Tax loss harvesting involves strategically selling securities at a loss to offset capital gains and reduce tax liability, whereas portfolio rebalancing focuses on realigning asset allocations to maintain desired risk levels and investment goals. Both techniques are essential for enhancing after-tax returns and ensuring disciplined investment management. Explore the nuances and benefits of tax loss harvesting versus portfolio rebalancing to optimize your financial strategy.

Why it is important

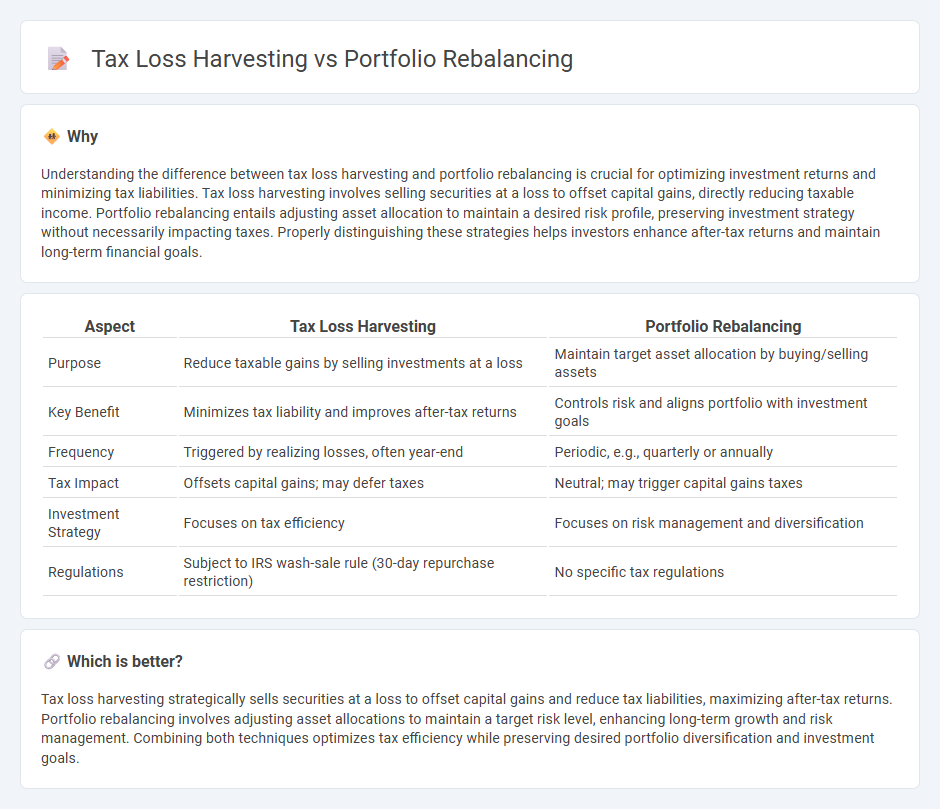

Understanding the difference between tax loss harvesting and portfolio rebalancing is crucial for optimizing investment returns and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, directly reducing taxable income. Portfolio rebalancing entails adjusting asset allocation to maintain a desired risk profile, preserving investment strategy without necessarily impacting taxes. Properly distinguishing these strategies helps investors enhance after-tax returns and maintain long-term financial goals.

Comparison Table

| Aspect | Tax Loss Harvesting | Portfolio Rebalancing |

|---|---|---|

| Purpose | Reduce taxable gains by selling investments at a loss | Maintain target asset allocation by buying/selling assets |

| Key Benefit | Minimizes tax liability and improves after-tax returns | Controls risk and aligns portfolio with investment goals |

| Frequency | Triggered by realizing losses, often year-end | Periodic, e.g., quarterly or annually |

| Tax Impact | Offsets capital gains; may defer taxes | Neutral; may trigger capital gains taxes |

| Investment Strategy | Focuses on tax efficiency | Focuses on risk management and diversification |

| Regulations | Subject to IRS wash-sale rule (30-day repurchase restriction) | No specific tax regulations |

Which is better?

Tax loss harvesting strategically sells securities at a loss to offset capital gains and reduce tax liabilities, maximizing after-tax returns. Portfolio rebalancing involves adjusting asset allocations to maintain a target risk level, enhancing long-term growth and risk management. Combining both techniques optimizes tax efficiency while preserving desired portfolio diversification and investment goals.

Connection

Tax loss harvesting and portfolio rebalancing are interconnected strategies that optimize investment returns and minimize tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains tax, while portfolio rebalancing realigns asset allocation to maintain desired risk levels. Implementing tax loss harvesting during rebalancing can enhance after-tax performance by strategically realizing losses without compromising the portfolio's long-term allocation goals.

Key Terms

Portfolio Rebalancing:

Portfolio rebalancing involves adjusting the weights of assets in an investment portfolio to maintain the desired risk and return levels, typically by buying or selling securities to restore the original asset allocation. This strategy helps manage portfolio risk, align with investment goals, and capitalize on market fluctuations without triggering taxable events. Explore the benefits of portfolio rebalancing and how it can optimize your investment strategy.

Asset Allocation

Portfolio rebalancing is the process of realigning the proportions of assets in a portfolio to maintain a target allocation, reducing risk and ensuring investment goals remain on track. Tax loss harvesting involves selling securities at a loss to offset capital gains taxes, optimizing after-tax returns without necessarily maintaining asset allocation. Understanding the differences and applications of these strategies can enhance your investment plan--explore more to optimize your portfolio effectively.

Risk Tolerance

Portfolio rebalancing aligns asset allocation with an investor's risk tolerance by systematically adjusting investments to maintain desired risk levels, preventing overexposure to volatile assets. Tax loss harvesting reduces tax liability by selling securities at a loss, but it does not directly address risk tolerance or portfolio balance. Explore how these strategies can complement each other while respecting your risk preferences to optimize your investment outcomes.

Source and External Links

Rebalancing your portfolio - Fidelity Investments - Portfolio rebalancing involves buying and selling investments to maintain your targeted asset allocation by comparing current allocation versus target, then trading to adjust the portfolio accordingly.

What is Portfolio Rebalancing and Why Should You Care? - E*Trade - Rebalancing means selling some assets and buying others to keep your portfolio aligned with your risk tolerance and target asset mix, especially important during market volatility.

Rebalancing investments - Wikipedia - Rebalancing strategies include fixed-interval timing, threshold-based triggers, or using contributions/withdrawals, with some advocating "over-rebalancing" to potentially improve returns by buying more of temporarily undervalued assets.

dowidth.com

dowidth.com