A decentralized autonomous organization (DAO) treasury operates through blockchain-based governance, enabling transparent, community-driven management of digital assets, whereas private equity funds rely on centralized decision-making by professional managers investing in private companies. DAO treasuries offer real-time voting and automated smart contract execution, contrasting with the longer investment horizons and regulatory frameworks typical of private equity funds. Explore further to understand how these distinct financial structures shape investment strategies and risk management.

Why it is important

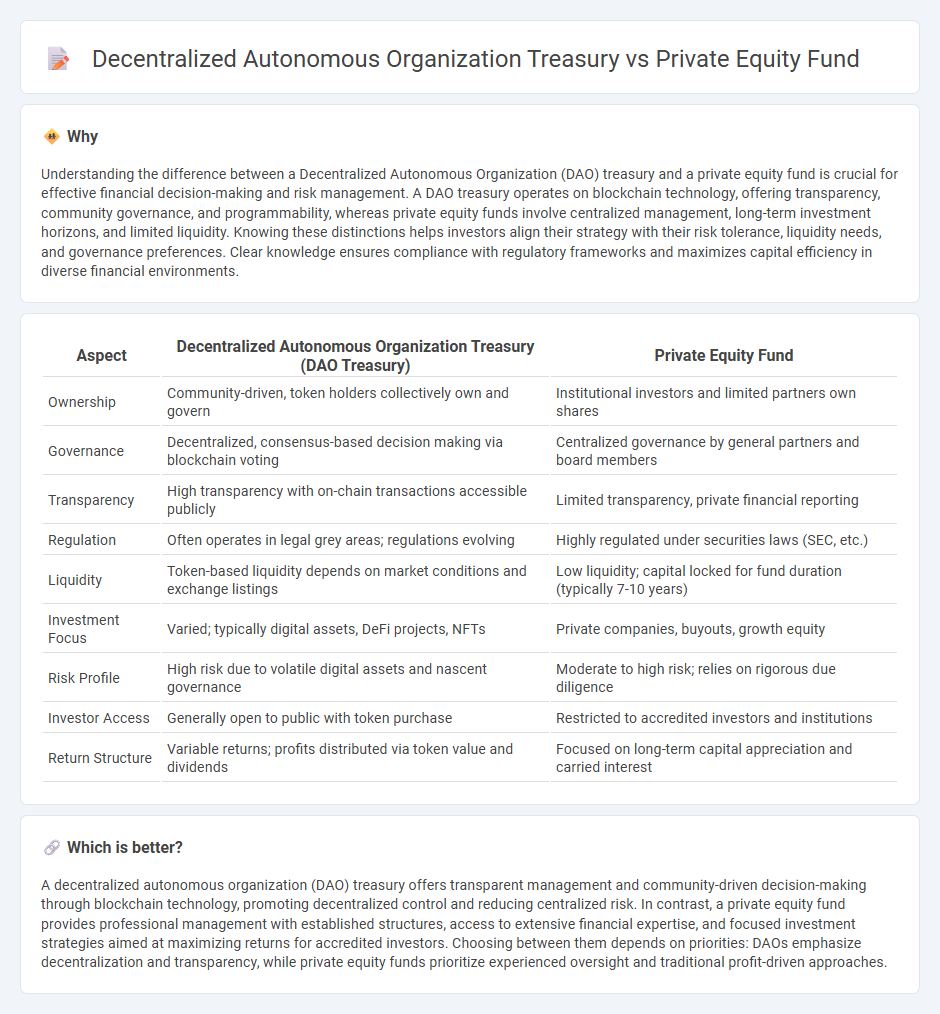

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a private equity fund is crucial for effective financial decision-making and risk management. A DAO treasury operates on blockchain technology, offering transparency, community governance, and programmability, whereas private equity funds involve centralized management, long-term investment horizons, and limited liquidity. Knowing these distinctions helps investors align their strategy with their risk tolerance, liquidity needs, and governance preferences. Clear knowledge ensures compliance with regulatory frameworks and maximizes capital efficiency in diverse financial environments.

