Private credit involves direct lending to middle-market companies, offering tailored financing solutions outside traditional banks with higher yields and lower volatility. Distressed debt targets securities of companies undergoing financial or operational distress, presenting opportunities for significant returns through restructuring or turnaround strategies. Discover more about how these financing approaches differ and their strategic benefits in today's investment landscape.

Why it is important

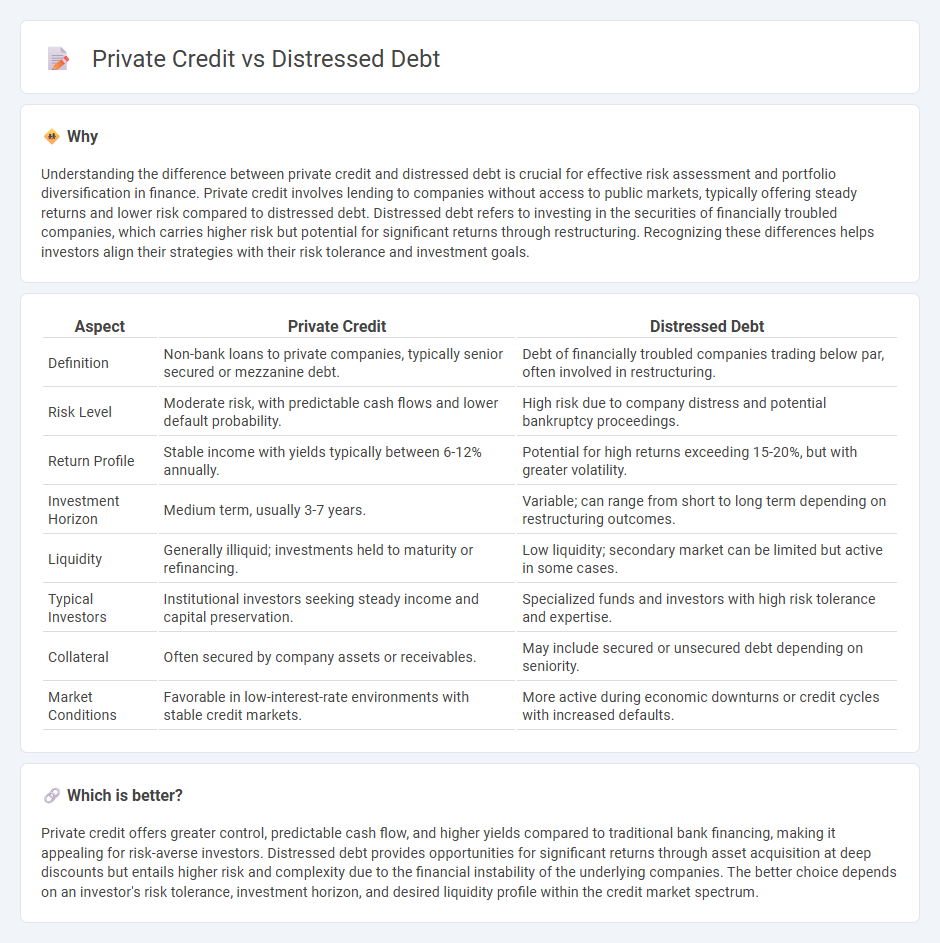

Understanding the difference between private credit and distressed debt is crucial for effective risk assessment and portfolio diversification in finance. Private credit involves lending to companies without access to public markets, typically offering steady returns and lower risk compared to distressed debt. Distressed debt refers to investing in the securities of financially troubled companies, which carries higher risk but potential for significant returns through restructuring. Recognizing these differences helps investors align their strategies with their risk tolerance and investment goals.

Comparison Table

| Aspect | Private Credit | Distressed Debt |

|---|---|---|

| Definition | Non-bank loans to private companies, typically senior secured or mezzanine debt. | Debt of financially troubled companies trading below par, often involved in restructuring. |

| Risk Level | Moderate risk, with predictable cash flows and lower default probability. | High risk due to company distress and potential bankruptcy proceedings. |

| Return Profile | Stable income with yields typically between 6-12% annually. | Potential for high returns exceeding 15-20%, but with greater volatility. |

| Investment Horizon | Medium term, usually 3-7 years. | Variable; can range from short to long term depending on restructuring outcomes. |

| Liquidity | Generally illiquid; investments held to maturity or refinancing. | Low liquidity; secondary market can be limited but active in some cases. |

| Typical Investors | Institutional investors seeking steady income and capital preservation. | Specialized funds and investors with high risk tolerance and expertise. |

| Collateral | Often secured by company assets or receivables. | May include secured or unsecured debt depending on seniority. |

| Market Conditions | Favorable in low-interest-rate environments with stable credit markets. | More active during economic downturns or credit cycles with increased defaults. |

Which is better?

Private credit offers greater control, predictable cash flow, and higher yields compared to traditional bank financing, making it appealing for risk-averse investors. Distressed debt provides opportunities for significant returns through asset acquisition at deep discounts but entails higher risk and complexity due to the financial instability of the underlying companies. The better choice depends on an investor's risk tolerance, investment horizon, and desired liquidity profile within the credit market spectrum.

Connection

Private credit and distressed debt are interconnected through their focus on non-investment grade borrowers and complex financial situations. Private credit often provides direct loans to companies facing financial distress, while distressed debt involves purchasing securities of companies experiencing or nearing default. Investors leverage private credit strategies to gain exposure to distressed debt opportunities, aiming for higher yields amid elevated risk.

Key Terms

Credit Risk

Distressed debt involves investing in the securities of companies experiencing financial distress or bankruptcy, carrying higher default risk but potential for significant returns through restructuring. Private credit refers to non-bank loans given to companies, typically with bespoke covenants and higher priority in capital structure, offering more controlled credit risk profiles. Explore the nuances of credit risk exposure in distressed debt and private credit to optimize your investment strategy.

Recovery Rate

Distressed debt typically offers higher recovery rates due to its negotiation in default scenarios, often resulting in substantial asset-backed returns for investors. Private credit, while generally providing more stable income streams, tends to have moderate recovery rates influenced by seniority and covenant protections within loan agreements. Explore detailed analyses on recovery metrics to optimize investment strategies in these credit instruments.

Illiquidity Premium

Distressed debt often carries a higher illiquidity premium compared to private credit due to the securities being associated with companies undergoing financial distress, resulting in limited trading opportunities and higher risk. Private credit, typically involving direct loans to middle-market companies, offers some liquidity advantages but still commands an illiquidity premium relative to public debt markets due to longer lock-up periods and less secondary market activity. Explore further to understand the intricacies of illiquidity premiums across these asset classes and their impact on investment returns.

Source and External Links

Distressed Debt Investing: Definition & Strategies - Distressed debt refers to securities of corporate or government entities in financial distress, often with credit ratings of CCC or lower, and are sold at substantial discounts to investors who aim to increase their value.

What is Distressed Debt Investing? - Distressed debt is debt held by organizations unable to refinance or meet debt obligations, offering investors potential high returns by buying at discounts and possibly restructuring or benefiting from bankruptcy payouts.

What Is Distressed Debt Investing? - This high-risk, high-reward strategy involves purchasing troubled companies' debt to control restructuring or benefit from bankruptcy asset liquidation where debt holders are prioritized over equity holders.

dowidth.com

dowidth.com