Sovereign debt restructuring involves renegotiating the terms of a country's debt to avoid default and restore fiscal sustainability, often including extended maturities or reduced interest rates. A haircut refers specifically to the reduction in the principal amount or value of the sovereign debt owed to creditors. Explore the differences and implications of these strategies for economic stability and investor confidence.

Why it is important

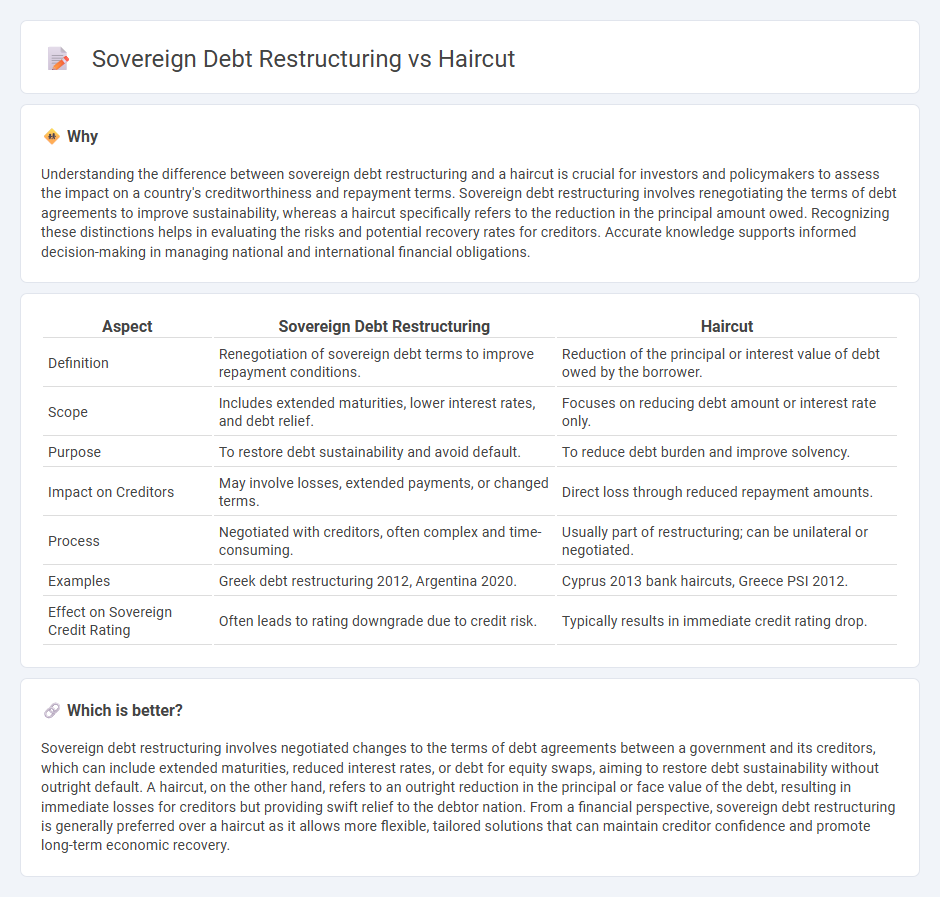

Understanding the difference between sovereign debt restructuring and a haircut is crucial for investors and policymakers to assess the impact on a country's creditworthiness and repayment terms. Sovereign debt restructuring involves renegotiating the terms of debt agreements to improve sustainability, whereas a haircut specifically refers to the reduction in the principal amount owed. Recognizing these distinctions helps in evaluating the risks and potential recovery rates for creditors. Accurate knowledge supports informed decision-making in managing national and international financial obligations.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Haircut |

|---|---|---|

| Definition | Renegotiation of sovereign debt terms to improve repayment conditions. | Reduction of the principal or interest value of debt owed by the borrower. |

| Scope | Includes extended maturities, lower interest rates, and debt relief. | Focuses on reducing debt amount or interest rate only. |

| Purpose | To restore debt sustainability and avoid default. | To reduce debt burden and improve solvency. |

| Impact on Creditors | May involve losses, extended payments, or changed terms. | Direct loss through reduced repayment amounts. |

| Process | Negotiated with creditors, often complex and time-consuming. | Usually part of restructuring; can be unilateral or negotiated. |

| Examples | Greek debt restructuring 2012, Argentina 2020. | Cyprus 2013 bank haircuts, Greece PSI 2012. |

| Effect on Sovereign Credit Rating | Often leads to rating downgrade due to credit risk. | Typically results in immediate credit rating drop. |

Which is better?

Sovereign debt restructuring involves negotiated changes to the terms of debt agreements between a government and its creditors, which can include extended maturities, reduced interest rates, or debt for equity swaps, aiming to restore debt sustainability without outright default. A haircut, on the other hand, refers to an outright reduction in the principal or face value of the debt, resulting in immediate losses for creditors but providing swift relief to the debtor nation. From a financial perspective, sovereign debt restructuring is generally preferred over a haircut as it allows more flexible, tailored solutions that can maintain creditor confidence and promote long-term economic recovery.

Connection

Sovereign debt restructuring involves renegotiating a country's debt terms to restore financial stability and improve repayment capacity. A haircut refers to the reduction in the principal or interest rates that creditors agree to accept during this restructuring process. This connection helps countries manage unsustainable debt levels while providing creditors with partial recovery instead of default.

Key Terms

Principal Reduction

Principal reduction in sovereign debt restructuring involves decreasing the original amount owed by a country to its creditors, providing fiscal relief and improving debt sustainability. This contrasts with a haircut, where creditors accept a portion of their claims as a loss, often reflecting a negotiated discount on principal or interest payments. Explore key strategies and outcomes of principal reduction to understand its critical role in sovereign debt management.

Creditor Negotiation

Creditor negotiation plays a pivotal role in sovereign debt restructuring, where a "haircut" refers to the percentage reduction in the debt's face value agreed upon by creditors. Effective negotiation strategies are essential for achieving favorable terms that balance debtor sustainability and creditor recovery, often involving complex discussions among international institutions, bondholders, and governments. Discover more about how creditor negotiation dynamics impact sovereign debt outcomes and economic stability.

Debt Sustainability

A haircut in sovereign debt restructuring refers to the reduction in the amount of principal or interest that creditors agree to accept, directly impacting a country's debt sustainability by easing repayment burdens and improving fiscal balance. Sovereign debt restructuring encompasses broader strategies including rescheduling, maturity extensions, and interest rate adjustments aimed at restoring debt sustainability without default. Explore in-depth how these mechanisms affect sovereign creditworthiness and economic stability.

Source and External Links

The Biggest Transformation YET?! YEARS of Long Hair... CUT OFF ... - A detailed vlog of cutting off years-long grown hair into a chin-length bob, discussing challenges with changing hairstyle patterns and tips for managing hair transitions.

Great Clips: Haircuts Near Me | Check In Online - A popular salon chain offering easy online check-in, quick haircuts tailored to your lifestyle, and consistent styling services nationwide.

Sport Clips: Haircuts for Men | Haircuts Near Me | Check-in Online - Specializes in men's and boys' haircuts with an emphasis on sports-themed service experience and online check-in convenience for reduced wait times.

dowidth.com

dowidth.com