Carbon credits function as tradable certificates representing the reduction of one metric ton of carbon dioxide emissions, incentivizing environmental sustainability through market mechanisms. Social impact bonds are financial instruments that fund social programs by linking returns to the achievement of predefined social outcomes, aligning investor interests with community benefits. Explore the detailed differences and potential impacts of carbon credits and social impact bonds to optimize your sustainable finance strategies.

Why it is important

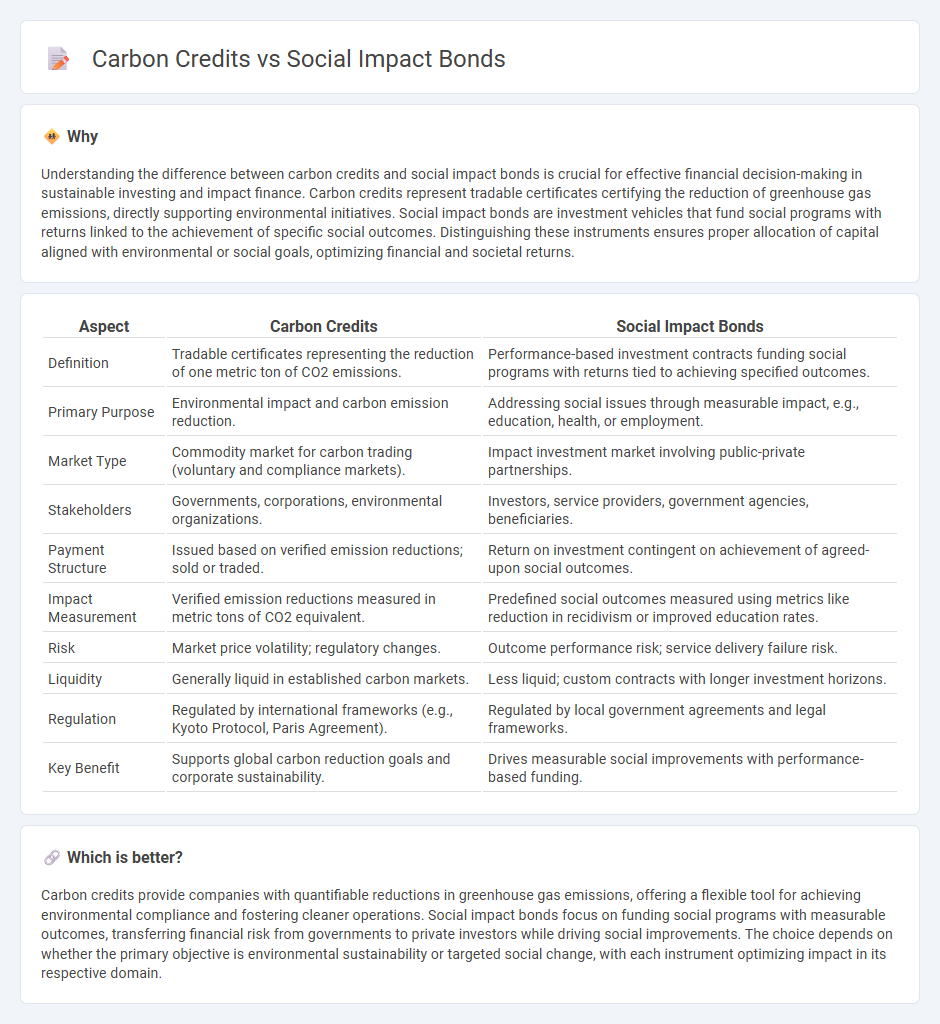

Understanding the difference between carbon credits and social impact bonds is crucial for effective financial decision-making in sustainable investing and impact finance. Carbon credits represent tradable certificates certifying the reduction of greenhouse gas emissions, directly supporting environmental initiatives. Social impact bonds are investment vehicles that fund social programs with returns linked to the achievement of specific social outcomes. Distinguishing these instruments ensures proper allocation of capital aligned with environmental or social goals, optimizing financial and societal returns.