Comparison Table

| Aspect | Decentralized Autonomous Organization Treasury (DAO Treasury) | Private Equity Fund |

|---|---|---|

| Ownership | Community-driven, token holders collectively own and govern | Institutional investors and limited partners own shares |

| Governance | Decentralized, consensus-based decision making via blockchain voting | Centralized governance by general partners and board members |

| Transparency | High transparency with on-chain transactions accessible publicly | Limited transparency, private financial reporting |

| Regulation | Often operates in legal grey areas; regulations evolving | Highly regulated under securities laws (SEC, etc.) |

| Liquidity | Token-based liquidity depends on market conditions and exchange listings | Low liquidity; capital locked for fund duration (typically 7-10 years) |

| Investment Focus | Varied; typically digital assets, DeFi projects, NFTs | Private companies, buyouts, growth equity |

| Risk Profile | High risk due to volatile digital assets and nascent governance | Moderate to high risk; relies on rigorous due diligence |

| Investor Access | Generally open to public with token purchase | Restricted to accredited investors and institutions |

| Return Structure | Variable returns; profits distributed via token value and dividends | Focused on long-term capital appreciation and carried interest |

Which is better?

A decentralized autonomous organization (DAO) treasury offers transparent management and community-driven decision-making through blockchain technology, promoting decentralized control and reducing centralized risk. In contrast, a private equity fund provides professional management with established structures, access to extensive financial expertise, and focused investment strategies aimed at maximizing returns for accredited investors. Choosing between them depends on priorities: DAOs emphasize decentralization and transparency, while private equity funds prioritize experienced oversight and traditional profit-driven approaches.

Connection

Decentralized autonomous organization (DAO) treasuries and private equity funds both manage pooled capital to finance ventures, with DAOs using blockchain technology for transparent, community-driven governance. DAO treasuries allocate digital assets through smart contracts, enabling decentralized investment decisions aligned with stakeholder interests, while private equity funds rely on centralized management teams for strategic capital deployment. The convergence occurs as some private equity funds adopt DAO frameworks to increase transparency and democratize investor participation in asset management.

Key Terms

Limited Partners (Private Equity Fund)

Limited Partners (LPs) in private equity funds commit capital to a managed pool with defined governance, primarily seeking capital appreciation through diversified investments and professional management. In contrast, decentralized autonomous organization (DAO) treasuries leverage blockchain technology, offering LP-like stakeholders a transparent, community-driven governance model with potentially higher liquidity but increased regulatory uncertainty. Explore the evolving roles and governance structures of LPs in private equity funds versus DAO treasuries to understand their implications for investors.

Smart Contracts (DAO Treasury)

Private equity funds operate through centralized management structures, focusing on direct investments and traditional financial instruments, whereas decentralized autonomous organization (DAO) treasuries utilize smart contracts to automate governance, fund allocation, and voting processes on blockchain platforms. Smart contracts in DAO treasuries enhance transparency, security, and efficiency by enabling real-time execution of financial transactions and governance decisions without intermediaries. Explore how smart contract integration within DAO treasuries revolutionizes asset management and investment strategies compared to private equity funds.

Governance Tokens (DAO Treasury)

Governance tokens in decentralized autonomous organization (DAO) treasuries enable community-driven decision-making and transparent fund management, contrasting with private equity funds that rely on centralized management and limited investor input. DAO treasuries leverage blockchain technology for real-time voting and proposals, enhancing liquidity and inclusivity compared to the traditional private equity structure. Explore deeper insights into how governance tokens revolutionize fund governance and investor engagement in the evolving financial ecosystem.

Source and External Links

Private equity fund - Wikipedia - A private equity fund is a collective investment scheme, usually structured as a limited partnership with a fixed term, used for making investments in equity and some debt securities, managed by a private equity firm acting as the general partner.

Private Equity Funds | Investor.gov - A private equity fund pools money from investors to make long-term investments in private companies, often taking controlling interests to improve and increase the value of the portfolio companies, with an investment horizon typically around 10 years or more.

How Private Equity Works: A Brief Explainer | Moonfare - Private equity funds are structured as limited partnerships where investors (limited partners) contribute capital managed by the general partner private equity firm, focusing on private company investments with potential tax benefits at the investor level.

dowidth.com

dowidth.com