Degen Box and Yield Farming represent two distinct strategies in decentralized finance (DeFi) with unique risk and reward profiles. Degen Box involves leveraging highly volatile assets through automated lending and borrowing protocols, maximizing capital efficiency but increasing exposure to liquidation risks. Explore these innovative methods to optimize your DeFi investments and understand their implications on portfolio performance.

Why it is important

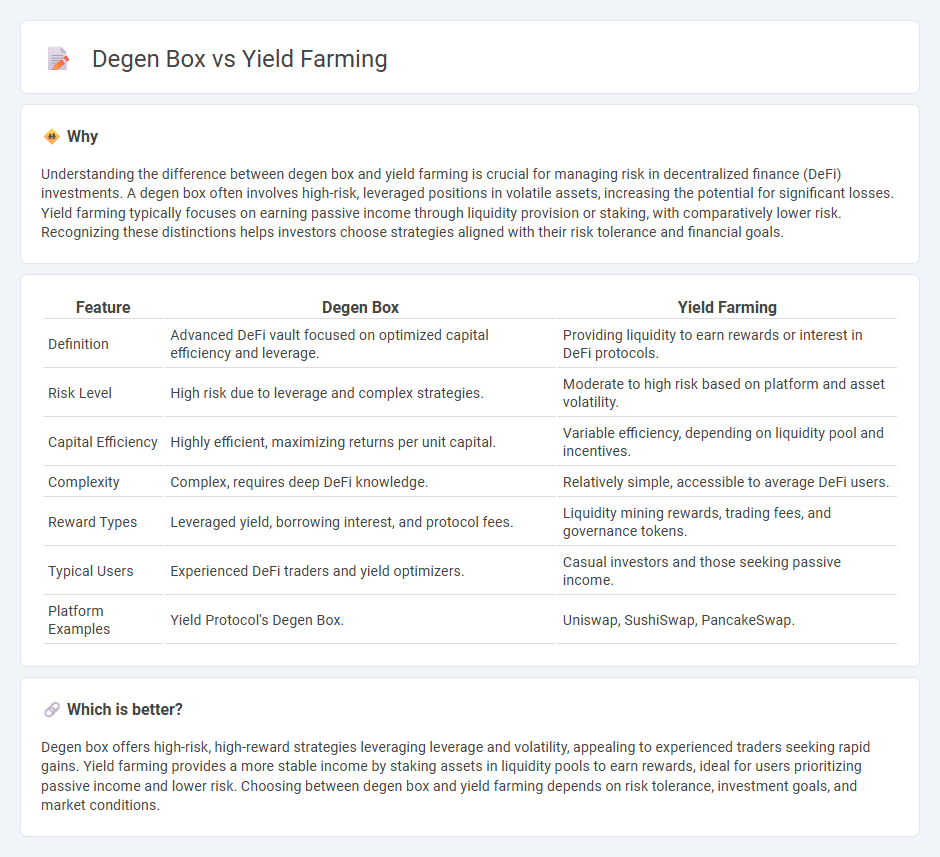

Understanding the difference between degen box and yield farming is crucial for managing risk in decentralized finance (DeFi) investments. A degen box often involves high-risk, leveraged positions in volatile assets, increasing the potential for significant losses. Yield farming typically focuses on earning passive income through liquidity provision or staking, with comparatively lower risk. Recognizing these distinctions helps investors choose strategies aligned with their risk tolerance and financial goals.

Comparison Table

| Feature | Degen Box | Yield Farming |

|---|---|---|

| Definition | Advanced DeFi vault focused on optimized capital efficiency and leverage. | Providing liquidity to earn rewards or interest in DeFi protocols. |

| Risk Level | High risk due to leverage and complex strategies. | Moderate to high risk based on platform and asset volatility. |

| Capital Efficiency | Highly efficient, maximizing returns per unit capital. | Variable efficiency, depending on liquidity pool and incentives. |

| Complexity | Complex, requires deep DeFi knowledge. | Relatively simple, accessible to average DeFi users. |

| Reward Types | Leveraged yield, borrowing interest, and protocol fees. | Liquidity mining rewards, trading fees, and governance tokens. |

| Typical Users | Experienced DeFi traders and yield optimizers. | Casual investors and those seeking passive income. |

| Platform Examples | Yield Protocol's Degen Box. | Uniswap, SushiSwap, PancakeSwap. |

Which is better?

Degen box offers high-risk, high-reward strategies leveraging leverage and volatility, appealing to experienced traders seeking rapid gains. Yield farming provides a more stable income by staking assets in liquidity pools to earn rewards, ideal for users prioritizing passive income and lower risk. Choosing between degen box and yield farming depends on risk tolerance, investment goals, and market conditions.

Connection

Degen box, a decentralized finance (DeFi) protocol, facilitates yield farming by enabling users to leverage their crypto assets for maximizing returns through liquidity provision and automated strategies. Yield farming involves staking or lending tokens in DeFi platforms like Degen box to earn interest or rewards, often in the form of governance tokens or fees. This symbiotic relationship enhances capital efficiency and incentivizes participation in yield-generating ecosystems within decentralized finance.

Key Terms

Liquidity Pools

Yield farming involves providing liquidity to decentralized finance (DeFi) platforms by depositing assets into liquidity pools to earn rewards, often through fees and native tokens. In contrast, the Degen Box is a specialized, high-risk yield strategy platform designed for experienced users to leverage positions within particular liquidity pools for amplified returns. Explore the nuances and risks of each to optimize your DeFi investment strategy.

Leverage

Yield farming leverages capital by providing liquidity to decentralized finance (DeFi) protocols, earning rewards in the form of interest or tokens. Degen Box amplifies leverage through multifunctional vaults that combine lending, borrowing, and yield strategies, enabling users to optimize returns with higher risk exposure. Explore how these mechanisms redefine leverage dynamics in DeFi to maximize your investment strategies.

Risk Exposure

Yield farming offers varied risk exposure based on the liquidity pools and tokens involved, often balancing returns against smart contract vulnerabilities and market volatility. Degen Box strategies typically present higher risk due to leveraging and concentrated positions in highly speculative assets, increasing potential for significant losses. Explore detailed comparisons to better understand risk profiles and optimize your DeFi investment approach.

Source and External Links

What Is Yield Farming? Meaning and Definition - Chainlink - Yield farming, also known as liquidity mining, is a DeFi practice that rewards users with tokens proportional to their liquidity deposits in a protocol, aiming to bootstrap liquidity and distribute governance tokens fairly, thereby incentivizing participation and value provision on decentralized platforms.

What is yield farming and how does it work? - Coinbase - Yield farming involves allocating digital assets into a DeFi protocol's liquidity pool to earn rewards, typically in governance tokens, which incentivizes protocol usage and liquidity provision but comes with risks such as impermanent loss and smart contract vulnerabilities.

Yield Farming in DeFi Explained: Possibilities, Risks & Strategies - Yield farming is evolving towards sustainable, real-yield rewards generated from actual platform revenue rather than inflationary token emissions, with new trends such as AI-driven strategies, regulatory frameworks, and crosschain interoperability shaping its future development in decentralized finance.

dowidth.com

dowidth.com