Comparison Table

| Aspect | Carbon Credits | Social Impact Bonds |

|---|---|---|

| Definition | Tradable certificates representing the reduction of one metric ton of CO2 emissions. | Performance-based investment contracts funding social programs with returns tied to achieving specified outcomes. |

| Primary Purpose | Environmental impact and carbon emission reduction. | Addressing social issues through measurable impact, e.g., education, health, or employment. |

| Market Type | Commodity market for carbon trading (voluntary and compliance markets). | Impact investment market involving public-private partnerships. |

| Stakeholders | Governments, corporations, environmental organizations. | Investors, service providers, government agencies, beneficiaries. |

| Payment Structure | Issued based on verified emission reductions; sold or traded. | Return on investment contingent on achievement of agreed-upon social outcomes. |

| Impact Measurement | Verified emission reductions measured in metric tons of CO2 equivalent. | Predefined social outcomes measured using metrics like reduction in recidivism or improved education rates. |

| Risk | Market price volatility; regulatory changes. | Outcome performance risk; service delivery failure risk. |

| Liquidity | Generally liquid in established carbon markets. | Less liquid; custom contracts with longer investment horizons. |

| Regulation | Regulated by international frameworks (e.g., Kyoto Protocol, Paris Agreement). | Regulated by local government agreements and legal frameworks. |

| Key Benefit | Supports global carbon reduction goals and corporate sustainability. | Drives measurable social improvements with performance-based funding. |

Which is better?

Carbon credits provide companies with quantifiable reductions in greenhouse gas emissions, offering a flexible tool for achieving environmental compliance and fostering cleaner operations. Social impact bonds focus on funding social programs with measurable outcomes, transferring financial risk from governments to private investors while driving social improvements. The choice depends on whether the primary objective is environmental sustainability or targeted social change, with each instrument optimizing impact in its respective domain.

Connection

Carbon credits and social impact bonds are connected through their shared goal of financing sustainable development and social outcomes by attracting private investment to public goods. Carbon credits generate revenue from reducing greenhouse gas emissions, which can be reinvested to fund environmental and social projects, while social impact bonds channel private capital to programs that deliver measurable social benefits, including climate resilience. Both instruments rely on performance-based metrics to ensure accountability and effective capital allocation toward environmental and societal impact.

Key Terms

**Social Impact Bonds:**

Social Impact Bonds (SIBs) are innovative financial instruments where private investors fund social programs, with returns linked to measurable outcomes such as reduced recidivism or improved education. These bonds align public sector goals with social impact by transferring performance risk from governments to investors, fostering accountability and efficiency. Explore how SIBs are revolutionizing public service funding and delivering measurable social change.

Outcome-based Contracts

Social impact bonds and carbon credits are both outcome-based contracts designed to fund social and environmental initiatives through measurable results. Social impact bonds allow investors to finance social programs, receiving returns only if predetermined outcomes are achieved, while carbon credits enable companies to offset emissions by purchasing credits linked to verified carbon reduction projects. Explore how these innovative financial instruments drive impact through performance-based funding models.

Investors

Social impact bonds attract investors by providing measurable social outcomes linked to financial returns, appealing to those seeking social value alongside profit. Carbon credits offer investors opportunities in carbon markets to offset emissions while potentially benefiting from price appreciation tied to environmental regulations. Explore detailed comparisons to understand investment potentials and risks in these innovative financial instruments.

Source and External Links

Social impact bond - Wikipedia - Social Impact Bonds (SIBs) are outcomes-based contracts where private investors provide upfront capital for social programs and are repaid by the government only if agreed social outcomes are achieved, encouraging innovation, early intervention, and shifting risk from the public sector to investors.

Impact bonds - GO Lab, University of Oxford - Impact bonds involve three key partners (outcome payer, service provider, investor) to finance social services focusing on measurable outcomes, offering benefits such as flexibility, prevention investment, and cross-sector collaboration, while facing challenges like complexity and difficulty defining outcomes.

Social Outcomes Partnerships and the Life Chances Fund - UK Government - UK government guidance explains that Social Outcomes Partnerships (another term for SIBs) show promise in overcoming public service challenges by promoting prevention, innovation, and collaboration, supported by growing evidence from UK and international experience.

dowidth.com

dowidth.com