Private credit offers direct lending solutions where non-bank entities provide customized loans to companies, often with greater flexibility in terms and covenants. Syndicated loans involve multiple financial institutions pooling resources to fund large-scale corporate borrowing, distributing risk among participants. Explore the nuances of private credit versus syndicated loans to understand which financing option aligns best with your business strategy.

Why it is important

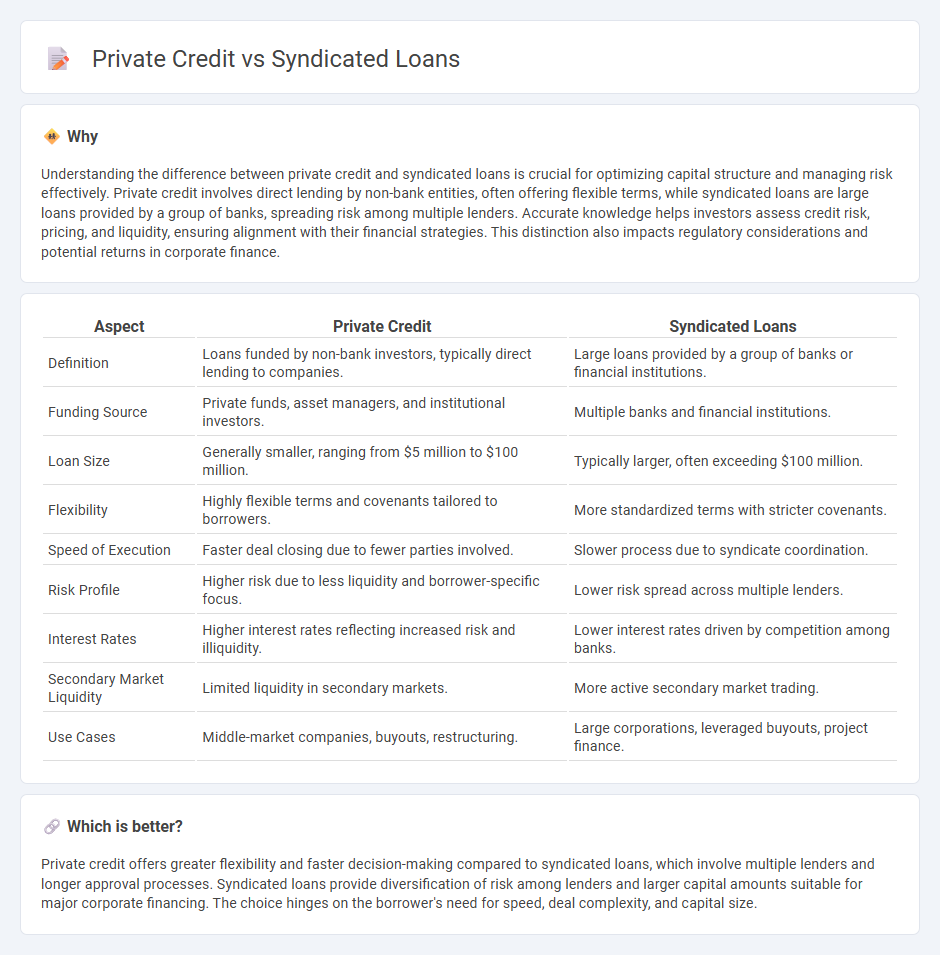

Understanding the difference between private credit and syndicated loans is crucial for optimizing capital structure and managing risk effectively. Private credit involves direct lending by non-bank entities, often offering flexible terms, while syndicated loans are large loans provided by a group of banks, spreading risk among multiple lenders. Accurate knowledge helps investors assess credit risk, pricing, and liquidity, ensuring alignment with their financial strategies. This distinction also impacts regulatory considerations and potential returns in corporate finance.

Comparison Table

| Aspect | Private Credit | Syndicated Loans |

|---|---|---|

| Definition | Loans funded by non-bank investors, typically direct lending to companies. | Large loans provided by a group of banks or financial institutions. |

| Funding Source | Private funds, asset managers, and institutional investors. | Multiple banks and financial institutions. |

| Loan Size | Generally smaller, ranging from $5 million to $100 million. | Typically larger, often exceeding $100 million. |

| Flexibility | Highly flexible terms and covenants tailored to borrowers. | More standardized terms with stricter covenants. |

| Speed of Execution | Faster deal closing due to fewer parties involved. | Slower process due to syndicate coordination. |

| Risk Profile | Higher risk due to less liquidity and borrower-specific focus. | Lower risk spread across multiple lenders. |

| Interest Rates | Higher interest rates reflecting increased risk and illiquidity. | Lower interest rates driven by competition among banks. |

| Secondary Market Liquidity | Limited liquidity in secondary markets. | More active secondary market trading. |

| Use Cases | Middle-market companies, buyouts, restructuring. | Large corporations, leveraged buyouts, project finance. |

Which is better?

Private credit offers greater flexibility and faster decision-making compared to syndicated loans, which involve multiple lenders and longer approval processes. Syndicated loans provide diversification of risk among lenders and larger capital amounts suitable for major corporate financing. The choice hinges on the borrower's need for speed, deal complexity, and capital size.

Connection

Private credit and syndicated loans are interconnected through their roles in providing alternative financing solutions outside traditional bank lending. Syndicated loans involve multiple lenders pooling resources to fund large-scale projects, while private credit often includes direct lending by non-bank entities targeting niche or middle-market borrowers. Both instruments serve to diversify capital sources, manage risk, and meet the financing needs of companies that might not access public debt markets.

Key Terms

Loan Structure

Syndicated loans feature a structured loan agreement involving multiple lenders sharing the credit risk, often with standardized terms and a lead arranger managing the process, allowing for large-scale financing with defined amortization schedules and covenants. Private credit loans tend to offer more flexible structures, often negotiated directly between borrower and lender, with customized repayment terms, tailored covenants, and potentially higher risk tolerance but less liquidity. Explore detailed comparisons of loan structures to determine the best financing strategy for your business needs.

Lender Composition

Syndicated loans involve multiple institutional lenders such as banks, insurance companies, and pension funds sharing risk and capital contributions, promoting liquidity in the credit market. Private credit predominantly features non-bank lenders including private debt funds and direct lending firms, which offer more flexible terms and customized financing solutions. Explore further to understand how lender composition impacts risk profiles and financing structures.

Flexibility

Syndicated loans typically offer lower flexibility due to multiple lenders imposing standardized terms, while private credit allows tailored structures to meet specific borrower needs. Private credit provides negotiable covenants and adjustable repayment schedules, enhancing borrower control and adaptability. Explore further to understand how flexibility impacts financing choices between syndicated loans and private credit.

Source and External Links

What Are Syndicated Loans and How Do They Work? - Truist Bank - Syndicated loans are large loans provided by a group of lenders (a syndicate) sharing the risk, used for financing capital expenditures, acquisitions, refinancing, leveraged buyouts, or shareholder returns, offering flexibility in loan types and repayment terms.

Syndicated Loan - Definition, How it Works, Advantages - A syndicated loan is a loan offered by multiple lenders to a large borrower with one lender acting as the manager, spreading risk among participants and governed by a single loan agreement.

Syndicated loan - Wikipedia - Syndicated loans are structured and administered by one or several banks, with key roles like arranger, agent, and trustee to coordinate the loan among lenders while maintaining individual lender interests and collective efficiency.

dowidth.com

dowidth.com