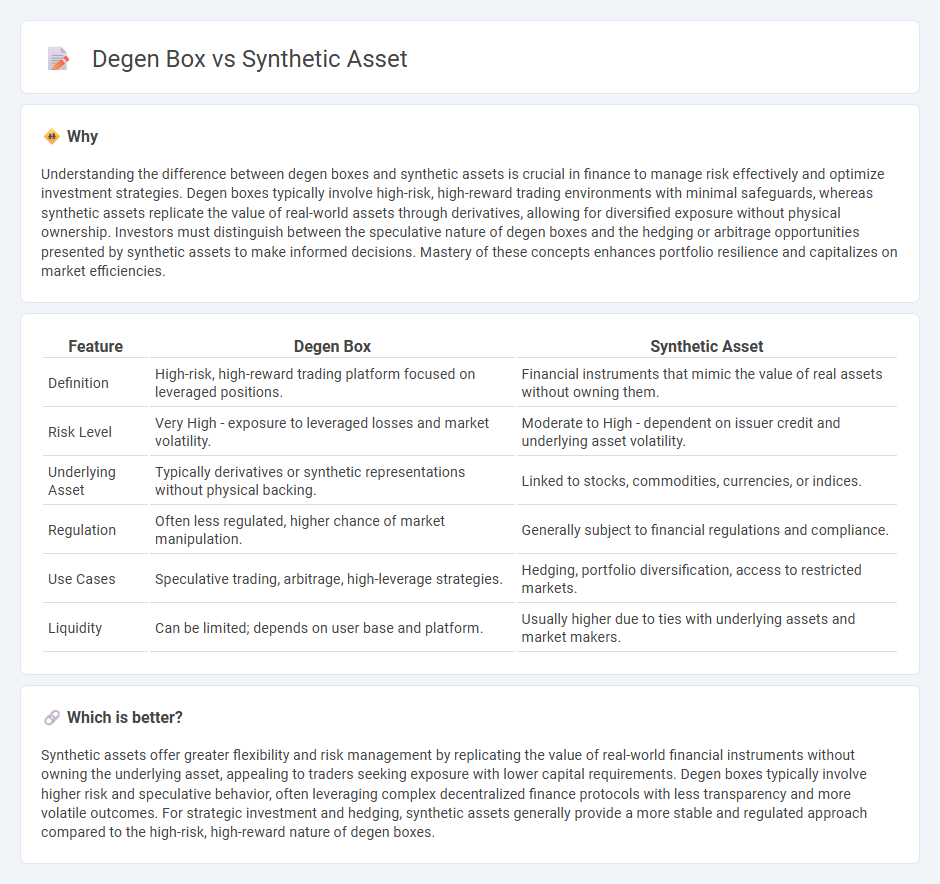

Understanding the difference between degen boxes and synthetic assets is crucial in finance to manage risk effectively and optimize investment strategies. Degen boxes typically involve high-risk, high-reward trading environments with minimal safeguards, whereas synthetic assets replicate the value of real-world assets through derivatives, allowing for diversified exposure without physical ownership. Investors must distinguish between the speculative nature of degen boxes and the hedging or arbitrage opportunities presented by synthetic assets to make informed decisions. Mastery of these concepts enhances portfolio resilience and capitalizes on market efficiencies.

Comparison Table

| Feature | Degen Box | Synthetic Asset |

|---|---|---|

| Definition | High-risk, high-reward trading platform focused on leveraged positions. | Financial instruments that mimic the value of real assets without owning them. |

| Risk Level | Very High - exposure to leveraged losses and market volatility. | Moderate to High - dependent on issuer credit and underlying asset volatility. |

| Underlying Asset | Typically derivatives or synthetic representations without physical backing. | Linked to stocks, commodities, currencies, or indices. |

| Regulation | Often less regulated, higher chance of market manipulation. | Generally subject to financial regulations and compliance. |

| Use Cases | Speculative trading, arbitrage, high-leverage strategies. | Hedging, portfolio diversification, access to restricted markets. |

| Liquidity | Can be limited; depends on user base and platform. | Usually higher due to ties with underlying assets and market makers. |

Which is better?

Synthetic assets offer greater flexibility and risk management by replicating the value of real-world financial instruments without owning the underlying asset, appealing to traders seeking exposure with lower capital requirements. Degen boxes typically involve higher risk and speculative behavior, often leveraging complex decentralized finance protocols with less transparency and more volatile outcomes. For strategic investment and hedging, synthetic assets generally provide a more stable and regulated approach compared to the high-risk, high-reward nature of degen boxes.

Connection

Degen boxes enable users to leverage synthetic assets by providing a platform for high-risk, high-reward trading strategies through decentralized finance protocols. Synthetic assets mirror the value of real-world financial instruments, allowing traders to gain exposure without owning the underlying asset. This connection drives liquidity and market accessibility, enhancing decentralized synthetic asset ecosystems in finance.

Key Terms

Leverage

Synthetic assets offer customizable leverage by replicating the price movements of underlying assets without owning them directly, allowing traders to gain exposure with reduced capital requirements. Degen boxes provide highly leveraged, often high-risk yield farming strategies within DeFi protocols, focusing on maximizing returns through complex derivatives and borrowing mechanisms. Explore our detailed comparison to understand which leverage strategy aligns best with your investment goals.

Collateral

Synthetic assets rely on overcollateralization, often using stablecoins or diversified token baskets to minimize liquidation risks and maintain price stability. The Degen Box optimizes capital efficiency by enabling users to lock minimal collateral, often volatile tokens, increasing leverage but also elevating liquidation risk. Explore how each collateral strategy impacts risk management and capital efficiency in decentralized finance.

Risk exposure

Synthetic assets offer controlled risk exposure by replicating real-world assets through decentralized finance, enabling users to hedge or speculate without direct ownership. In contrast, degen boxes involve high-risk, high-reward strategies typically associated with leveraged positions and volatile returns, often lacking formal risk management mechanisms. Explore deeper to understand which option aligns best with your risk tolerance and investment goals.

Source and External Links

Synthetic Asset - Coinmetro - Synthetic assets, or synths, are blockchain-based tokenized derivatives that mimic the value of assets like stocks, commodities, or currencies, allowing users to gain exposure without holding the actual assets by using smart contracts and cryptocurrency collateral.

Synthetic Asset Definition - CoinMarketCap - Synthetic assets are tokenized derivatives recorded on the blockchain that enable investors to trade assets' price movements securely and anonymously without owning the underlying assets, merging features of cryptocurrencies and traditional derivatives.

Unlocking Crypto Synthetic Assets: Explained - LCX - Crypto synthetic assets are digital financial instruments created through smart contracts and collateral on blockchain platforms that replicate real-world asset prices and allow decentralized access to diverse markets, though they carry complexity and risk.

dowidth.com

dowidth.com