Structured credit involves the pooling of various debt instruments into tranches that are sold to investors with differing risk levels, offering diversified exposure to credit risk. Direct lending entails non-bank financial institutions providing loans directly to businesses, bypassing traditional intermediaries, which often results in tailored financing solutions and higher yields. Discover more about how these financing strategies impact portfolio risk and return profiles.

Why it is important

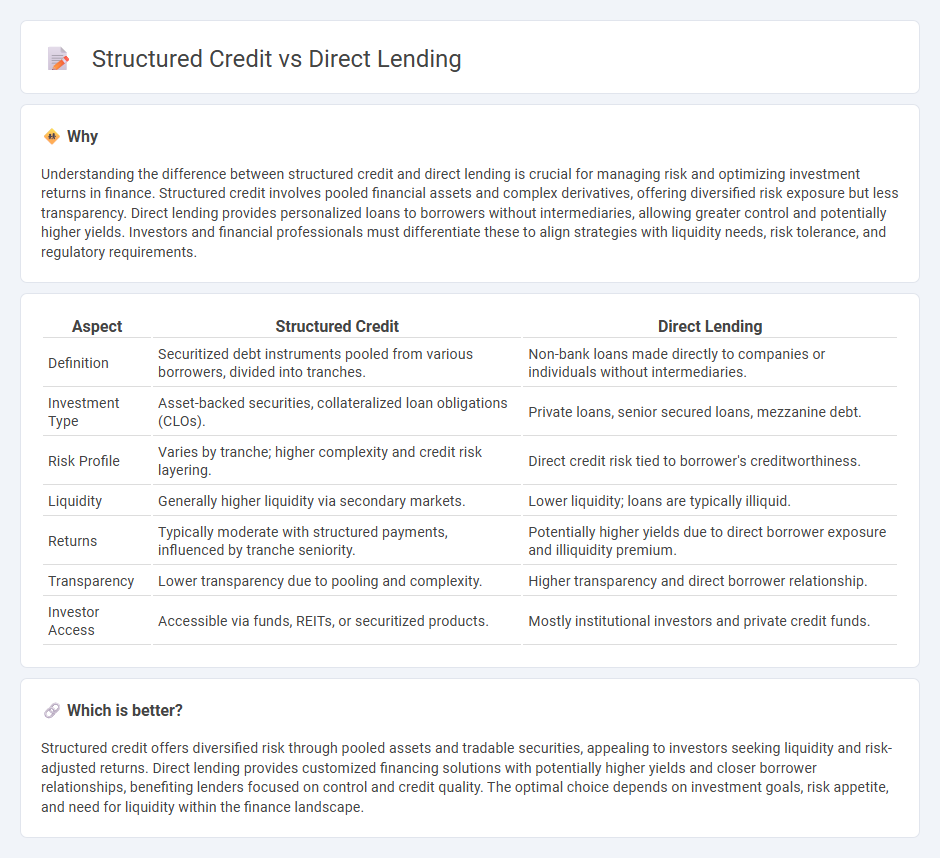

Understanding the difference between structured credit and direct lending is crucial for managing risk and optimizing investment returns in finance. Structured credit involves pooled financial assets and complex derivatives, offering diversified risk exposure but less transparency. Direct lending provides personalized loans to borrowers without intermediaries, allowing greater control and potentially higher yields. Investors and financial professionals must differentiate these to align strategies with liquidity needs, risk tolerance, and regulatory requirements.

Comparison Table

| Aspect | Structured Credit | Direct Lending |

|---|---|---|

| Definition | Securitized debt instruments pooled from various borrowers, divided into tranches. | Non-bank loans made directly to companies or individuals without intermediaries. |

| Investment Type | Asset-backed securities, collateralized loan obligations (CLOs). | Private loans, senior secured loans, mezzanine debt. |

| Risk Profile | Varies by tranche; higher complexity and credit risk layering. | Direct credit risk tied to borrower's creditworthiness. |

| Liquidity | Generally higher liquidity via secondary markets. | Lower liquidity; loans are typically illiquid. |

| Returns | Typically moderate with structured payments, influenced by tranche seniority. | Potentially higher yields due to direct borrower exposure and illiquidity premium. |

| Transparency | Lower transparency due to pooling and complexity. | Higher transparency and direct borrower relationship. |

| Investor Access | Accessible via funds, REITs, or securitized products. | Mostly institutional investors and private credit funds. |

Which is better?

Structured credit offers diversified risk through pooled assets and tradable securities, appealing to investors seeking liquidity and risk-adjusted returns. Direct lending provides customized financing solutions with potentially higher yields and closer borrower relationships, benefiting lenders focused on control and credit quality. The optimal choice depends on investment goals, risk appetite, and need for liquidity within the finance landscape.

Connection

Structured credit and direct lending are interconnected through their roles in the debt finance ecosystem, where structured credit products often bundle and repackage loans, including direct loans, into tradable securities. Direct lending provides capital directly to borrowers, which serves as the underlying asset pool for structured credit instruments such as collateralized loan obligations (CLOs). The performance of structured credit depends heavily on the cash flows and credit quality of these direct lending portfolios.

Key Terms

Senior Loans

Senior loans in direct lending offer secured, floating-rate debt primarily to middle-market companies, providing protection with first-lien positions and higher recovery rates. Structured credit involves pooling various debt instruments, including senior loans, into collateralized loan obligations (CLOs) to distribute risk and enhance yield through tranching. Explore the nuances of senior loan investment strategies and risk profiles to optimize your fixed income portfolio.

Collateralized Loan Obligations (CLOs)

Direct lending involves non-bank lenders providing loans directly to companies, often resulting in higher yields and more flexible terms. Structured credit, particularly through Collateralized Loan Obligations (CLOs), pools various loans and slices them into tranches with different risk and return profiles, offering investors diversified exposure to leveraged loans. Explore in-depth insights on how direct lending compares to CLOs for optimizing risk-return strategies in fixed income portfolios.

Credit Risk

Direct lending involves issuing loans directly to borrowers, often resulting in higher credit risk due to limited diversification and reliance on borrower creditworthiness. Structured credit pools various debt instruments like loans or bonds, slicing them into tranches with varying risk levels, which helps mitigate credit risk through risk redistribution. Explore further insights into credit risk strategies in direct lending and structured credit to optimize risk management.

Source and External Links

Direct lending - Wikipedia - Direct lending is a form of corporate debt provision where non-bank lenders, such as asset management firms or private debt funds, provide loans directly to smaller or mid-sized companies without intermediaries like banks or brokers, mainly focusing on senior secured first lien debt to reduce risk relative to equity.

Direct Lending Evolution: Driving Force of Private Credit Market - Direct lending is a private credit strategy providing illiquid loans, often first lien or unitranche, to middle market companies outside traditional banks, filling the lending gap left by banks exiting this space and benefiting from strong investor demand and refinancing needs through 2030.

Direct lending: benefits, risks and opportunities (Oaktree Capital) - Direct lending involves non-bank creditors making loans to middle-market companies (typically $50 million to $1 billion in revenue), financing leveraged buyouts, acquisitions, growth, and recapitalizations, with loan types including first and second lien, mezzanine, and unitranche debt.

dowidth.com

dowidth.com